Oil Little Changed in Thin Trading Ahead of Key OPEC+ Meeting

(Bloomberg) -- Oil was little changed as trading thinned before the US Thanksgiving holiday, with the focus on this weekend’s OPEC+ meeting.

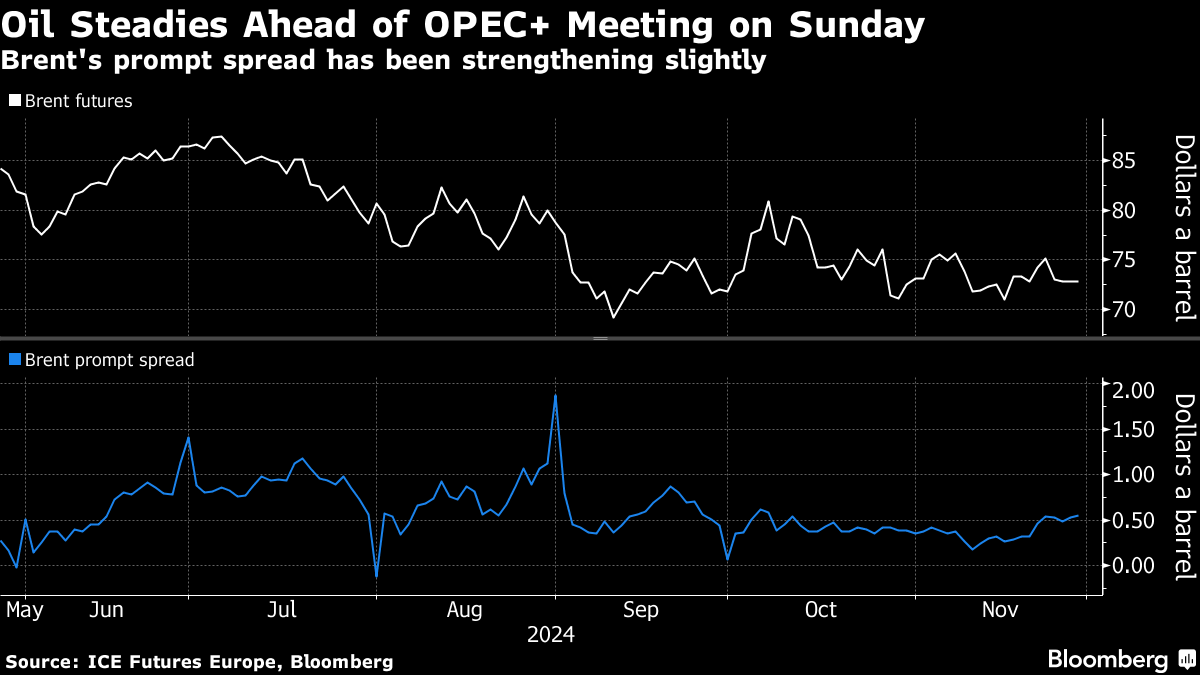

Global benchmark Brent was near $73 a barrel after ending just 2 cents higher on Wednesday, with West Texas Intermediate below $69. OPEC+ is widely expected to once again delay restoring production when it meets on Sunday, to offset concerns about an anticipated glut next year.

Oil has been caught in a tight range since mid-October, with prices buffeted by geopolitical risks in the Middle East and Ukraine, Donald Trump’s presidential election victory and expectations of a glut in 2025. US trading has quietened before the holiday, with just over 500,000 lots of WTI changing hands on Wednesday — almost 40% less than the year-to-date average.

“Crude may have already baked in a small deferral in OPEC+ tapering” its production cuts, said Vandana Hari, founder of Vanda Insights in Singapore. “A decision to proceed with the boost from Jan. 1 or something as drastic as an indefinite postponement” would be a surprise for markets, she added.

Meanwhile, US crude inventories fell by 1.8 million barrels last week, snapping a three-week run of gains, according to Energy Information Administration data.

Widely watched timespreads have also strengthened. The gap between Brent’s two nearest contracts was 53 cents a barrel in a bullish backwardation pattern, when the prompt contract trades at a premium over the following one. The difference was 29 cents at the beginning of last week.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

ExxonMobil reports $8.6 billion Q3 2024 earnings, hits record 3.2M barrels/day production

Alberta Prepares to Fight Trudeau Cap on Oil and Gas Emissions

Oil Edges Lower as Trump Tariff Threats Pushes Dollar Higher

Oil Drops as Israel Moves Closer to Cease-Fire With Hezbollah

India Aiming to Finalize Carbon Deals With Japan, Singapore

Shell-Cosan Venture Raizen Weighs Ethanol Partner, Oxxo Sale

Oil Advances on Rising Geopolitical Tensions From Iran, Russia

Oil Steady as Traders Weigh Ukraine Risks After Stockpiles Gain

China’s Surging LNG Imports From US Threatened by Next Trade War

Oil Steadies After Biggest Gain in Five Weeks on Weak Dollar

Watch/Listen

Enhancing efficiency and accelerating decarbonisation through AI and digital innovation

China’s natural gas market: transitioning amid renewable goals and carbon neutrality

Nabors: transforming drilling and rig operations with digitalisation