Oil Steadies After Biggest Gain in Five Weeks on Weak Dollar

(Bloomberg) -- Oil steadied after the biggest gain in more than five weeks as the dollar weakened and a risk-on tone swept across wider markets.

Brent traded above $73 a barrel after surging 3.2% on Monday, while West Texas Intermediate was near $69. A gauge of the dollar headed for a third day of losses, making commodities priced in the currency less expensive for most buyers, and Asian shares followed Wall Street higher.

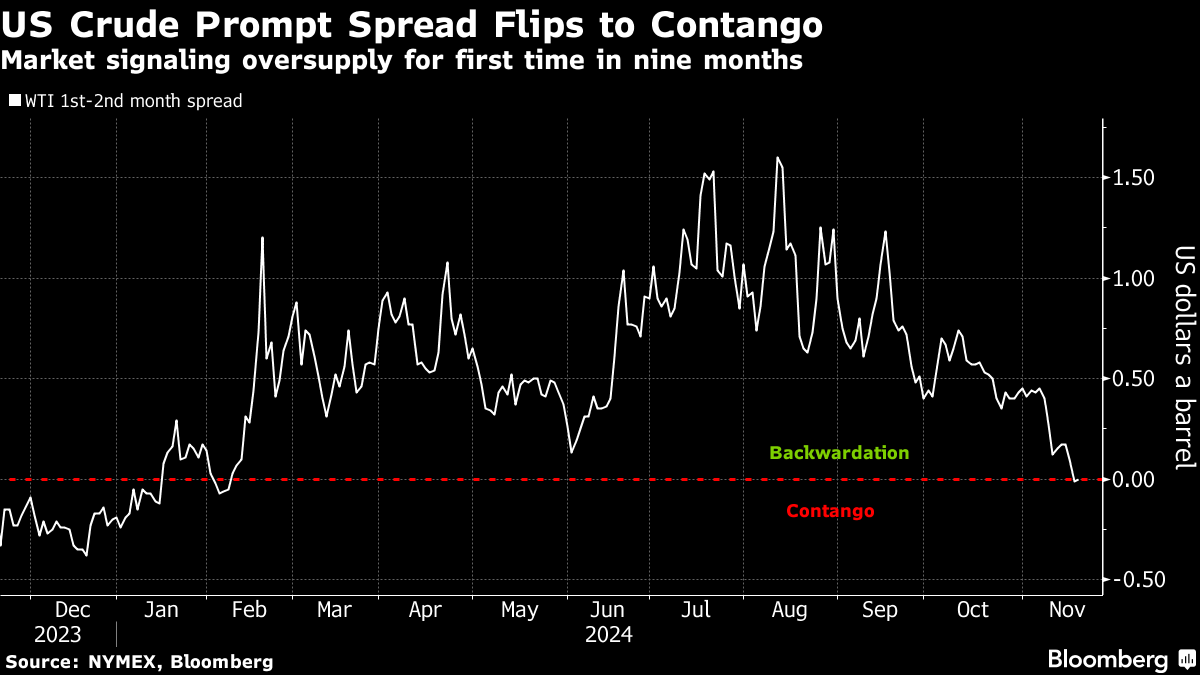

Oil is still lower for the year as concerns around Chinese demand and plentiful global supply weigh on the outlook. The prompt spread for WTI — the difference between the two nearest futures contracts — traded in a bearish contango structure on Monday for the first time since February.

The International Energy Agency has forecast a potential surplus of more than 1 million barrels a day next year as Chinese demand continues to falter, which could be even bigger if OPEC+ decides to revive output.

“We remain bearish on oil in the mid- to long-term,” said Zhou Mi, an analyst at the Chaos Research Institute in Shanghai. “OPEC+’s planned output increases and China’s demand peaking” raises the prospect for a global glut, he added.

In the Middle East, meanwhile, Lebanon and the Hezbollah militia have agreed to a US proposal for a cease-fire with Israel, according to a report from Reuters on Monday, which cited a top Lebanese official. A US official cautioned that negotiations were ongoing.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge