Oil Steadies With Middle East Tensions and US Election in Focus

(Bloomberg) -- Oil steadied after jumping almost 3% on Monday on heightened tensions in the Middle East and OPEC+’s move to extend supply curbs, with investors turning their focus to the US presidential election.

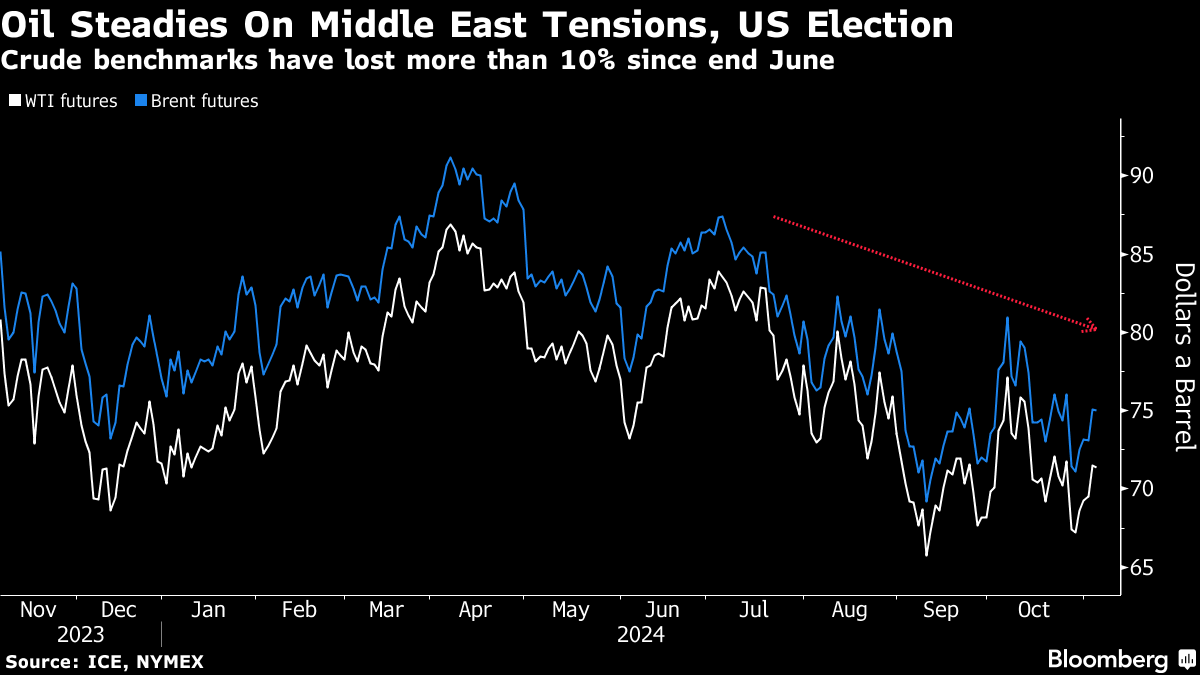

Brent traded above $75 a barrel after rising the most in more than three weeks in the previous session, while West Texas Intermediate was near $72. Traders are on edge after Iran’s supreme leader warned over the weekend of a “crushing response” to the country’s enemies, escalating his rhetoric after a recent attack by Israel, and raising the specter of supply disruptions.

The international benchmark has lost about 13% since the end of June on disappointing Chinese demand and surging supply from the Americas, particularly the US, prompting the OPEC+ alliance to push back a plan to restore production. The market is also jumpy ahead of the US presidential election, which remains on a knife edge after months of intense campaigning.

The action by OPEC+ “suggests that the group is more willing to support the market than many had expected,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Lingering tension in the Middle East and Gulf of Mexico storms provide some upside risk, while oil is also vulnerable to getting caught up in any broader market moves related to the US election.”

Polls still suggest the contest between Donald Trump and Kamala Harris remains close. Among potential consequences, South Korea is considering increasing energy imports from the US if Trump wins to reduce the country’s trade surplus with America, people familiar with the matter said.

Meanwhile, Tropical Storm Rafael threatened evacuations from US offshore oil and natural gas platforms in the Gulf of Mexico. Among producers, Shell Plc said it would evacuate some non-essential personnel in the area.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Small Plane Crashes Near Philadelphia With Six People Aboard

Trump’s Envoy Grenell in Venezuela to Discuss US Prisoners, Gang Members

Asian Stocks Retreat as Samsung, SK Hynix Weigh: Markets Wrap

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles

Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk

Glencore-Indonesia JV Eyes $1 Billion Sustainability-Linked Loan

Oil Fluctuates as Trump’s Rapid-Fire Trade Moves Rattle Market

China’s Surging Power Demand Creates a Climate Conundrum