Oil Steady as Traders Weigh Ukraine Risks After Stockpiles Gain

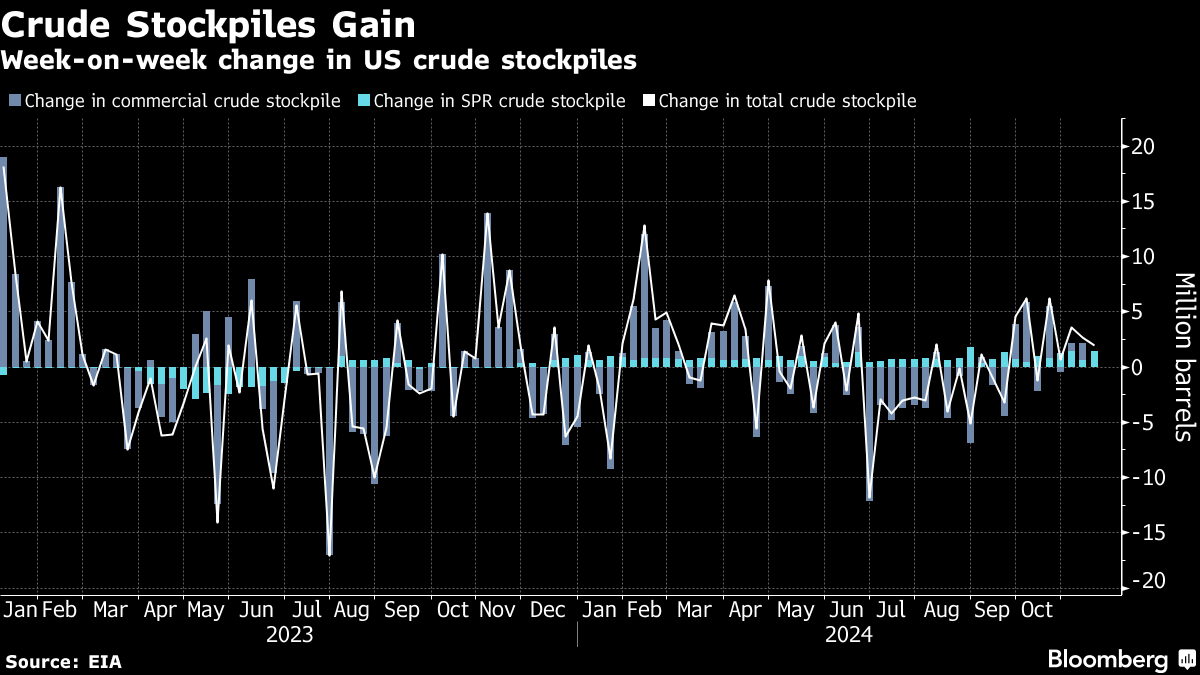

(Bloomberg) -- Oil steadied as the market monitored developments in Ukraine and the Middle East after US crude stockpiles rose for a third week.

Brent traded near $73 a barrel after losing 0.7% on Wednesday, and West Texas Intermediate was close to $69. Ukrainian forces expanded the use of Western-provided long-range weapons on Russian military targets, while the US says talks on a truce between Hezbollah and Israel made progress.

In the US, meanwhile, crude inventories increased by 545,000 barrels last week, according to government data. The gain was significantly smaller than figures flagged by an industry report on Tuesday.

Oil has swung between gains and losses since mid-October, buffeted by a range of factors including concerns over Chinese demand and a stronger dollar. The market is facing a supply glut next year and investors are watching for a decision from OPEC+ on plans to start reviving idled supply.

“We expect oil prices to test new lows next year as geopolitical risk subsides and bearish fundamental factors take great weight,” Macquarie Group analysts including Vikas Dwivedi wrote in a note dated Nov. 20. Futures are currently “range-bound with limited catalysts,” they added.

©2024 Bloomberg L.P.