Brent Oil Falls Below $80 as China Holds Back on More Stimulus

(Bloomberg) -- Brent oil dropped below $80 a barrel as China’s top economic planner ended a highly anticipated briefing on Tuesday without new stimulus measures, sparking a risk-off mood across markets.

The global benchmark lost as much as 2.2%, snapping a five-day rally, while West Texas Intermediate traded near $76 a barrel. The National Development and Reform Commission said it’s confident in reaching economic targets this year, but the lack new spending disappointed investors.

Still, the oil market remains susceptible to a flare-up in the Middle East. Traders are watching for Israel’s retaliation against Iran following a missile attack last week, which raised concerns over an all-out war.

The briefing from the NDRC “did not sit well with investors,” said Arne Lohmann Rasmussen, head of research at A/S Global Risk Management. China is closely linked to commodity demand, so the disappointment was immediately reflected in the price of oil, he added.

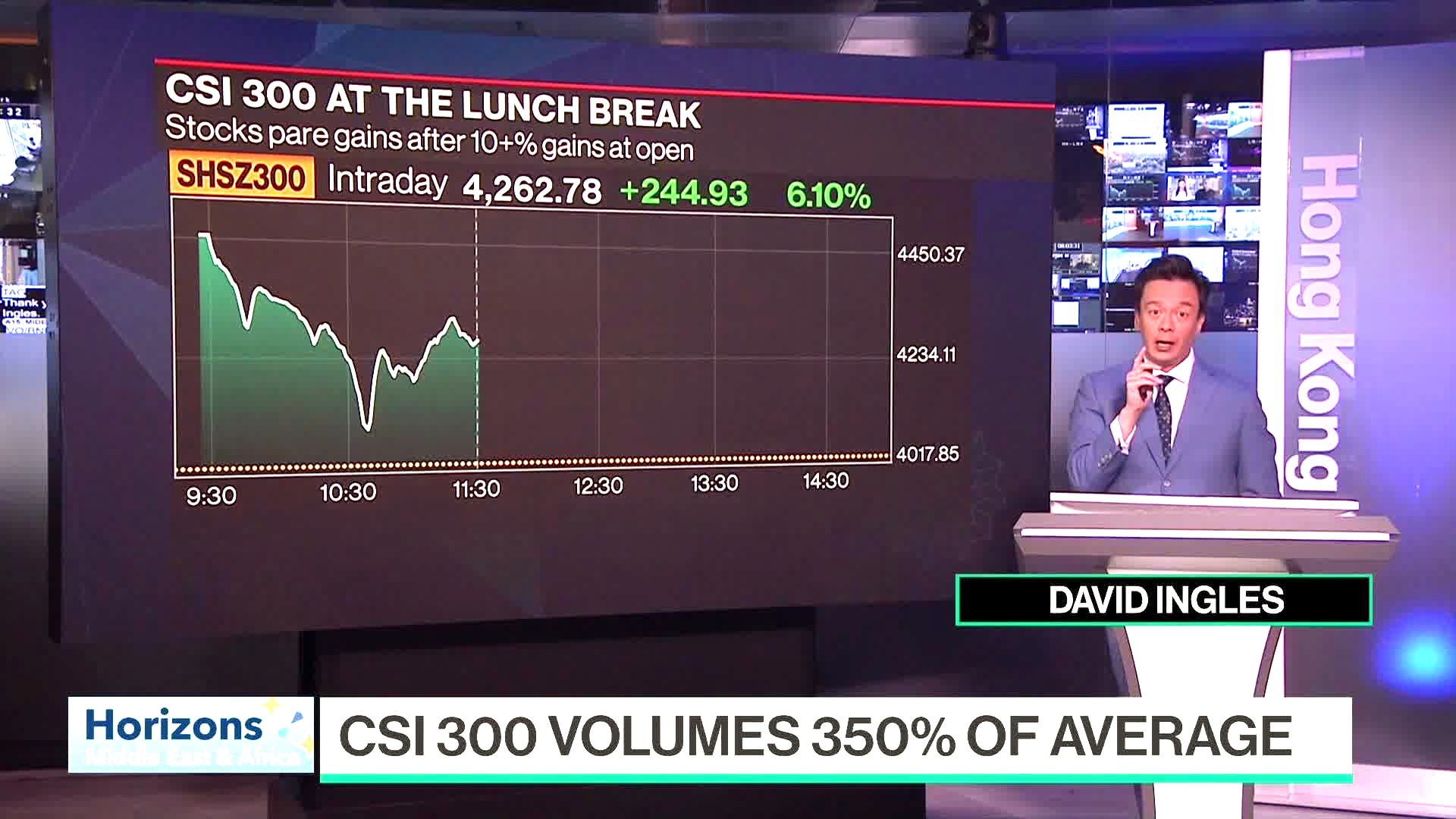

Iron ore and base metals declined, while a gauge of Chinese shares listed in Hong Kong slid as much as 11%. NDRC officials said that they would speed up spending while largely reiterating plans to boost investment.

Israel, meanwhile, escalated fighting against Iran-backed groups on Monday, keeping the market on edge. The region accounts for a third of global crude supply, and President Joe Biden has sought to discourage Israel from attacking Tehran’s oil fields.

Other markets have been jolted by the hostilities, with a gauge of implied volatility for Brent near the highest in a year. There’s been a deluge of call options — which profits buyers when futures gain — and the premium of Brent calls over puts swelled to the widest in a year as of Monday’s close.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Lower as Trade War Concerns Vie With Pressure on Iran

Oil Falls After Trump Delays Canada, Mexico Tariffs by a Month

Wright Confirmed to Lead Energy Agency Key to Trump’s Plans

Oil Rises as Trump Slaps Tariffs on Biggest Crude Supplier to US

UAE’s Adnoc Aims to Buy Nova Chemicals, Roll Into Deal With OMV

Ukrainian Drone Surge Highlights Russian Oil Refining Risk

South Korea Exports Resilient as Trump’s Tariff Threat Looms

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles