Oil Edges Higher After Two-Day Drop With Middle East in Focus

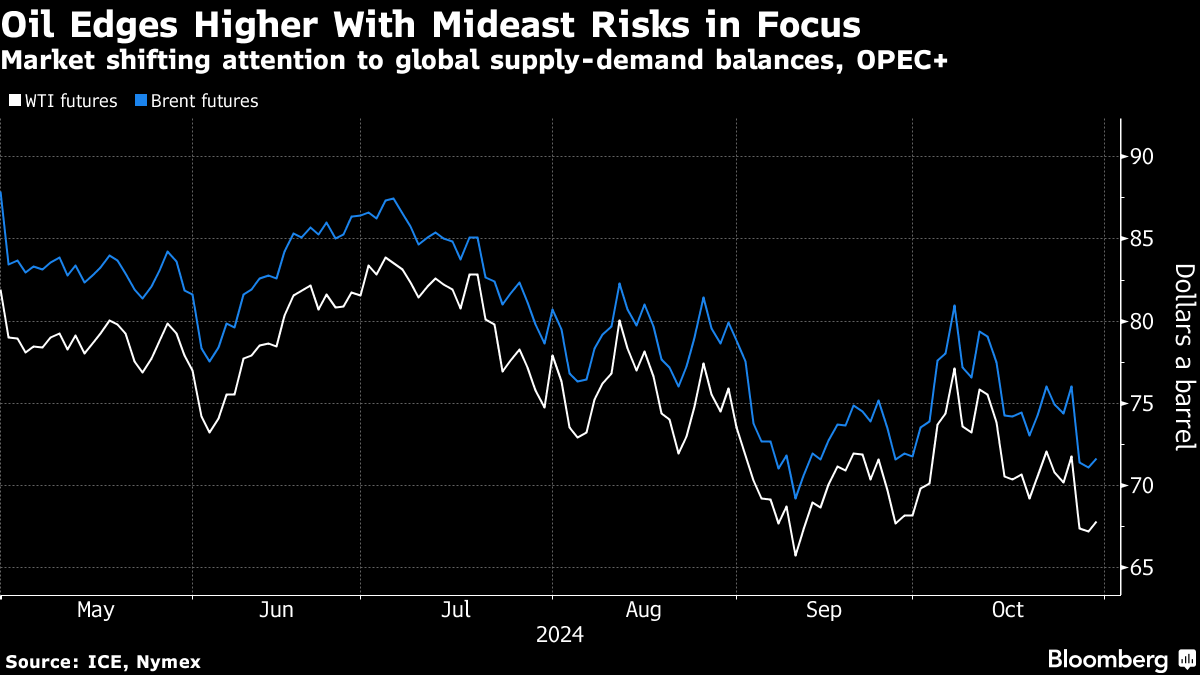

(Bloomberg) -- Oil edged higher after a two-day decline, with traders weighing developments in the Middle East and the prospect for more OPEC+ supply.

Brent rose toward $72 a barrel after tumbling more than 6% over the previous two sessions, while West Texas Intermediate was near $68. Israel appeared to be making moves to end the war with Hezbollah by year-end, but has vowed to strike Iran “very hard” should the OPEC producer attack again.

The unwinding of a Middle East war premium has put weak fundamentals back into focus, including sluggish Chinese demand and plentiful global supply. All eyes are on OPEC+’s plans to gradually revive production from December, with traders split on whether the alliance will press ahead.

“Focus remains very much on the removal of the war premium and whether or not OPEC+ will go ahead with the planned increase in production,” said Robert Rennie, head of commodity and carbon strategy at Westpac Banking Corp. Brent is expected to test the high $60s in “a matter of time,” he added.

The market, howver, has “relaxed too quickly” over Middle East risks, and renewed hostilities between Israel and Iran after the US election could boost prices, according to Standard Chartered Plc analysts.

Commodity and financial markets are gearing up for two crucial events next week — the US election and a meeting of China’s top legislative body, with investors watching for any additional stimulus efforts to revive the economy. The Asian nation is the world’s biggest crude importer.

US crude stockpiles, meanwhile, shrank by 600,000 barrels last week, the industry-funded American Petroleum Institute reported, according to a document seen by Bloomberg. Gasoline and distillate inventories also fell.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge