Oil Extends Losses on Report Israel Won’t Target Iranian Crude

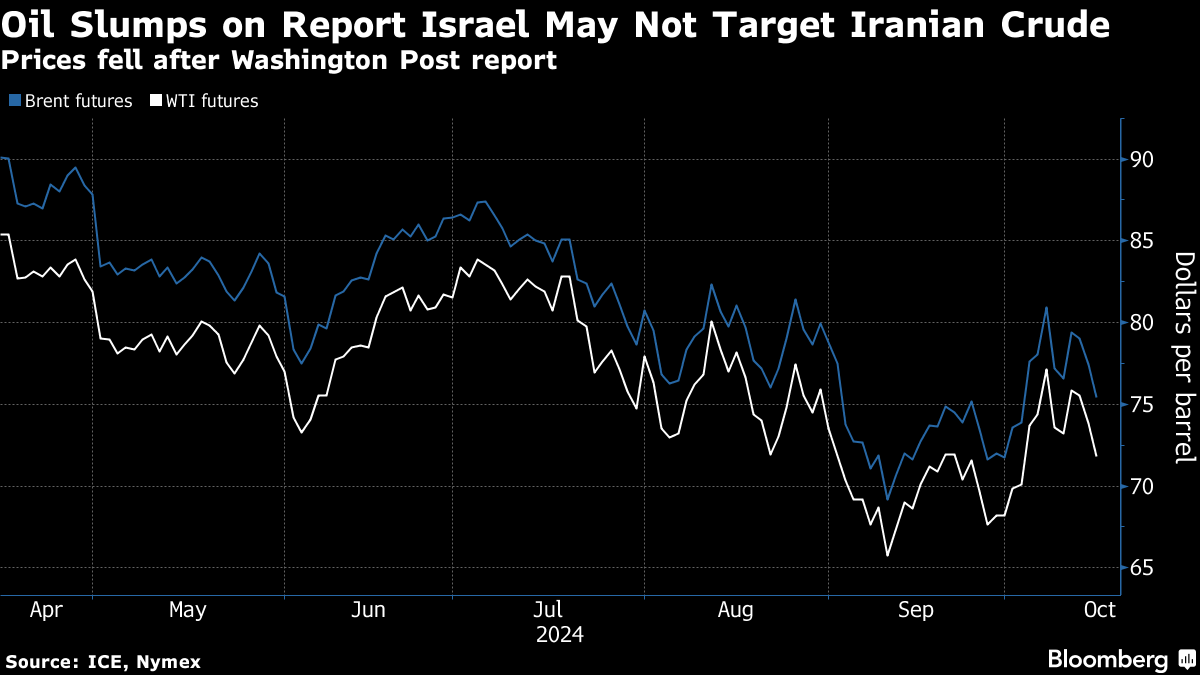

(Bloomberg) -- Oil fell for a third session after a report that Israel may avoid targeting Iran’s crude infrastructure eased concerns over a major supply disruption.

Brent futures dropped almost 3% to near $75 after losing 2% on Monday, while West Texas Intermediate slid to below $72 a barrel. Israeli Prime Minister Benjamin Netanyahu told the Biden administration he is willing to strike military rather than oil or nuclear facilities in Iran, the Washington Post reported, citing two officials familiar with the matter.

Crude prices have been on a roller coaster in recent weeks as traders tracked an escalating conflict in the Middle East — home to about a third of global supply — after Israel vowed significant retaliation to an Oct. 1 missile barrage from Iran. That had offset concerns about slowing growth in key markets including China.

“A scaled-back strike on Iran by Israel reduces supply risks and thus the need for a geopolitical risk premium,” said Dominic Schnider, head of global foreign-exchange and commodities at UBS Global Wealth Management. “It also brings old demand concerns to the fore.”

Futures declined on Monday after China’s highly anticipated Finance Ministry briefing over the weekend lacked specific new incentives to boost consumption in the world’s biggest crude importer. Adding to the gloom, OPEC joined a chorus of others projecting weakening demand growth, trimming its forecasts for this year and next for a third consecutive month.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge