Oil Holds China-Induced Slump as Traders Watch Middle East

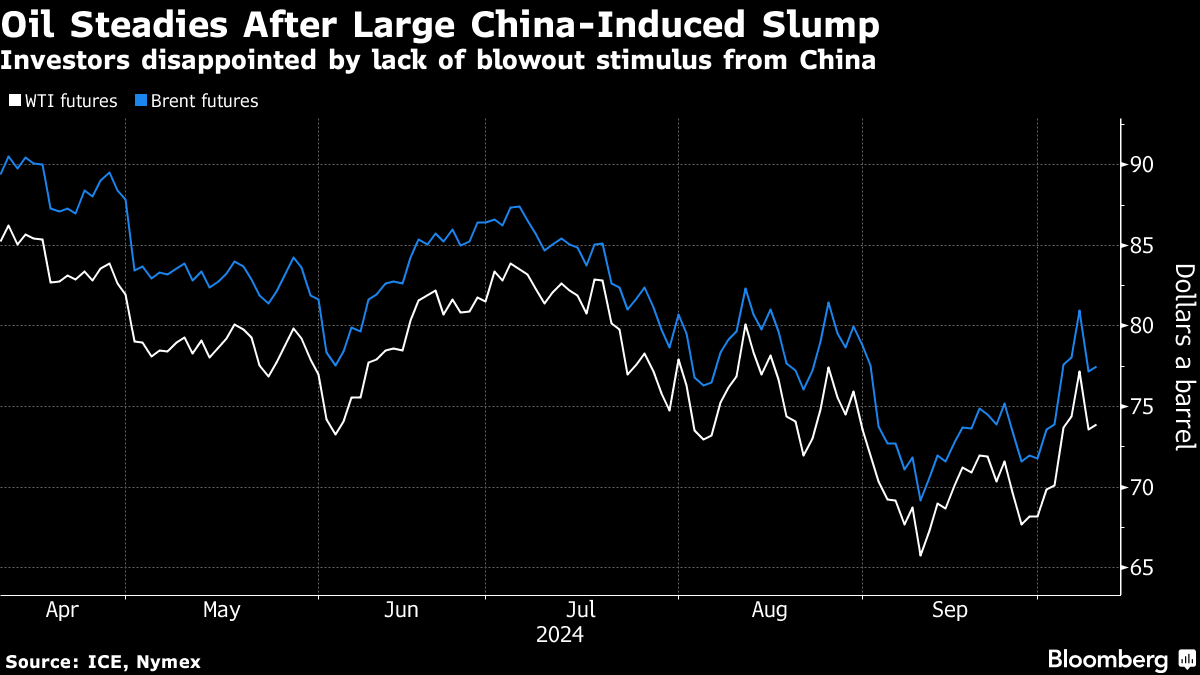

(Bloomberg) -- Oil steadied after tumbling the most in more than a year in the previous session on concerns around China’s economic outlook, with the market also watching for Israel’s response to Iran’s missile barrage last week.

Brent traded above $77 a barrel after losing 4.6% on Tuesday, while West Texas Intermediate was near $74. Beijing held back on major fresh stimulus after the nation’s return from a week-long holiday, compounding concerns about the trajectory for demand growth from the world’s biggest crude importer.

The slide in prices overshadowed nervousness about an escalation of hostilities in the Middle East, particularly a possible strike by Israel on Iran’s oil facilities. A visit to the US by Israel’s defense chief — billed as a chance for allies to craft a common strategy in a face-off against Tehran — has been postponed.

President Joe Biden has discouraged Israel from targeting Tehran’s oil fields, and Iran continued exporting crude from its main Kharg Island terminal. Still, markets remained on edge, with options in a bias toward calls — where buyers profit when prices rise — and volatility soaring.

Oil is facing a tug-of-war between fundamentals indicating a surplus in 2025 and geopolitical tensions, said Priyanka Sachdeva, a senior market analyst at brokerage Phillip Nova Pte in Singapore. Bearish headwinds include a weak Chinese economy and a plan by OPEC+ to increase supply, she said.

Morgan Stanley raised its Brent price forecast by $5 to $80 a barrel for the fourth quarter of this year on heightened geopolitical risk, but warned of a widening surplus in 2025. Demand is weaker than expected and supply has been robust, analysts including Martijn Rats said in a note.

In the US, the American Petroleum Institute reported crude stockpiles expanded by 11 million barrels last week. However, inventories of gasoline and distillates — a category which includes diesel — each declined.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions