Oil Steadies as Mideast Tensions Vie With Libyan Supply Outlook

(Bloomberg) -- Oil steadied at the start of the fourth quarter as geopolitical risks in the Middle East, with Israel beginning ground raids inside Lebanon, vied with the prospects of a return of Libyan supply.

Brent for December traded near $72 a barrel after it ended Monday modestly higher, with West Texas Intermediate above $68. Israel’s military said it has begun targeted raids against Hezbollah targets in southern Lebanon. Libya is preparing to restore production after its two rival governments reached a compromise, according to people familiar with the situation.

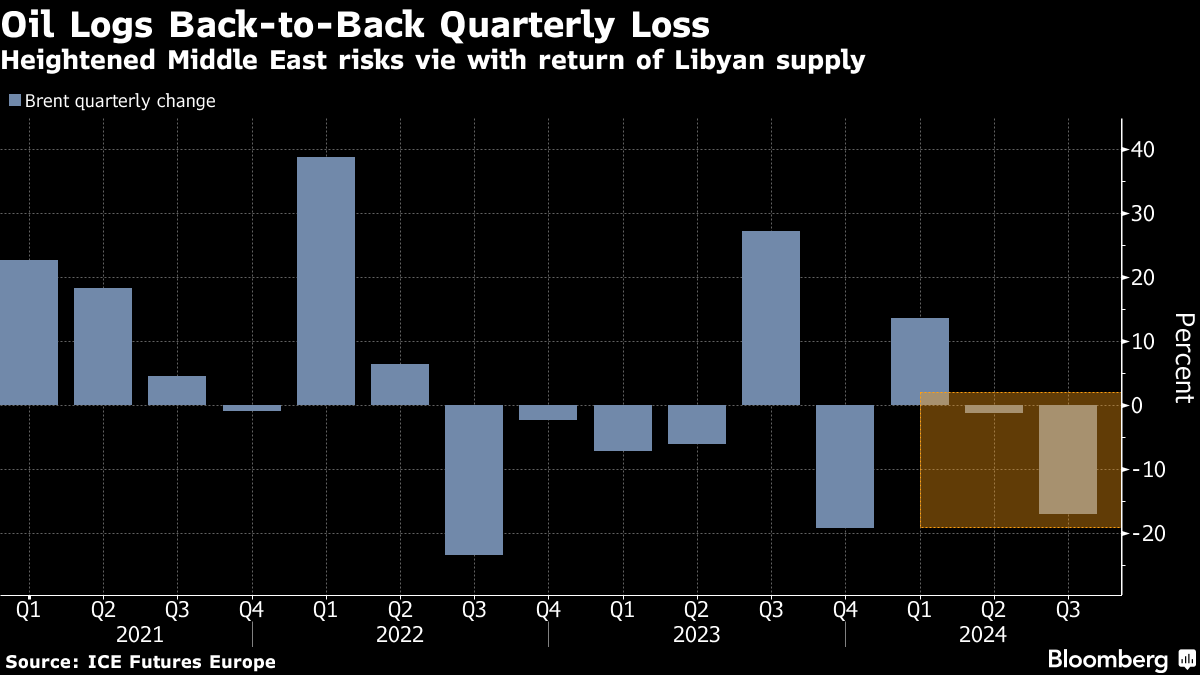

The global crude benchmark plunged almost 17% last quarter, and is now lower year-to-date. Expectations that OPEC+ will make good on plans to bring back production, as well as a slowdown in China — even after massive stimulus was unveiled last week — have weighed on prices.

OPEC+ will hold an online monitoring meeting on Wednesday, as the alliance prepares to increase production. The group will start restoring supply in December and isn’t discussing any new proposals, Russian Deputy Prime Minister Alexander Novak said last week.

Israel had been stepping up its assault on Hezbollah in Lebanon since it killed the Iranian-backed group’s chief on Friday. Oil prices have so far not reacted to the escalation, with the production of crude in the Middle East largely unaffected by the hostilities.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

S&P 500 Posts Longest Winning Run Since January: Markets Wrap

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq