Shifting Fed Views Boost Yields, Weigh on Stocks: Markets Wrap

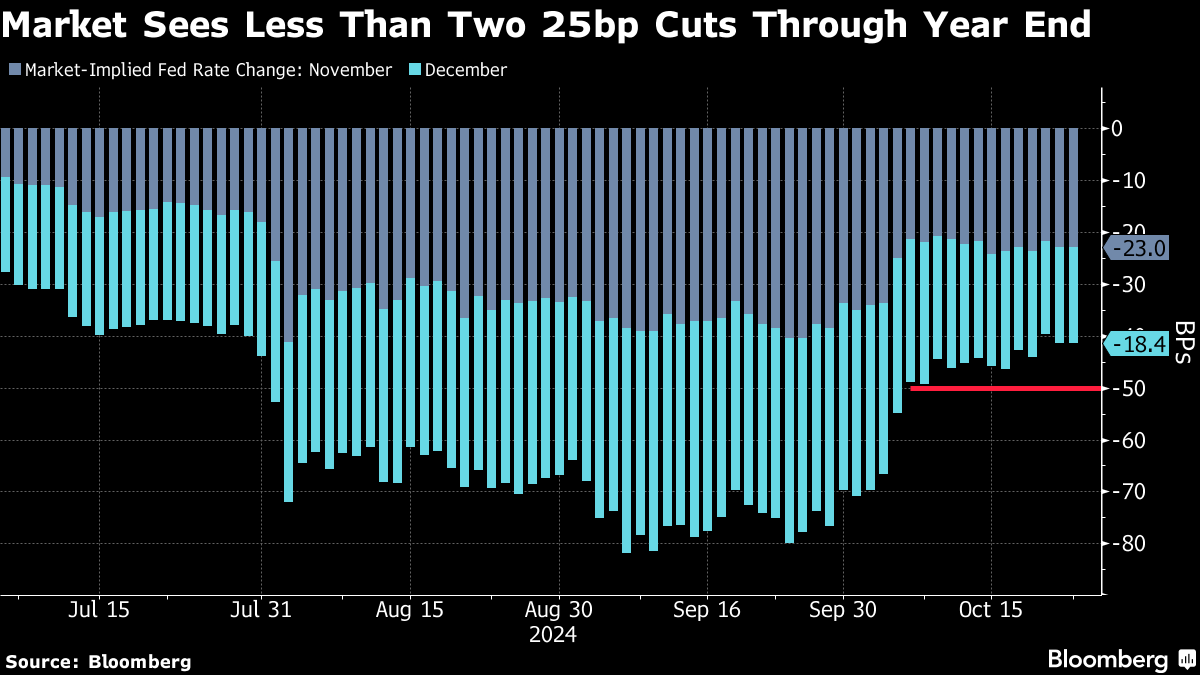

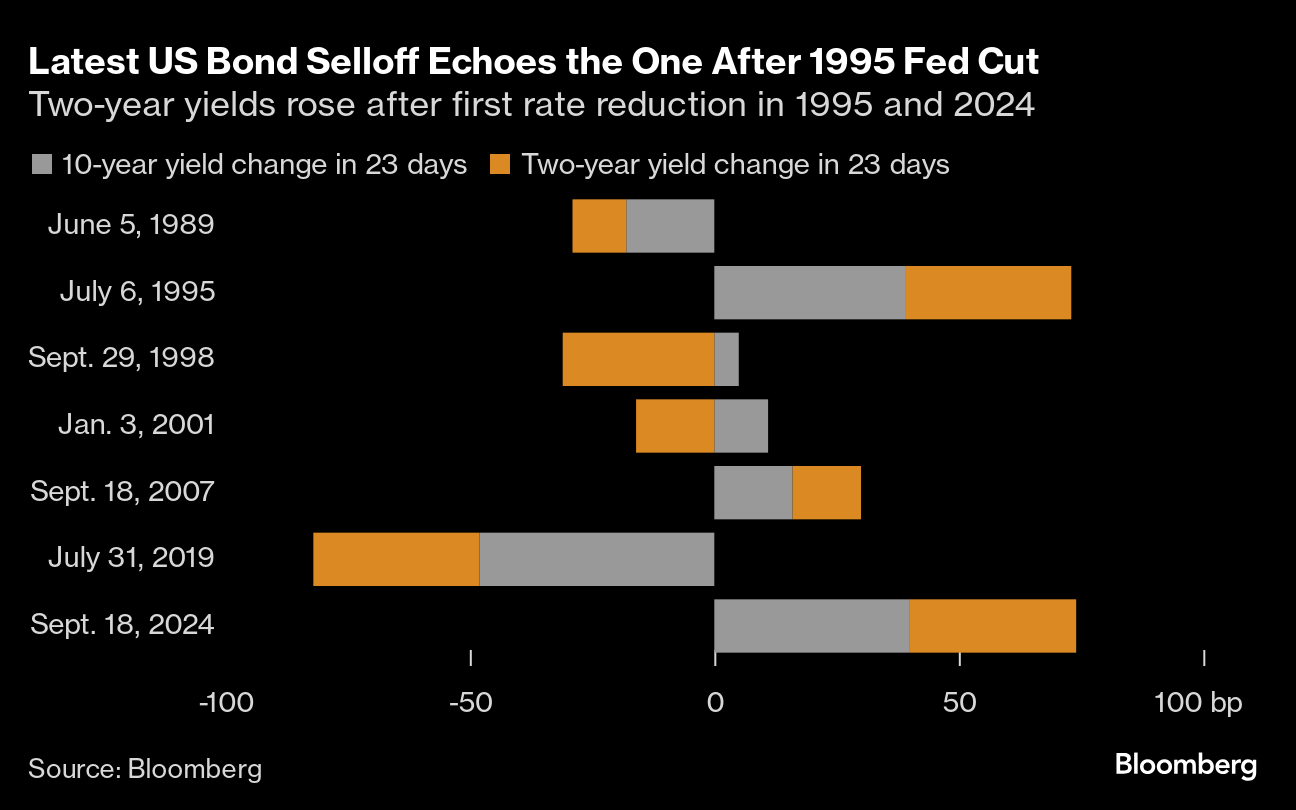

(Bloomberg) -- A selloff in global bonds resumed, weighing on Asian shares as risk appetite stayed subdued given the prospect of less aggressive Federal Reserve interest rate cuts.

Yields on 10-year Treasuries rose another three basis points after topping 4.2% for the first time since July earlier this week. Those on Japan’s 40-year notes also reached the highest in 16 years. A Bloomberg gauge of the dollar was up slightly, with the yen losing as much as 0.8%.

An index tracking Asian equities was flat, amid declines in Japan and gains in South Korea. US futures edged lower, while European contracts pointed to a steady open. Hong Kong and mainland Chinese shares were outliers, rising after a top government-linked think tank called on authorities to issue 2 trillion yuan ($281 billion) of special government bonds to help create a market stabilization fund.

The broader risk-off tone comes as investors have pared back bets on rapid policy easing, on signs that the US economy remains robust and concerns about wider fiscal deficits after the presidential election. Most Fed officials speaking earlier this week signaled they favor a slower tempo of rate reductions.

“Asia is mostly on its back foot,” said Vishnu Varathan, Asia head of economics and strategy for Mizuho Bank. “USD is dominating against a backdrop of Fed speak suggesting more gradual cuts, IMF revisions suggesting relative US exceptionalism holding up, and the absence of follow-through bulls in China.”

Bank of America Corp. Chief Executive Officer Brian Moynihan was among the latest to join the monetary policy debate, urging Fed policymakers to be measured in the magnitude of interest-rate reductions.

The International Monetary Fund lowered its global growth forecast for next year and warned of accelerating risks from wars to trade protectionism, even as it credited central banks for taming inflation without sending nations into recession.

Back in Asia, two stock listings were in the spotlight. Tokyo Metro Co.’s shares rose as much as 47% in their debut, after the company raised 348.6 billion yen ($2.3 billion) in the country’s largest initial public offering since mobile carrier SoftBank Corp. listed in 2018. In Hong Kong, China Resources Beverage Holdings Co. gained 14%, showing strong response to one of the city’s biggest initial public offerings this year.

Meanwhile, Goldman Sachs Group Inc. tactically lowered Indian equities to neutral from overweight as slowing economic growth dents the outlook for corporate earnings.

Oil fell as a US industry group signaled a rise in nationwide crude inventories, and the Biden administration renewed efforts to secure a cease-fire in the Middle East. Gold was steady after climbing to a fresh record.

Elsewhere, options traders are increasing bets that Bitcoin will reach $80,000 by the end of November no matter who wins the US election.

In corporate news, Jio Financial Services Ltd., controlled by billionaire Mukesh Ambani, has held talks with Allianz SE to set up an insurance partnership in India as the German firm seeks to scrap two existing joint ventures in the country, according to people familiar with the matter.

Texas Instruments Inc. gave a downbeat outlook for the current period even after topping estimates. Starbucks Corp. pulled guidance for 2025 after sales plunged for a third consecutive quarter. McDonald’s Corp. slumped as its Quarter Pounders were linked to an E. Coli outbreak in the western part of the US.

Key events this week:

- Canada rate decision, Wednesday

- Eurozone consumer confidence, Wednesday

- US existing home sales, Wednesday

- Boeing, Tesla, Deutsche Bank earnings, Wednesday

- Fed’s Beige Book, Wednesday

- US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

- UPS, Barclays earnings, Thursday

- Fed’s Beth Hammack speaks, Thursday

- US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 6:47 a.m. London time

- Japan’s Topix fell 0.5%

- Hong Kong’s Hang Seng rose 1.5%

- The Shanghai Composite rose 0.7%

- Euro Stoxx 50 futures were little changed

- Nasdaq 100 futures fell 0.2%

- Australia’s S&P/ASX 200 rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0803

- The Japanese yen fell 0.7% to 152.09 per dollar

- The offshore yuan was little changed at 7.1382 per dollar

- The Australian dollar fell 0.1% to $0.6675

- The British pound was little changed at $1.2991

Cryptocurrencies

- Bitcoin fell 0.7% to $67,050.46

- Ether fell 0.8% to $2,612.63

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.23%

- Australia’s 10-year yield advanced three basis points to 4.47%

Commodities

- West Texas Intermediate crude fell 0.2% to $71.61 a barrel

- Spot gold rose 0.2% to $2,753.19 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Declines After Surge as Traders Keep Focus on Middle East

US Watching Dark Fleet Ship-to-Ship Oil Transfers in Asia Waters

Aramco CEO Says He’s Bullish on China After Stimulus Roll-Out

Oil Rebounds as Israel Plans Next Iran Move After Weekend Attack

Oil Prices Show How Numb Traders Have Become to US Sanctions

US Pins Hope for Cease-Fire and More on Sinwar’s Killing

Diesel Exports From China Decline to Lowest Level Since Mid-2023

Oil Steadies as Traders Weigh Middle East Risks, China Outlook

World Set for Cheaper Energy on Shift From Oil and Gas, IEA Says