Asian Stocks Advance on China Stimulus Hopes: Markets Wrap

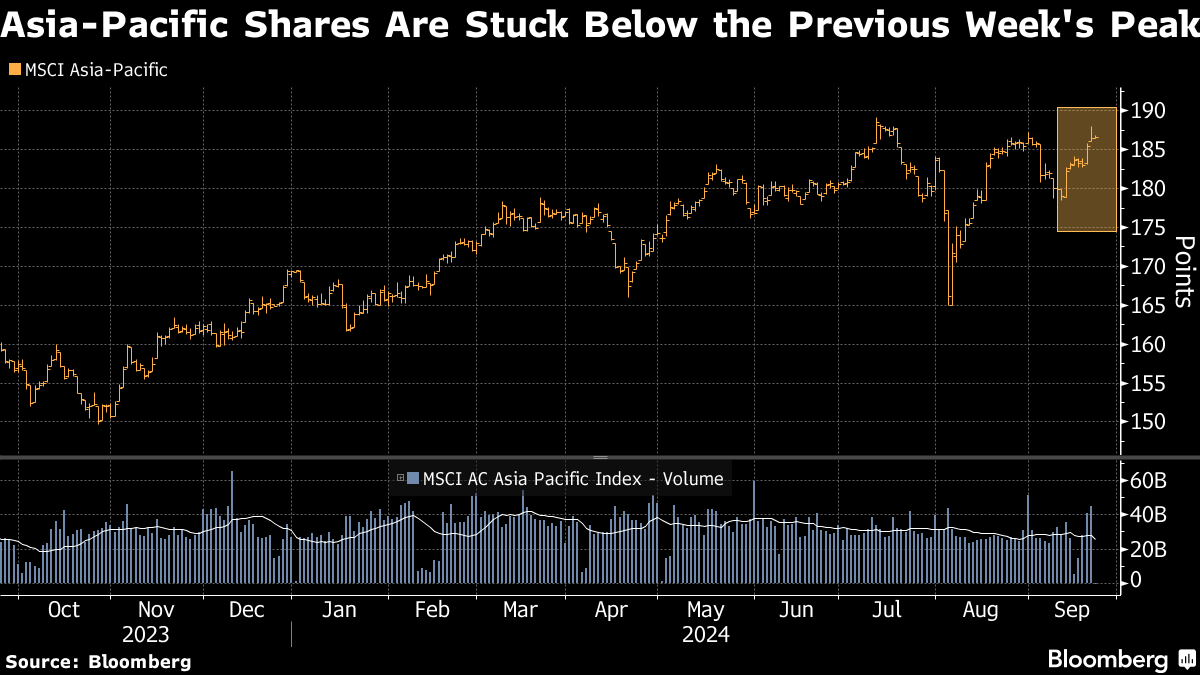

(Bloomberg) -- Asian stocks rose along with US equity futures on expectations that China may deliver more stimulus to revive the world’s second-largest economy.

The MSCI Asia Pacific Index climbed as shares in China, Hong Kong and South Korea advanced. The People’s Bank of China and other regulators will hold a briefing on Tuesday, after data on Friday reinforced the slowing momentum in the economy. The yen dropped after Bank of Japan Governor Kazuo Ueda indicated Friday that authorities aren’t in a hurry to raise interest rates again.

China’s central bank cut a short-term policy rate on Monday as part of reductions initiated in July. The central bank lowered the 14-day reverse repurchase rate to 1.85% from 1.95% previously.

“I do expect PBOC will cut the seven-day repo rate as well as the reserve requirement ratio in the coming months,” said Zhiwei Zhang, president and chief Economist at Pinpoint Asset Management. “There is a press conference tomorrow when the financial regulators will shed light on their policy stance.”

Global markets are also getting a lift from the Federal Reserve kicking off its rate cut cycle. A gauge of the dollar was little changed while Australian bonds fell ahead of the central bank likely extending a policy pause on Tuesday as housing costs underpin sticky inflation.

Cash trading of US Treasuries was closed in Asia due to a holiday in Japan.

A swath of Fed speakers is due, while among the raft of economic data this week will be the Fed’s preferred measure of inflation, which may give fresh impetus to the global share rally.

“What markets will probably be looking for here is a very fine balance in the data — where disinflation continues unfettered whereas jobs don’t deteriorate too sharply,” Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd., told Bloomberg TV.

Oil rose after a second weekly gain, with the focus on an escalation in the conflict between Israel and Hezbollah. Gold steadied near a record.

In the newest geopolitical twist, the US Commerce Department is said to be planning to reveal proposed rules that would ban Chinese- and Russian-made hardware and software for connected vehicles as soon as Monday. Meanwhile, Sri Lanka’s dollar bonds slid after leftist candidate Anura Kumara Dissanayake won the presidential election over the weekend.

Elsewhere this week, the central banks of Sweden and Switzerland are scheduled to hold monetary policy decisions.

Key events this week:

- Malaysia CPI, Monday

- Eurozone HCOB Manufacturing PMI, HCOB Services PMI, Monday

- UK S&P Global Manufacturing PMI, S&P Global Services PMI, Monday

- Australia rate decision, Tuesday

- Japan Jibun Bank Manufacturing PMI, Services PMI, Tuesday

- Mexico CPI, Tuesday

- Bank of Canada Governor Tiff Macklem speaks, Tuesday

- Australia CPI, Wednesday

- China medium-term lending facility rate, Wednesday

- Sweden rate decision, Wednesday

- Switzerland rate decision, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US jobless claims, durable goods, revised GDP, Thursday

- Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

- Mexico rate decision, Thursday

- Japan Tokyo CPI, Friday

- China industrial profits, Friday

- Eurozone consumer confidence, Friday

- US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 9:04 a.m. Tokyo time

- Hang Seng futures fell 0.5%

- Australia’s S&P/ASX 200 fell 0.4%

- Euro Stoxx 50 futures fell 1.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1160

- The Japanese yen fell 0.2% to 144.11 per dollar

- The offshore yuan was little changed at 7.0464 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $63,461.17

- Ether rose 0.2% to $2,578.54

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.74%

- Australia’s 10-year yield advanced three basis points to 3.95%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China Steel Mills Are Facing a Wave of Bankruptcies, BI Says

Oil Holds Steady as Middle East Tensions Rise, Fed Boost Fades

Oil Gains as Traders Track Risk-On Tone and Middle East Tension

Oil Edges Lower With US Stockpiles and Mideast Tensions in Focus

Oil Climbs Ahead of Fed Decision But Demand Concerns Persist

Energy Transfer Says Blast Occurred on Texas NGL Line

Oil Steadies as Falling Libyan Exports Offset Weak Chinese Data

Alcoa to Get $1.1 Billion for Stakes in Saudi Aluminum Plants

Hedge Funds Have Never Been This Bearish on Brent Crude Before

Oil Fades After Short-Lived Rebound as Storm Francine Passes

TC Energy powers North America's future by delivering critical infrastructure

Rockwool's innovative corrosion-resistant technology transforms the future of industrial insulation

Crown LNG at the forefront of cutting-edge harsh weather solutions

World Economic Forum on the role of technology in scaling critical mineral supply chains

Leveraging carbon markets and technology for a stronger global climate response

Why data centres and AI could shake up the global LNG market

Why energy executives expect the world to hit net zero by 2060

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Partner content

TAQA Water Solutions pioneers water sustainability efforts worldwide

Integrally geared compressors cut the carbon and boost carbon capture

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled