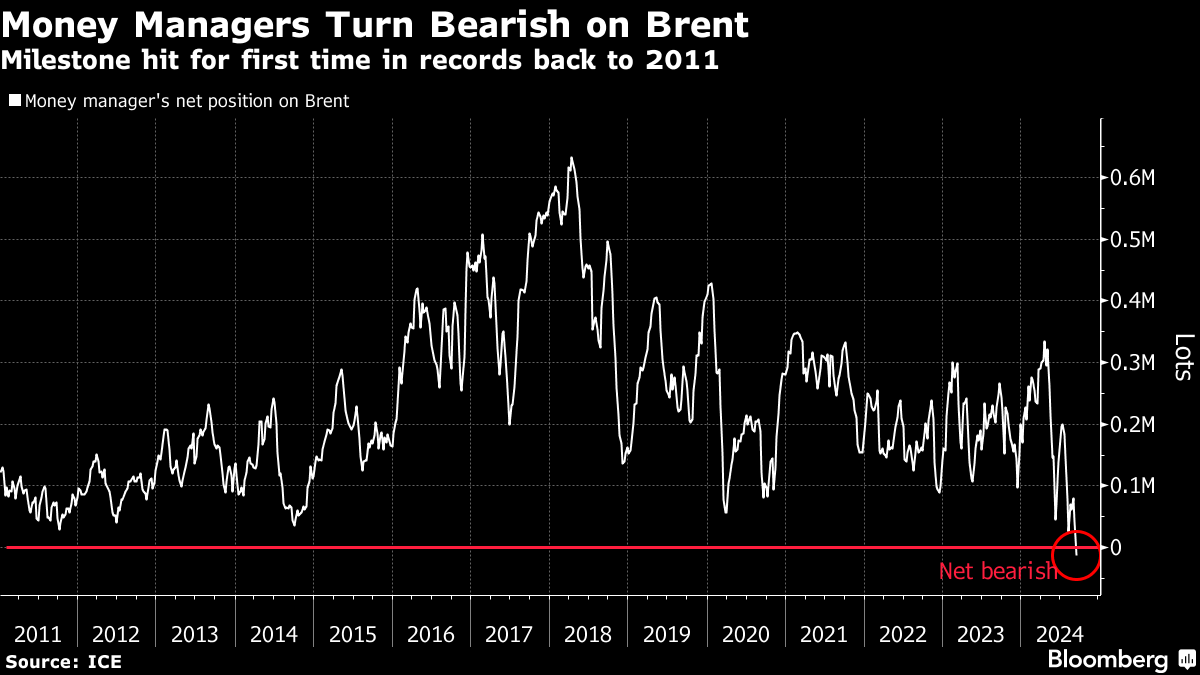

Hedge Funds Have Never Been This Bearish on Brent Crude Before

(Bloomberg) -- Hedge funds turned net bearish on Brent crude for the first time on record as concerns about an oversupply of oil hammer futures prices.

Money managers’ short positions outnumbered long bets by 12,680 lots in the week ended Sept. 10, the first time that’s happened in ICE Futures Europe data going back to January 2011. Hedge funds remained net bullish on WTI, though that position was the smallest since February. Money managers shrank their net bullish Nymex WTI position to 105,024 lots, weekly CFTC data on futures and options show.

Investors are increasingly concerned about an oversupply of crude next year as non-OPEC countries boost output and demand from China and the US — the world’s top oil consumers — appears to be faltering.

The gloomy sentiment rippled across refined-products markets as well. Money managers also turned the most bearish on diesel in almost nine years, deepening their net-short position to 38,609 lots. Similarly, gasoline’s net-long position was the least bullish in more than seven years, dwindling to just 5,193 lots. Money managers also boosted their bearish gasoil bets to a record net-short position of 64,461 lots.

Trading in oil options and heavy selling from algorithm-driven traders helped drive prices to the lowest in more than two years earlier this week. As bearish bets have surged and the trade got crowded, some of those positions were unwound later this week, leading to a tepid price recovery.

©2024 Bloomberg L.P.