Oil Advances After China Announces Sweeping Support Measures

(Bloomberg) -- Oil rose after Chinese authorities unleashed a blitz of policy support for the economy, and a major Israeli strike on Hezbollah targets in Lebanon kept tensions high in the Middle East.

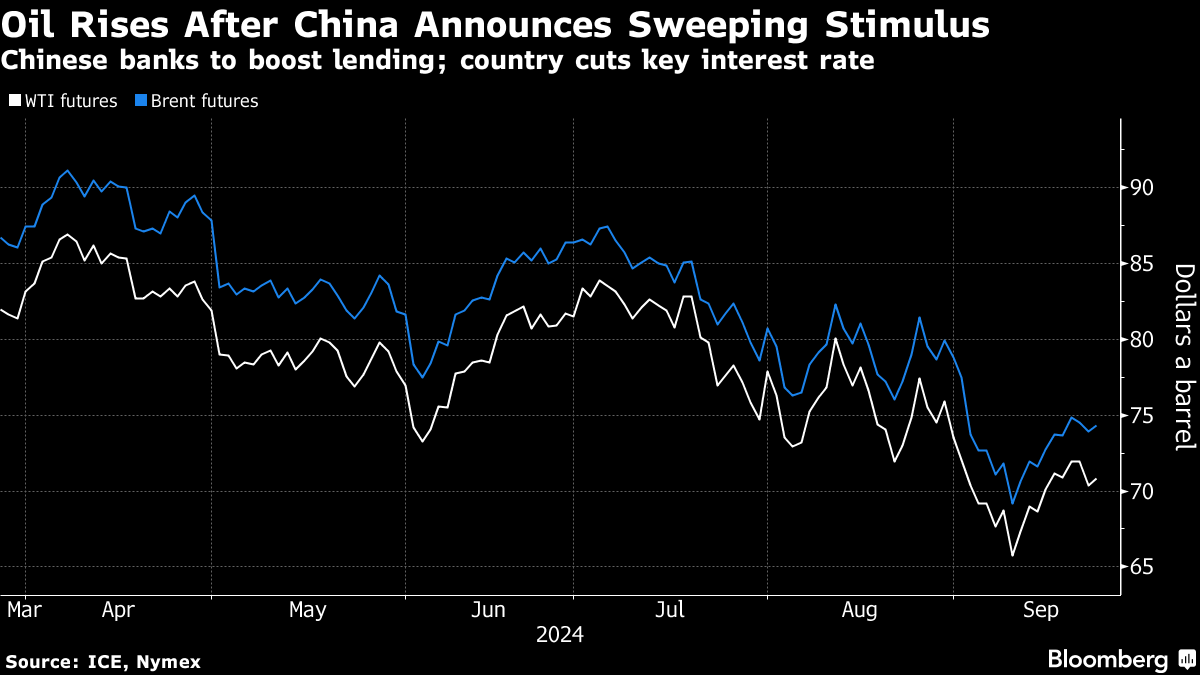

Brent crude rose above $74 a barrel after dropping 0.8% on Monday, with West Texas Intermediate near $71. People’s Bank of China governor Pan Gongsheng announced a series of stimulus measures at a briefing on Tuesday in Beijing, as policymakers made their broadest swing so far to hit this year’s annual growth target of about 5%.

Concerns over the flagging Chinese economy and the prospect of increased supplies from OPEC+ have combined to undermine oil prices, which are down by around 14% so far this quarter. The measures announced Tuesday — which include boosting banks’ lending to consumers and corporates and a cut to the PBOC’s key short-term interest rate — could support growth and energy demand in the world’s biggest oil importer.

“At the margin, this would be positive for China demand,” said Han Zhong Liang, an investment strategist from Standard Chartered Plc in Singapore. “The feed-through from lower rates to the real economy will be key from here.”

In the Middle East, Israel attacked targets across southern Lebanon, killing nearly 500 people in the deadliest day of strikes since its 2006 war with Hezbollah. Iran, which backs the group, had said earlier that it was prepared to de-escalate tensions.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge