Oil Climbs Ahead of Fed Decision But Demand Concerns Persist

(Bloomberg) -- Oil edged higher as a widely expected interest-rate cut by the Federal Reserve this week offset concerns about the demand outlook.

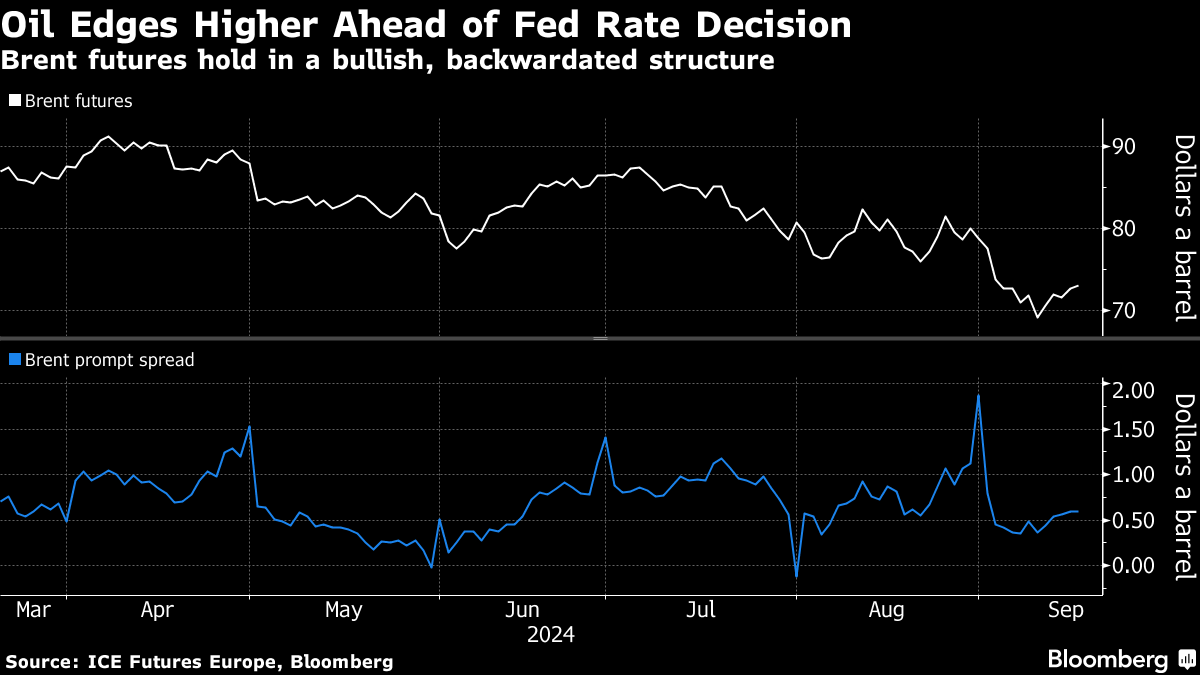

Brent traded near $73 a barrel after rising by 1.6% on Monday, while West Texas Intermediate was above $70. Opinion remains divided on the Fed’s easing path, but some are wagering it will start with a half-point cut on Wednesday. Lower rates would likely provide bullish tailwinds for energy demand.

Oil has lost around 14% this quarter on China’s economic slowdown and signs of plentiful supply. Positioning of trend-following commodity trading advisers are close to their maximum short positions after a recent price slump, according to EA Quant Analytics, which may ease selling pressure.

The market is torn on the size of the interest-rate cut, and investors are probably covering their positions ahead of the decision, helping to keep oil prices elevated, said Warren Patterson, Singapore-based head of commodity strategy for ING Groep NV. There are also lingering concerns about Libyan supply, he added.

In Europe, major oil refineries are cutting how much crude they process at their plants, adding to bearish headwinds. The region is also facing competition from a new mega refinery in Nigeria, that’s in the process of firing up.

Timespreads are showing a mixed picture. While the gap between Brent’s two nearest contracts has widened slightly in a bullish, backwardated structure, they remain lower from a month ago. The spread was last at 61 cents a barrel in backwardation, compared with 81 cents about a month ago.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge