Oil Swings as Traders Guess at Israel’s Next Moves in Conflict

(Bloomberg) -- Oil swung in a day of choppy trading as investors assessed the risks that Israel’s recent strikes against Hezbollah will widen the conflict in the Middle East.

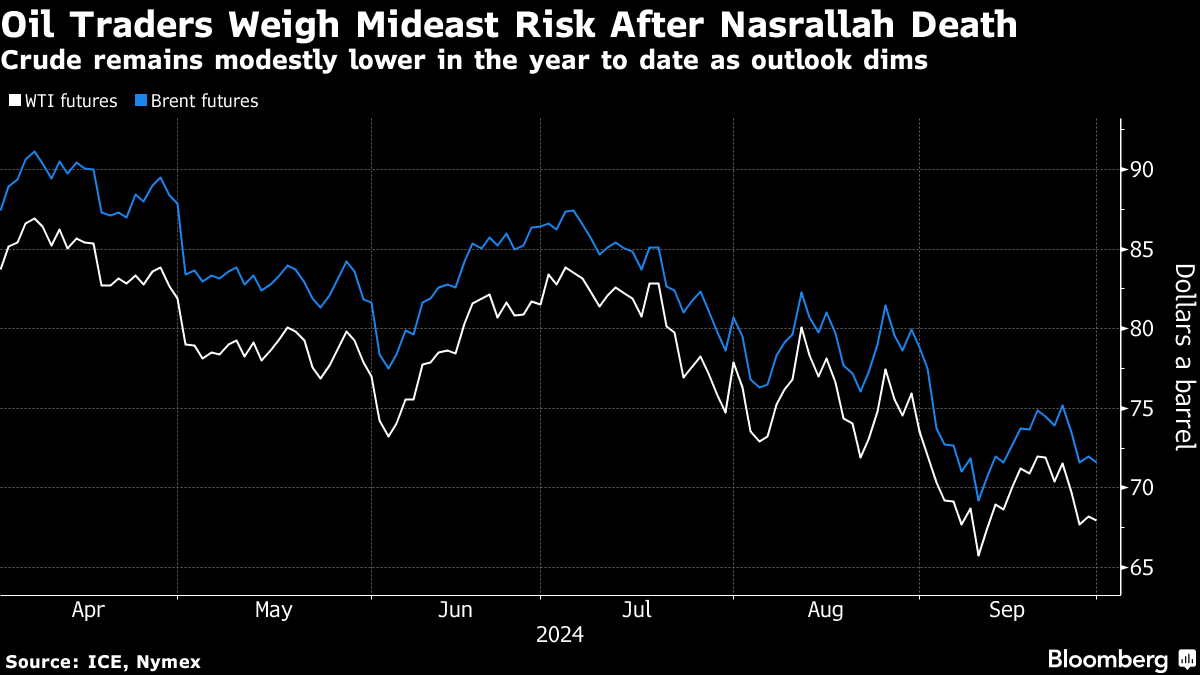

West Texas Intermediate edged higher to trade above $68 a barrel but has swung in a range of about $1.75 a barrel, largely tracking moves in equities. Stocks were slightly lower as traders await remarks from Federal Reserve Chair Jerome Powell later Monday.

Israel bombed the center of Beirut for the first time in almost a year of hostilities with Lebanon’s Hezbollah, days after the killing of the Iran-backed group’s chief last week. According to a US official, the Biden administration persuaded Israel to conduct limited, targeted attacks focused on clearing Hezbollah’s infrastructure from the Lebanon-Israel border.

Still, the recent escalations in the conflict in the Middle East — a region that supplies about a third of the world’s oil — have done little to shake crude from its recent slump. Crude is down about 16% this quarter, driven by the prospect of tepid demand and production increases from both OPEC and non-member nations.

“Between last week’s OPEC news about potentially abandoning its price goals and the geopolitical conflict in the Middle East, there’s a difficulty in assessing direction to price at the moment,” said Rohan Reddy, head of international business development & corporate strategy at Global X Management.

Global production remains ample, with OPEC+ planning to relax output curbs. The producer group will meet to assess global markets this week, with several delegates saying there are currently no plans to make changes to policy.

Meanwhile, Libyan oil fields that were were halted or curtailed by an eastern government ban are expected to start restoring output on Tuesday, people with knowledge of the matter said.

Since the outbreak of the war in Gaza almost a year ago, oil traders have been been on alert for actual disruptions to supply, especially at times of heightened friction between Israel and Iran. While Houthi attacks in the Red Sea have forced some tankers to go around southern Africa — lengthening voyages — crude output from the region has been largely unscathed.

“Some oil market participants will look past this escalation given that there still has not been a major physical supply disruption and Iran has not demonstrated any appetite to enter this nearly yearlong conflict,” RBC Capital Markets LLC analysts including Helima Croft said in a note. “And yet, it is extremely difficult to see where this regional conflict is headed, and whether this is the beginning of the end, or the end of the beginning.”

©2024 Bloomberg L.P.