Oil Holds Sharp Drop on Signs Libya May Soon Resume Production

(Bloomberg) -- Oil steadied after declining the most in two weeks as Libya’s factions reached a “compromise” on leadership for the OPEC member’s central bank, opening the way to the return of some crude production.

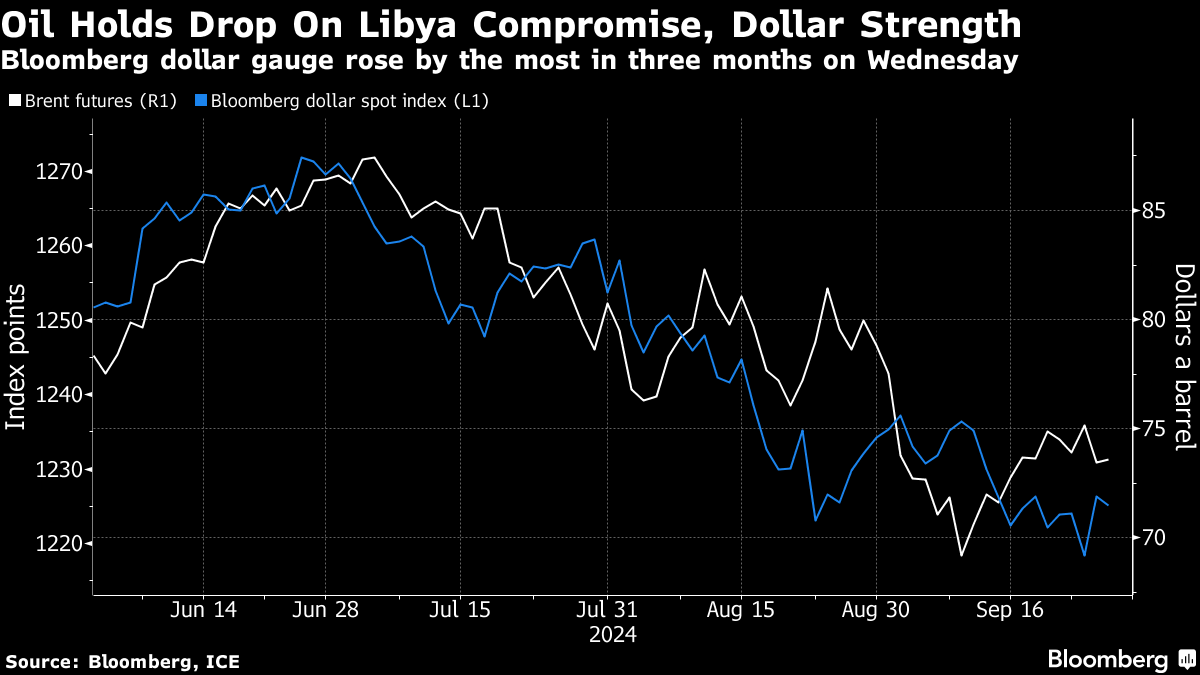

Brent traded below $74 a barrel after tumbling 2.3% on Wednesday, with West Texas Intermediate near $70. Representatives from Libya’s rival eastern and western administrations “initialed an agreement” on steps for the bank’s board, with a signing ceremony to take place on Thursday, the United Nations said.

A stronger dollar also weighed on commodities such as oil priced in the currency. A Bloomberg gauge of the greenback rose by the most in three months on Wednesday as risk appetite abated in wider markets.

The potential revival in Libyan production comes as crude is set to close its worst quarter this year, hurt by the prospect of additional supply from OPEC+ and China’s dour economic outlook. Even so, oil traders have this week shrugged off initial euphoria over Beijing’s announcement of a slew of stimulus measures due to their unclear impact on demand in the biggest importer, as well as data that showed higher consumption in the US.

“In the medium term, we are still going to be in a trading range of $70 to $90 a barrel,” said Stefano Grasso, senior portfolio manager at Singapore-based fund 8vantedge Pte. “If the stimulus is the missing piece of the puzzle for the Chinese recovery, we may see commodities test new highs.”

As part of the support, China is considering injecting as much as 1 trillion yuan ($142 billion) of capital into its biggest state banks to increase their capacity to support the economy, according to people familiar with the matter. Such a move would be the first time since the global financial crisis in 2008 that Beijing has injected capital into its largest lenders.

US commercial oil inventories shrank by 4.5 million barrels last week, taking levels to the lowest since April 2022, data released on Wednesday showed. Stockpiles of gasoline and distillates, which includes diesel, also fell.

Meanwhile, the US, European Union, and major powers in the Middle East including Saudi Arabia and Qatar have proposed a three-week cease-fire between Israel and Hezbollah in Lebanon, part of a bid to clear the way for negotiations and avert an all-out war in the region.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge