Oil’s Meltdown Worsens on Concern Over Demand and OPEC+ Supply

(Bloomberg) -- Oil sank even further after crashing to the lowest level this year on concern that fragile demand and restored supplies from OPEC+ will create a new glut.

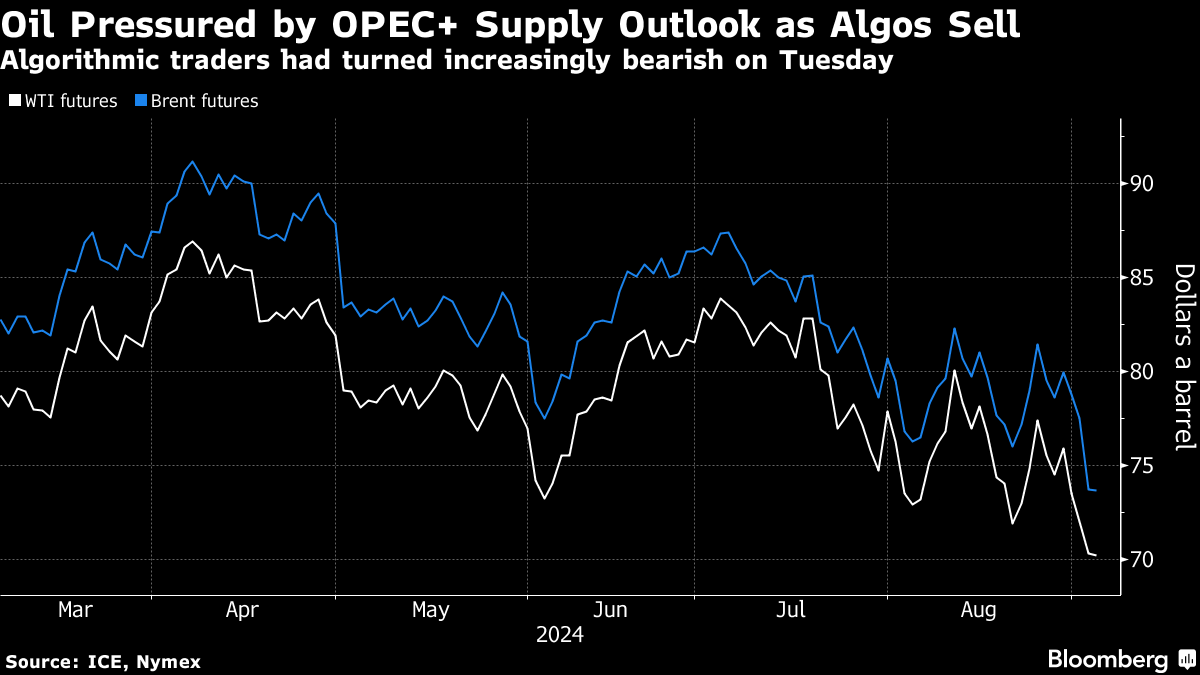

Brent futures fell to around $73 a barrel following a meltdown of almost 5% on Tuesday, while West Texas Intermediate dropped under $70 for the first time since early January.

Downbeat economic data from China and the US stirred fears over demand in the top two consumers, while a Libyan official predicted a resolution to the crisis that has shuttered half the country’s output. Despite the gloom, other OPEC+ nations appear set to proceed with reviving supplies in October.

“Demand concerns and the negative reaction of oil prices to potential supply additions from OPEC+ and Libya indicates a weak market sentiment, suggesting market players don’t want to see additional barrels from OPEC+ at present,” said Giovanni Staunovo, an analyst at UBS AG in Zurich.

Oil forecasters from JPMorgan Chase & Co. to Standard Chartered Plc had predicted a rally to $90 a barrel or beyond this quarter, as summer driving demand and OPEC+ supply restraint drained storage tanks around the world. Instead, the commodity has wiped out all of this year’s gains.

Tuesday’s slump began after data from China showed critical engines of economic growth sputtering, with factory activity contracting for a fourth month and the value of new-home sales declining. US manufacturing activity showed a fifth consecutive month of contraction.

The plunge intensfied after Libya’s ousted central bank governor, Sadiq Al-Kabir, predicted an end to the crisis that has slashed the North African nation’s output in half.

More than 500,000 barrels a day were halted last week when authorities in the east of the country protested Al-Kabir’s removal by the Tripoli-based government. Tuesday’s sell-off was likely exacerbated by increasingly bearish trend-following algorithmic traders.

Meanwhile, speculators are growing increasingly anxious that Libya’s partners in the Organizaton of Petroleum Exporting Countries seem set on proceeding with an agreement to restore halted production.

Led by Saudi Arabia and Russia, the OPEC+ alliance plans to add 180,000 barrels a day in October as it gradually restarts output halted since 2022 in a bid to shore up prices. The cartel had said it could “pause or reverse” the hike if necessary, but officials have privately indicated the increase remains on track.

Investors are also watching monthly jobs data due Friday that could offer more insight on the Federal Reserve’s path forward on interest-rate cuts. A report last month showed a rise in the unemployment rate to a level that triggered a popular recession indicator.

“The financial markets seem to be in peak panic mode with a fortnight left for the Fed’s crucial ‘pivot’ policy meeting,” said Vandana Hari, founder of Vanda Insights.

©2024 Bloomberg L.P.