Oil Set for Deep Weekly Loss Even as OPEC+ Delays Adding Barrels

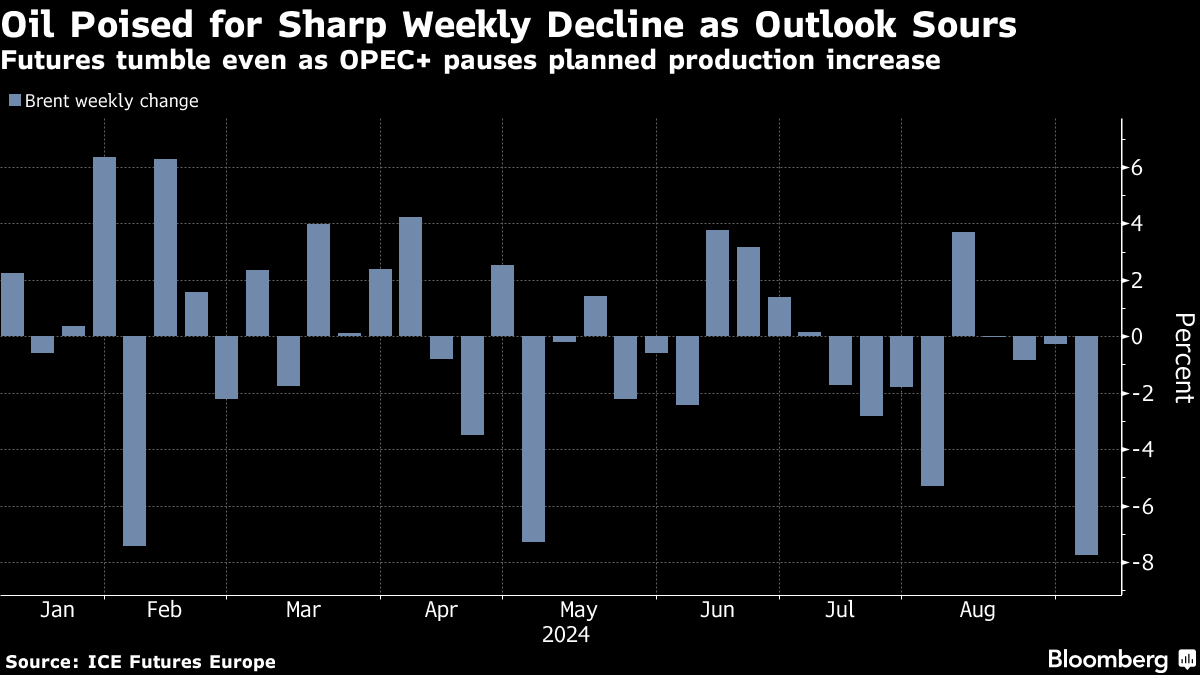

(Bloomberg) -- Oil was poised for the deepest weekly loss in almost a year on persistent concerns about soft demand and ample supply, even as OPEC+ delayed a planned increase in output by two months.

Brent traded near $73 a barrel on Friday, but is down nearly 8% for the week, while West Texas Intermediate was around $69. The producer group won’t boost output by 180,000 barrels a day in October and November, OPEC said in a statement, but kept its plan to revive 2.2 million barrels a day over the course of a year in place.

OPEC+ had earlier given indications that it was keen on pressing ahead with its planned supply increases from October, but reversed course amid a sharp decline in global benchmark prices. Oil initially rose when the alliance released its statement on Thursday but ended the session flat.

Crude has trended lower since early July on demand concerns from key consumers, particularly China, and signs of rising supply from outside of OPEC, although recent disruptions to supplies from Libya have provided some support. Timespreads are also indicating weakness, with their bullish backwardation structure narrowing sharply.

“We see the OPEC+ unwind delay, ongoing geopolitics and financial positioning providing price support at $70 to $72 Brent,” Citigroup Inc. analysts including Eric Lee said in a note. The bank said it sees “moves down to the $60 range in 2025 as a sizable market surplus emerges.”

There are also signs of poor demand in some refined products. Chinese and Indian diesel markets — which account for the bulk of Asian demand — are showing signs of a slowdown, with refining margins declining. That’s echoing trends in Europe, where futures hit the lowest since mid-2023 last week.

In the US, meanwhile, official data showed US commercial crude inventories dropped by almost 7 million barrels last week to the lowest in about a year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Traders Lurch From Praying for Volatility to Drowning in It

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026