Oil Fades After Short-Lived Rebound as Storm Francine Passes

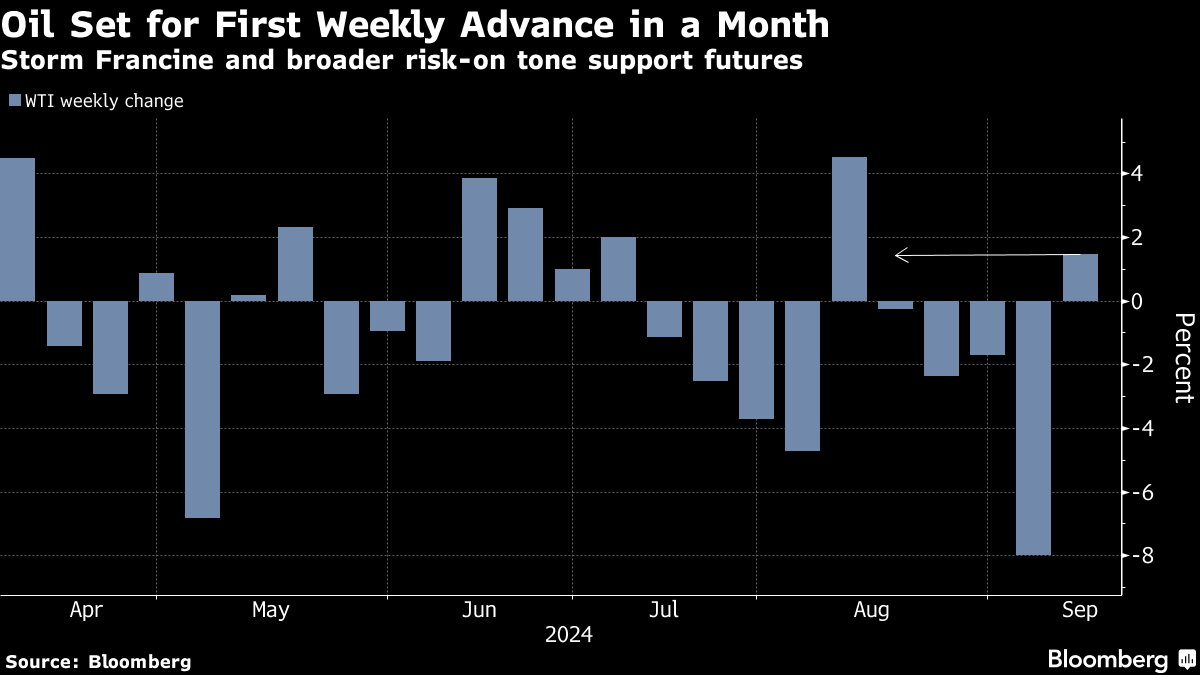

(Bloomberg) -- Oil slipped after producers started bringing output back online after Storm Francine passed, though futures still headed for their first weekly gain in a month as the disruptions and risk-on sentiment in wider markets helped ease a previously oversold crude market.

West Texas Intermediate slid about 0.5% to dip below $69 a barrel, giving up earlier gains after Shell Plc started reviving output in the Gulf of Mexico. The earlier rebound had mostly been driven by covering of extreme bearish positioning after prices settled under $66 on Tuesday, the lowest closing price since December 2021.

Francine — which weakened from its previous hurricane force — had shut down a sizable amount of production in the Gulf of Mexico and equity markets have been gaining, providing tailwinds for crude. Still, a large increase in the rig count on Friday put pressure on oil, said Robert Yawger, director of the energy futures division at Mizuho Securities USA.

“A lot of the weaker length is pulling the plug, taking their money, and going home,” Yawger said.

WTI has slid about 16% this quarter on concerns about slumping demand, particularly in top importer China. The International Energy Agency said global consumption growth in the first half was the lowest since the pandemic as China’s economy cooled. Against that backdrop, producer cartel OPEC+ has deferred a plan to relax supply curbs and Libyan oil flows have continued to slump.

“The market is not without upside potential, given recent strife in Libya and a series of geopolitical distortions in recent years,” Macquarie analysts including Marcus Garvey and Vikas Dwivedi said in a note. “We forecast a heavy surplus, as non-OPEC supply growth and sluggish demand will limit the market’s need for OPEC+ to return barrels as planned.”

The US Federal Reserve is widely expected to start cutting US interest rates at its meeting next week after signs of a labor market slowdown emerged, and traders are boosting bets that policymakers will opt for a 50-basis-point reduction. Lower borrowing costs may support growth and increase energy demand.

©2024 Bloomberg L.P.