Stocks Slip, Gold Up as Inflation Views Weighed: Markets Wrap

(Bloomberg) -- US stocks edged lower while gold climbed to another all-time high Friday as Federal Reserve policymakers weighed in on the fight against inflation.

Traders were digesting differing views from Fed Governors Christopher Waller and Michelle Bowman. Waller told CNBC it was favorable inflation data that convinced him to support the Fed’s decision for a half percentage point interest-rate cut this week. Bowman, the lone dissenting voice against the jumbo rate cut, said the move was declaring victory over inflation too early.

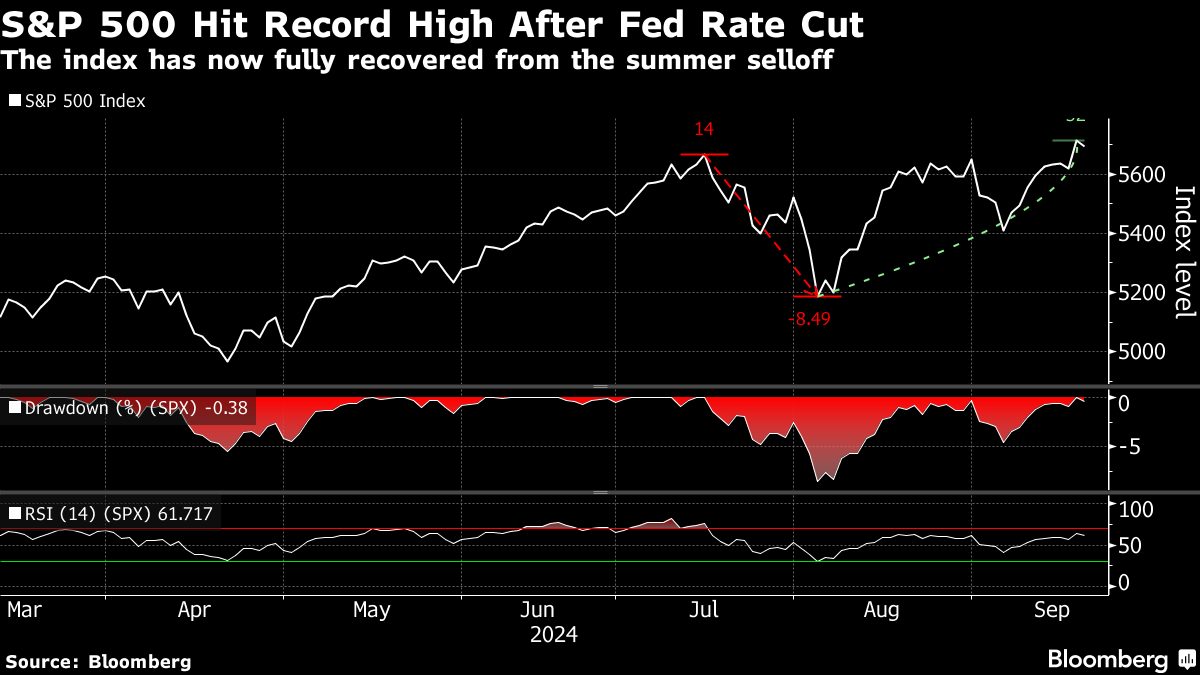

The S&P 500 retreated some , with the benchmark fresh off its 39th record high of 2024, while the tech-heavy Nasdaq 100 slumped . FedEx Corp. plunged as the economic bellwether missed profit estimates and cautioned that its business would slow while Lennar Corp. slipped after quarterly home orders fell short of Wall Street expectations. Constellation Energy Corp., the biggest US operator of reactors, jumped to a record on plans to put Three Mile Island back into service.

Confidence has been growing that the central bank will be able to engineer a soft landing, but warnings such as the one from FedEx underscore lingering concerns. Fed policymakers have projected a further half point of reductions this year.

“A sustained melt-up in risk is unlikely into peak election uncertainty that may generate a soft patch in the data,” Evercore ISI’s Krishna Guha wrote. “Investors should view the gains in risk post-Fed as a downpayment, with a check in the mail for the balance after election day.”

Evercore ISI’s vice chairman sees another half-point cut as possible if labor or inflation data come in weak.

The prospect of further rate cuts helped propel gold to an all-time high Friday. The precious metal traded above $2,600 an ounce, extending gains after an Israeli strike on a Beirut suburb. Meanwhile, a gauge of dollar strength edged higher while Treasuries were mixed.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon registered his doubts that the world’s largest economy can straddle slowing growth without tipping into a recession.

“I hope it’s true,” he said at an event. “But I’m also more skeptical that inflation is going to go away so easily, not because it hasn’t come down — it has — and it can come down more.”

Traders are braced for market swings from Friday’s quarterly “triple witching,” when about $5.1 trillion derivatives contracts tied to stocks, index options and futures mature, according to an estimate from derivatives analytical firm Asym 500.

The options expiry coincides with the rebalancing of benchmark indexes. The event has a reputation for causing sudden price moves as contracts disappear and traders roll over their existing positions or start new ones.

For Bank of America Corp.’s Michael Hartnett, the optimism in equity markets following the Fed’s move is stoking the risk of a bubble, making bonds and gold an attractive hedge against any recession or renewed inflation.

The strategist said stocks are now pricing in more Fed easing and about 18% earnings growth for the S&P 500 by end-2025. It doesn’t “get much better than that for risk, so investors are forced to chase” the rally, Hartnett wrote in a note.

He also said stocks outside the US and commodities were a good way to play a possible soft economic landing, with the latter being an inflation hedge. International equities are cheaper and starting to outperform US peers, according to Hartnett.

The yen slid after Governor Kazuo Ueda proved less hawkish than some traders expected. Ueda signaled little urgency to hike rates, and said that upside risks to inflation are easing.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4% as of 2:29 p.m. New York time

- The Nasdaq 100 fell 0.6%

- The Dow Jones Industrial Average fell 0.1%

- The MSCI World Index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.1159

- The British pound rose 0.2% to $1.3311

- The Japanese yen fell 0.9% to 143.93 per dollar

Cryptocurrencies

- Bitcoin fell 0.7% to $62,609.43

- Ether rose 3% to $2,539.37

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.73%

- Germany’s 10-year yield advanced one basis point to 2.21%

- Britain’s 10-year yield advanced one basis point to 3.90%

Commodities

- West Texas Intermediate crude fell 0.3% to $71.70 a barrel

- Spot gold rose 1.3% to $2,619.67 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Set for Weekly Gain After Fed Cut as Focus Shifts to Mideast

Oil Gains as Traders Track Risk-On Tone and Middle East Tension

Oil Edges Lower With US Stockpiles and Mideast Tensions in Focus

Oil Climbs Ahead of Fed Decision But Demand Concerns Persist

Energy Transfer Says Blast Occurred on Texas NGL Line

Oil Steadies as Falling Libyan Exports Offset Weak Chinese Data

Alcoa to Get $1.1 Billion for Stakes in Saudi Aluminum Plants

Hedge Funds Have Never Been This Bearish on Brent Crude Before

Oil Fades After Short-Lived Rebound as Storm Francine Passes

GEODE Consortium launches to roadmap the growth and development of geothermal energy

TC Energy powers North America's future by delivering critical infrastructure

ADNOC Gas takes a leading role to shape the future of low-carbon energy

Crown LNG at the forefront of cutting-edge harsh weather solutions

World Economic Forum on the role of technology in scaling critical mineral supply chains

Leveraging carbon markets and technology for a stronger global climate response

Why data centres and AI could shake up the global LNG market

Why energy executives expect the world to hit net zero by 2060

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Partner content

TAQA Water Solutions pioneers water sustainability efforts worldwide

Integrally geared compressors cut the carbon and boost carbon capture

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled