Oil Advances in Risk-On Mood as China Weighs Tariff Exemptions

(Bloomberg) -- Oil pushed higher alongside equity markets as China considered suspending tariffs on some US imports, though conflicting messages on trade raised uncertainty about the prospect for easing tensions.

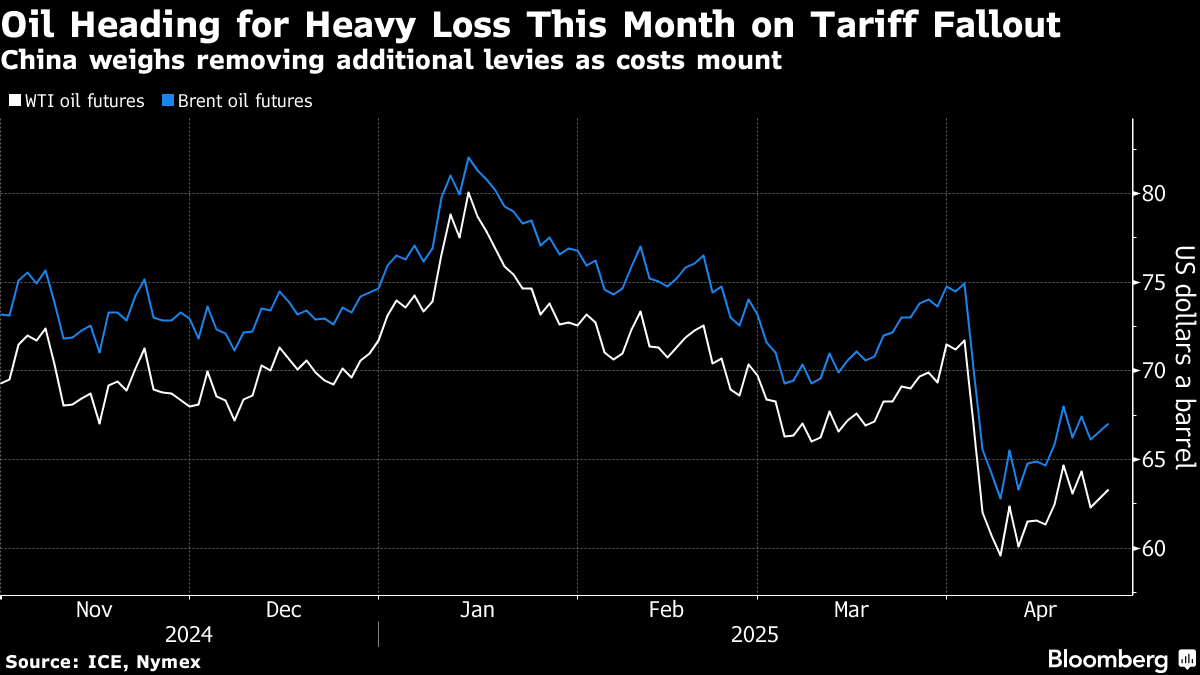

Brent rose for a second session to trade near $67 a barrel, trimming a weekly decline, while West Texas Intermediate climbed above $63. Chinese authorities are weighing removing additional levies on a number of products including ethane, according to people familiar, as economic costs mount.

Still, the outlook for an agreement on trade between the US and China appears far off. President Donald Trump said on Thursday that his administration was talking with China on trade, despite Beijing earlier denying the existence of negotiations and demanding that unilateral tariffs be revoked.

Oil has dropped sharply this month on concerns that Trump’s sweeping tariffs and retaliatory measures from trading partners including China will cripple economic activity and throttle energy demand. In an effort to reassure US oil firms, Energy Secretary Chris Wright said that the trade turmoil will be fleeting and the administration fully supports more crude output.

“Conflicting headlines on the US-China tariff situation isn’t helping sentiment,” said Priyanka Sachdeva, a senior market analyst for brokerage Phillip Nova Pte in Singapore. “Oil investors should be biased toward downside.”

OPEC+ has added to the bearish headwinds by ramping up idled oil production, stoking fears of oversupply. The group will meet on May 5 to discuss its output plans for June, and Reuters reported this week that some members are seeking a bumper increase as a dispute over quota compliance worsens.

Still, some metrics are pointing to near-term strength in the oil market. The prompt spreads for global benchmark Brent and WTI have widened this month in a bullish backwardation structure, signaling tight supply.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus

Oil Traders Lurch From Praying for Volatility to Drowning in It