Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

(Bloomberg) -- Oil rose after a tepid session on Monday, with traders monitoring the latest US moves in the trade war and the prospect of looser restrictions on Iranian crude.

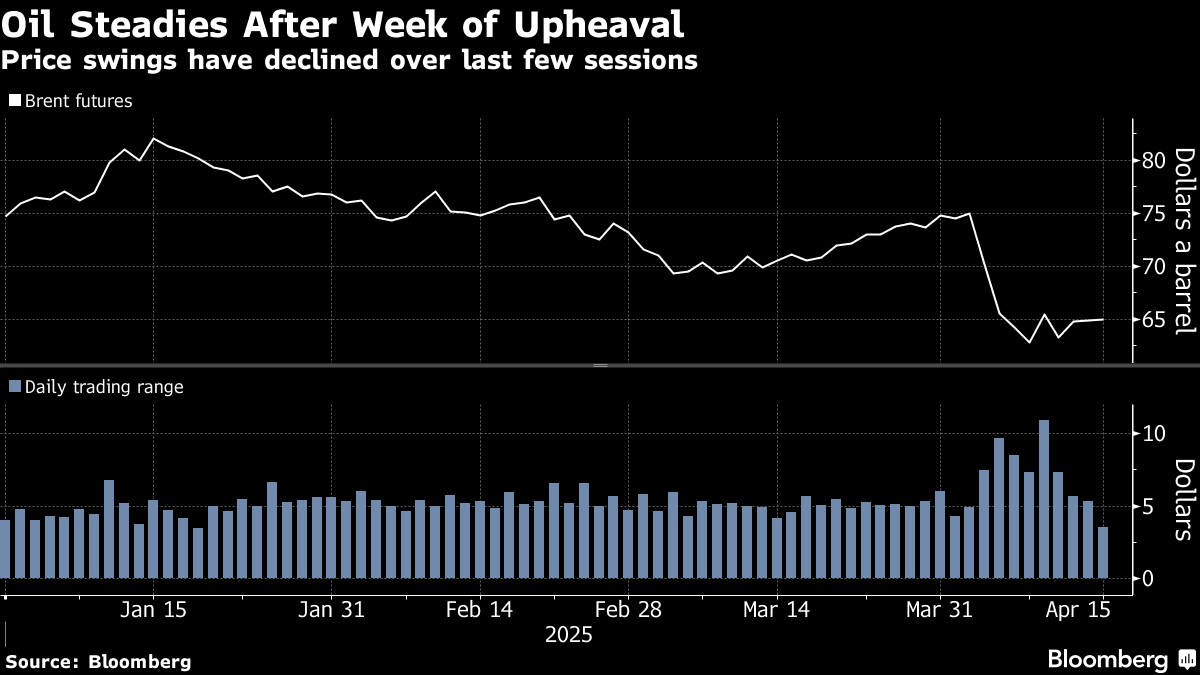

Brent traded around $65 a barrel after adding 0.2% on Monday, while West Texas Intermediate held near $62. A degree of calm returned to Wall Street on Monday, with stocks and bonds rallying after a tumultuous week in the grip of President Donald Trump’s disruptive tariff policy.

“Macro sentiment has stabilized for now, and crude is on a slow path to recovery,” said Huang Wanzhe, an analyst at Dadi Futures. “With the first wave of ‘tariff pricing’ largely baked in, markets are now gearing up for the next phase — where the focus shifts to actual demand impact as the trade war escalates, barring any policy flipflop.”

Oil has dropped about $10 this month as the trade war stoked fears of a global recession that would hurt energy demand, especially in the US and China — the biggest crude consumers. Those concerns have led agencies to cut demand outlooks and analysts to slash price forecasts, with the possibility of a glut amplified by OPEC+’s surprise decision to bring back output more quickly than expected.

The US and Iran held nuclear discussions over the weekend that both parties characterized as constructive, in the first high-level contact since 2022. The two sides are set to meet again in Rome, raising the possibility of increased oil output from the OPEC member.

“Last weekend’s US-Iran talks offered little substance, but with another round slated for Saturday, markets will be watching closely for clearer signals,” Huang said.

On the demand side, the Organization of the Petroleum Exporting Countries trimmed its outlook for consumption over the next two years by about 100,000 barrels a day, following a larger cut by the US Energy Information Administration. More banks also reduced their price forecasts, with JPMorgan Chase & Co. now seeing Brent at $66 this year.

Parts of oil’s futures curve remain in contango, a bearish pricing pattern that’s characterized by nearer-term contracts trading at a discount to longer-dated ones. The spread between the nearest two December contracts for Brent has been in the structure since last week.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz

Aramco announces discovery of 14 new oil and gas fields in Eastern Region

Oil Extends Steep Selloff as Fresh Tariff Wave Imperils Demand

Oil Edges Higher After Three-Day Tumble With Trade War in Focus