Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

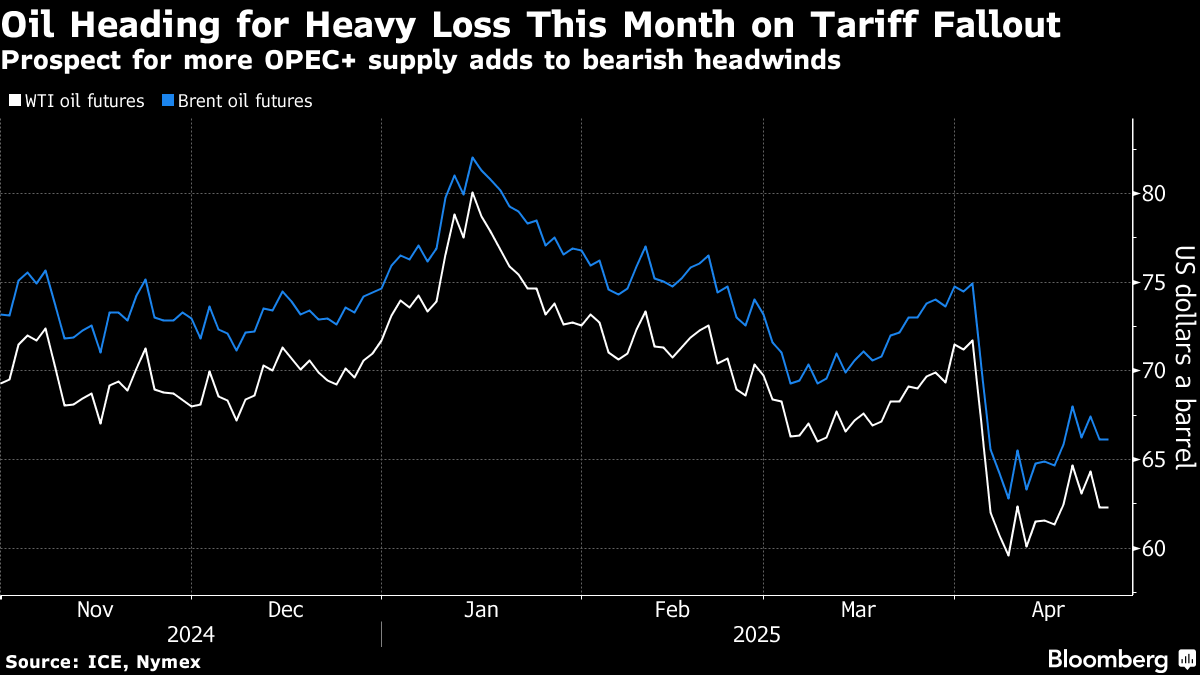

(Bloomberg) -- Oil held a decline as investors weighed the prospect of more OPEC+ supply and the fallout from trade tensions between the US and China.

Brent traded near $66 a barrel after sliding 2% on Wednesday, while West Texas Intermediate was above $62. Several members of the producer group will seek another bumper supply increase in June as a dispute over compliance to quotas worsens, Reuters reported, citing people familiar with the matter.

Growing strain within the group, particularly with Kazakhstan, have stoked fears of a price war. The Organization of the Petroleum Exporting Countries and its allies will hold a meeting on May 5 to decide what to do in June.

“The internal discord within OPEC+ has amplified downside risks on oil supply, while persistent tariff tensions continue to weigh on macro sentiment,” said Zhou Mi, an analyst at a research institute affiliated with Chaos Ternary Futures Co. “Against this backdrop, crude may resume its downward trend.”

Oil has dropped sharply this month on concerns that US tariffs and counter-levies from its biggest trading partners will hit economic activity and impact energy demand. While there are signs of easing tensions between Washington and Beijing, Treasury Secretary Scott Bessent said that President Donald Trump hasn’t offered to take down duties on a unilateral basis.

US crude stockpiles, meanwhile, expanded by 244,000 barrels last week, according to government data. That compares with an industry report that indicated inventories had shrunk the most this year.

Still, some metrics are pointing to a bullish near-term market. The prompt spread for benchmark Brent is in the widest backwardation since January, a structure that signals tighter supply.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus

Oil Traders Lurch From Praying for Volatility to Drowning in It

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply