Oil Rally Wavers as Focus Turns to US ‘Liberation Day’ Tariffs

(Bloomberg) -- Oil was little changed, pausing last month’s rally as traders position themselves for US tariff announcements.

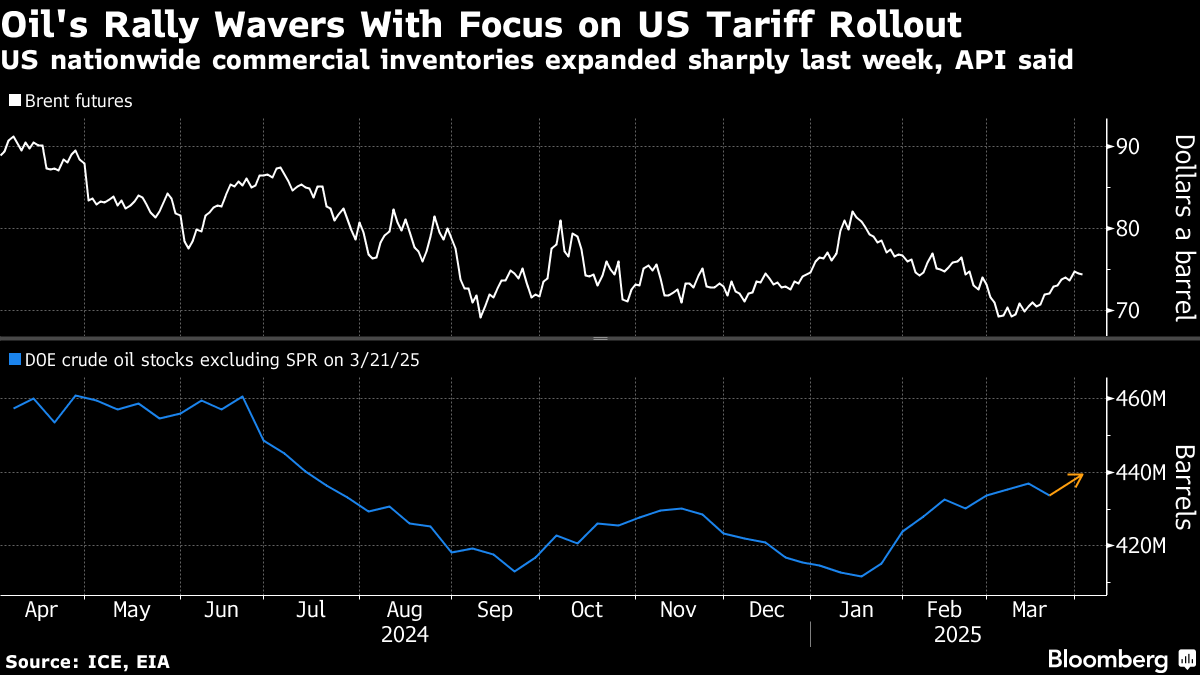

Brent traded below $75 a barrel after slipping 0.4% on Tuesday, with West Texas Intermediate above $71. US President Donald Trump is set to announce his tariff measures later on Wednesday, and the sweeping duties will take immediate effect, according to his top spokeswoman.

Several proposals are said to be under consideration, including a tiered tariff system with a set of flat rates for different countries, as well as a more customized “reciprocal” plan. Wide-ranging measures remained on the table even as the announcement approached.

After a robust rally last month, “the handbrake has been applied,” said Chris Weston, head of research for Pepperstone Group in Melbourne. “Market players are running down exposures and looking to go into ‘Liberation Day’ less exposed to potential gyrations, knowing the ultimate response to the tariff announcement is really anyone’s guess.”

The tariffs threaten global growth prospects, adding to a deluge of conflicting drivers since Trump came into office. Sanctions threaten to curb supply from Russia and Iran, even as a production boost by OPEC and its allies from this month exacerbates concerns a glut is looming later this year.

The US might further tighten the screws on Russia. A group of 50 Republican and Democratic senators introduced a sanctions package on the third-largest oil producer and countries that buy its fuel if President Vladimir Putin refuses to engage in good-faith ceasefire negotiations with Ukraine, or breaches an eventual agreement.

Elsewhere, the industry-funded American Petroleum Institute reported US crude inventories rose by a hefty 6 million barrels last week, according to a document seen by Bloomberg. Levels at Cushing, Oklahoma — the delivery point for WTI — rose by 2.2 million barrels, according to the report, which would be the largest build since January 2023 if confirmed by official data later on Wednesday.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Gains Ground With Trade War and China’s Outlook to the Fore

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping