S&P 500 Posts Longest Winning Run Since January: Markets Wrap

(Bloomberg) -- A solid Wall Street week ended with gains for stocks as a rally in the market’s most-influential group offset conflicting signals about progress in President Donald Trump’s trade negotiations. Bonds and the dollar rose.

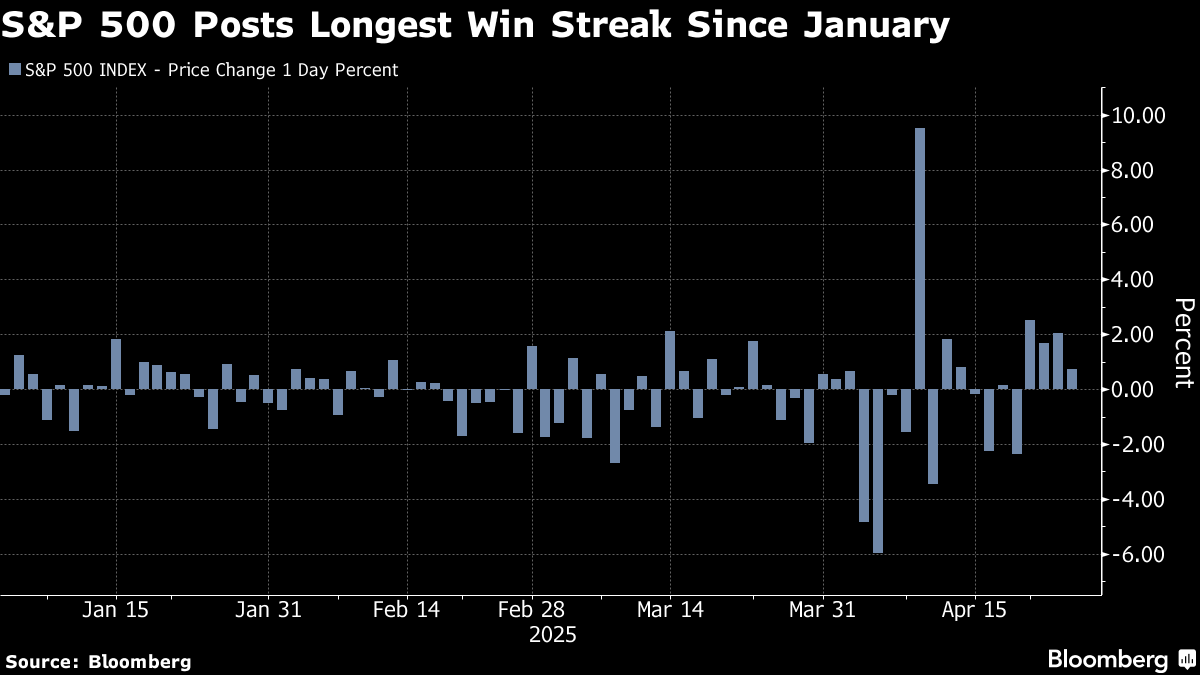

The surge in megacaps sent the S&P 500 above 5,500, with the gauge notching its longest advance since January. Tesla Inc. jumped 9.8% while Alphabet Inc. climbed on solid results. Equities briefly lost steam as Trump suggested another delay to reciprocal tariffs was unlikely, and he wouldn’t drop levies on China without “something substantial” in return.

“Markets have staged an impressive recovery,” said Mark Hackett at Nationwide. “While fears of a 2008- or 2020-style crisis are fading, the road back to record highs won’t be easy. Markets are showing resilience, but still face the same persistent challenges, including tariff uncertainty and signs of an economic slowdown.”

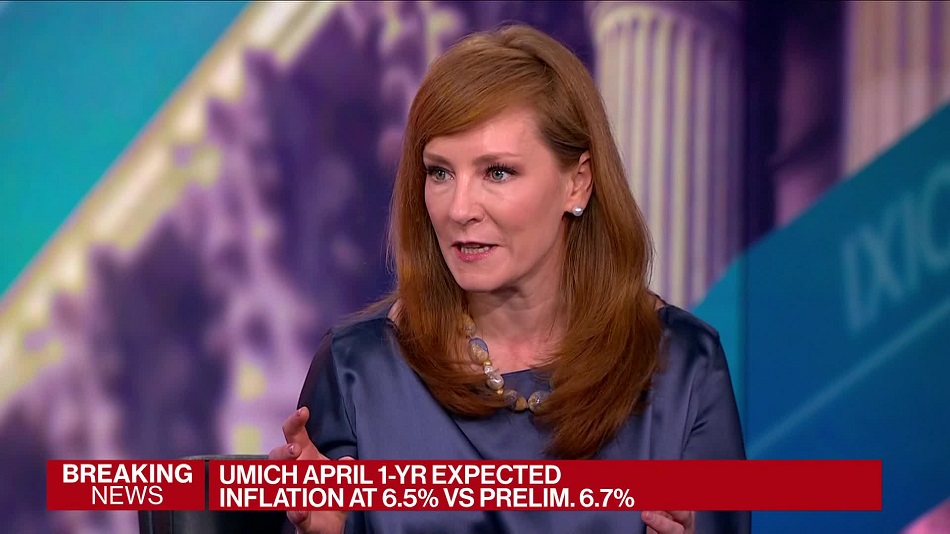

Worries about the economic fallout from tariffs drove US consumer sentiment to one of its lowest readings on record while long-term inflation expectations climbed to the highest since 1991.

President Trump’s administration has drafted a framework to handle negotiations with trading partners rushing to secure deals to avert tariff hikes, according to people familiar with the matter.

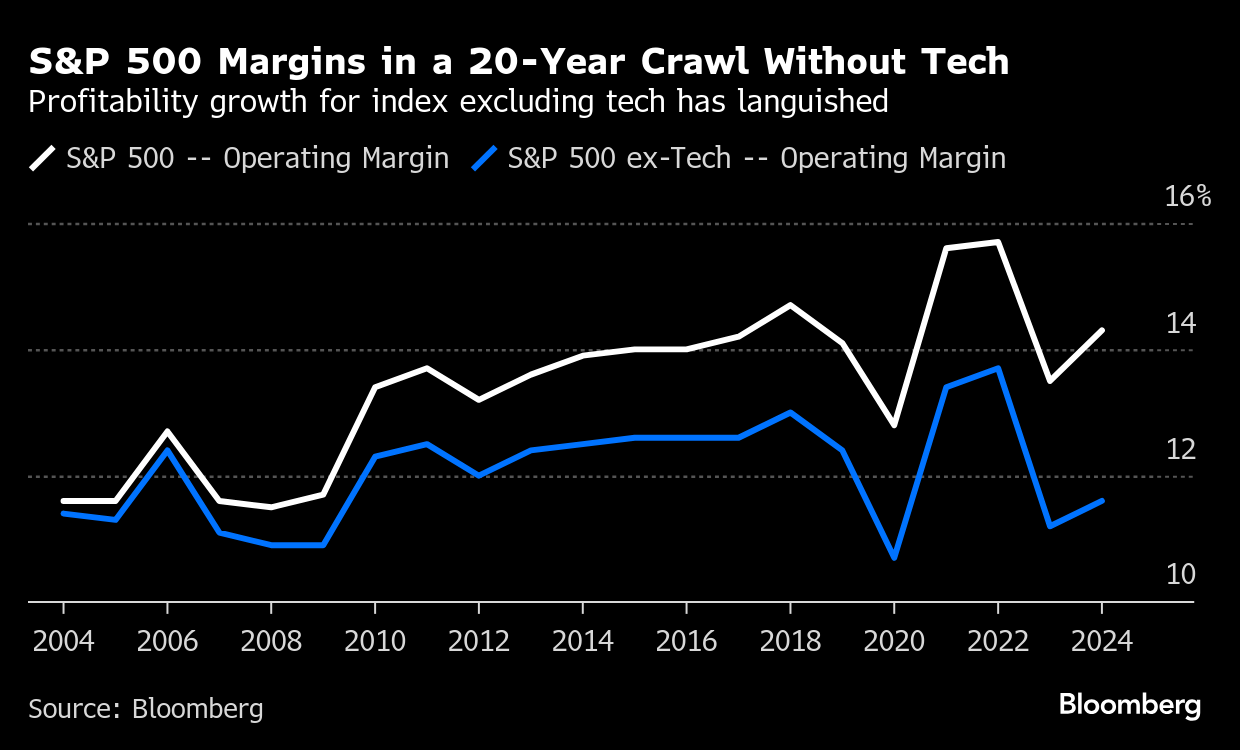

As profit margins remain close to record levels, Corporate America has some room to absorb costs from higher tariffs. However, the track record of S&P 500 companies over the past two decades suggests their ability to withstand additional levies is fragile, at least by one measure.

Nearly all of the margin growth eked out from corporate sales on the gauge since 2004 has come from the booming technology sector, according to Bloomberg Intelligence. Removing the group, profitability barely rose.

“The tariff-induced slowdown in economic activity, as well as the higher costs, will crimp corporate profit growth,” said David Lefkowitz at UBS Global Wealth Management. “But the economy should rebound next year as businesses and consumers adjust to the tariffs, with an assist from Federal Reserve rate cuts and certainty on tax policy.”

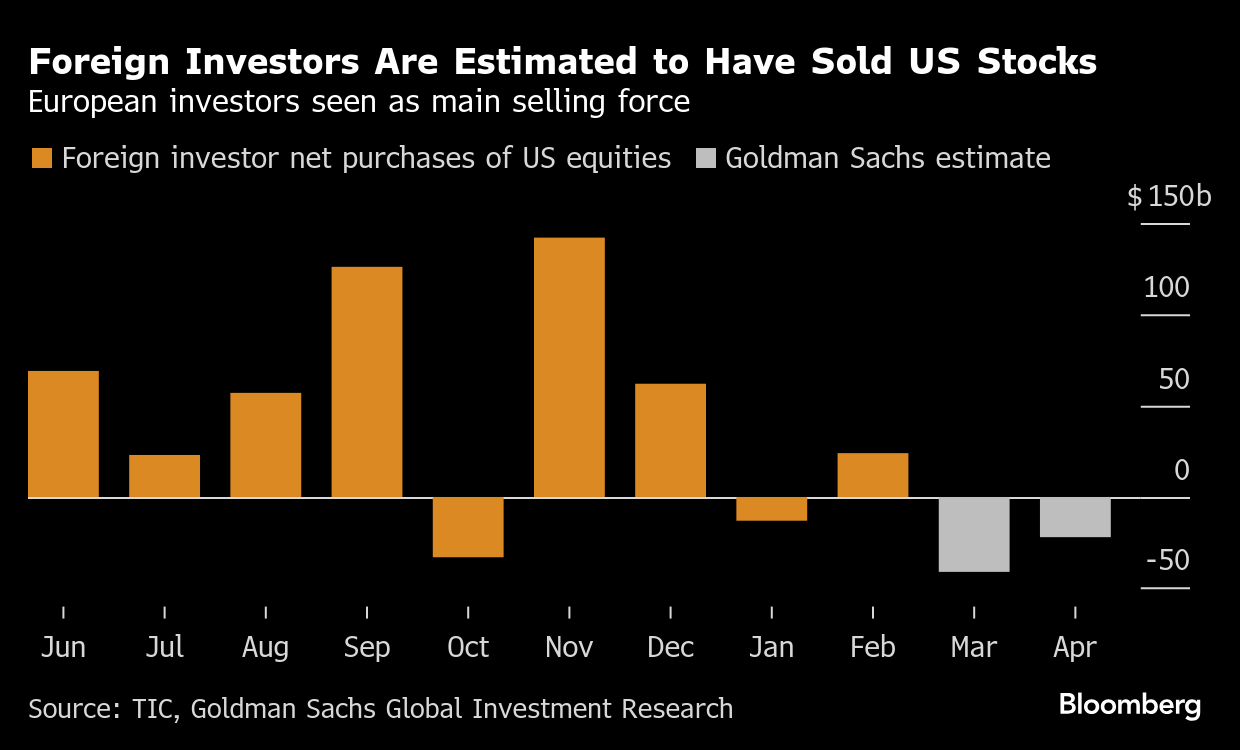

Bank of America Corp. strategists led by Michael Hartnett warned that the conditions for sustained gains in US stocks and the dollar are missing.

The greenback is in the midst of a longer-term depreciation while the shift away from US assets has further to go, they noted. The trend would continue until the Federal Reserve starts cutting rates, the US reaches a trade deal with China and consumer spending stays resilient.

Foreign investors have sold $63 billion of US equities since the start of March, Goldman Sachs Group Inc. strategists estimate, noting that the data from high-frequency fund flows suggest that European investors have been driving the selling, while other regions have continued to buy US stocks.

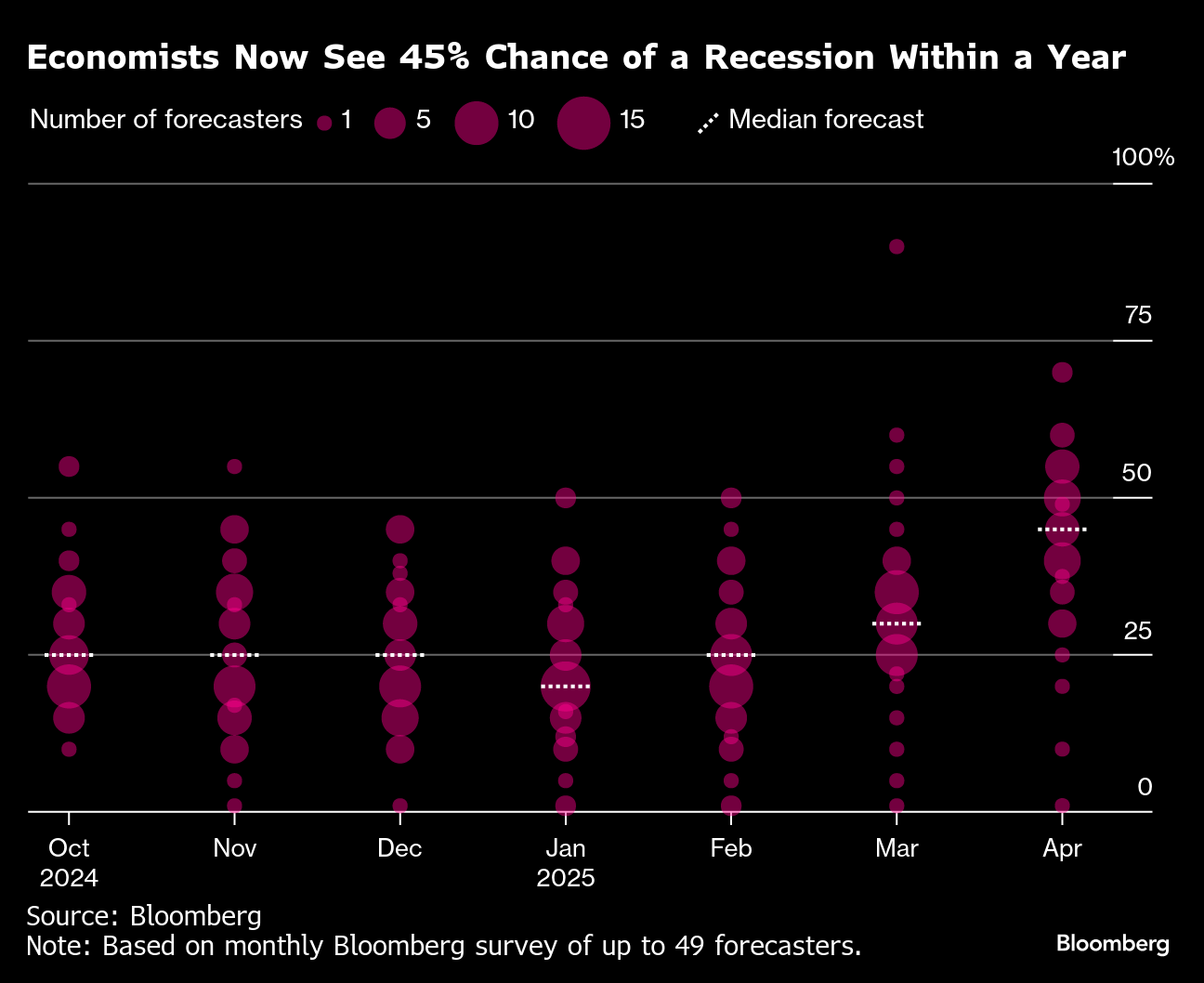

Forecasters anticipate the trade war will hit economic growth this year and next as tariffs push prices higher and put a dent in consumer spending.

The US economy is set to expand 1.4% in 2025 and 1.5% in 2026, according to the latest Bloomberg survey of economists, compared with 2% and 1.9% in last month’s poll. The median respondent now sees a 45% chance of a downturn in the next 12 months, up from 30% in March.

Corporate Highlights:

- Intel Corp. Chief Executive Officer Lip-Bu Tan gave investors a stark diagnosis of the chipmaker’s problems this week, along with the sense that it will take a while to fix them.

- Apple Inc. is seeking to import most of the iPhones it sells in the US from India by the end of next year, accelerating a shift beyond China to mitigate risks related to tariffs and geopolitical tensions.

- T-Mobile US Inc. reported fewer new wireless phone subscribers than analysts expected in the first quarter.

- AbbVie Inc. raised its profit outlook for the year on better-than-expected sales from newer autoimmune treatments, but warned its forecast doesn’t take into account any potential changes in trade policy.

- Centene Corp. expects higher medical costs this year, adding to investor concerns after the largest health insurer sounded a similar alarm earlier this month.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7% as of 4 p.m. New York time

- The Nasdaq 100 rose 1.1%

- The Dow Jones Industrial Average was little changed

- The MSCI World Index rose 0.6%

- Bloomberg Magnificent 7 Total Return Index rose 2.8%

- The Russell 2000 Index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $1.1363

- The British pound fell 0.2% to $1.3320

- The Japanese yen fell 0.7% to 143.64 per dollar

Cryptocurrencies

- Bitcoin rose 2.1% to $95,404.61

- Ether rose 2.3% to $1,803.71

Bonds

- The yield on 10-year Treasuries declined six basis points to 4.26%

- Germany’s 10-year yield advanced two basis points to 2.47%

- Britain’s 10-year yield declined two basis points to 4.48%

Commodities

- West Texas Intermediate crude rose 0.6% to $63.19 a barrel

- Spot gold fell 1.3% to $3,305.25 an ounce

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Swings as Traders Eye Next Moves in US-China Trade Tumult

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus