Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

(Bloomberg) -- Investors in Japanese stocks are keeping a close watch out for Warren Buffett’s annual letter to shareholders in the hopes that it will provide a boost to the country’s trading houses.

The veteran investor, known as the ‘Oracle of Omaha,’ has previously enthusiastically endorsed trading houses including Itochu Corp. and Marubeni Corp. in his letter, which is expected to be released on Feb. 22.

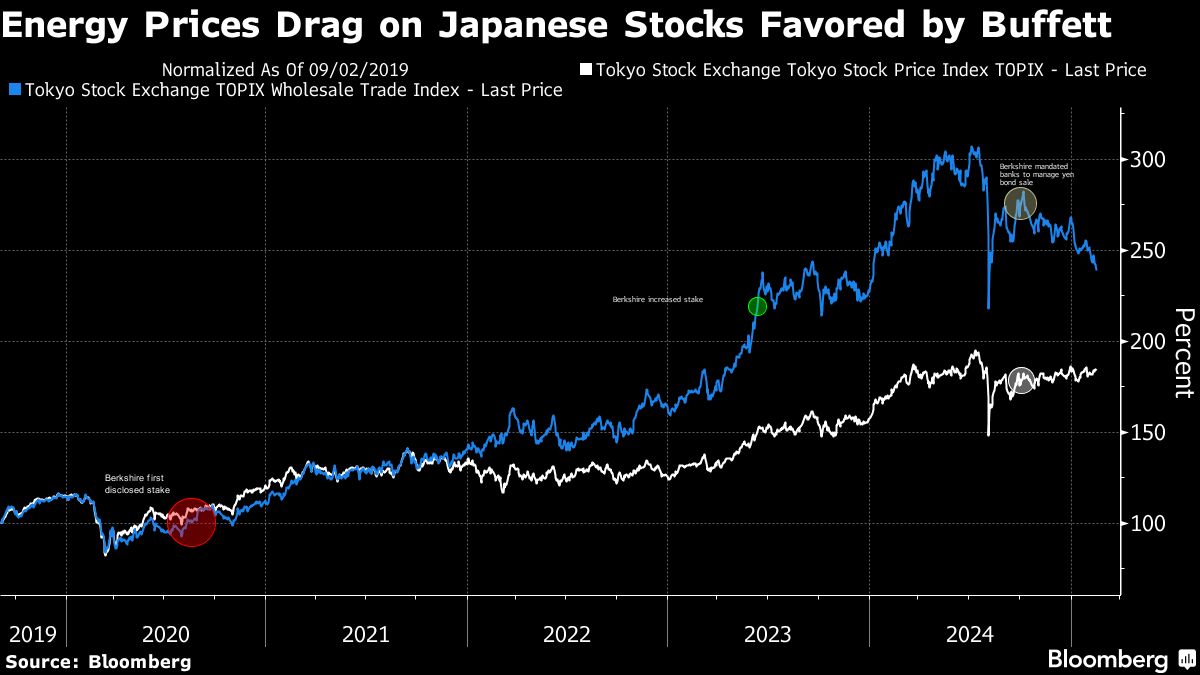

This means that investors will be scouring Buffett’s comments for any signs of succor for trading companies, which have been dragged down by falling energy costs on pressure from Donald Trump to cut oil prices. The Topix Wholesale Trade index has dropped about 12% since the US election, underperforming the broader measure of stocks.

Any comments on Japanese stocks, trading companies or otherwise, also matter because of the sheer heft of Buffett in the financial markets. They may provide some impetus to nudge Japan’s equity benchmarks out of the narrow trading range that they’ve been stuck in for the past few months.

“Buffett’s past holdings became a catalyst for inflows from foreign investors,” said Kohei Onishi, a senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities Co. That means “the positive impact of any comments on Japanese stocks overall will be quite significant,” he said.

Last year, Buffett praised five trading companies in which he has stakes for investor-friendly policies that are “much superior” to US firms, sending Mitsui & Co. and Mitsubishi Corp. shares to a record. Such companies are considered unique to Japan and offer a diversified trading model in a range of businesses from energy to retail.

Buffett’s holding was first disclosed in 2020, drawing the attention of global investors to undervalued Japan stocks. Strong buying from foreigners propelled the Nikkei 225 index to an all-time high this time last year.

Even so, Mineo Bito, president and chief executive officer of Bito Financial Service Co. and a frequent attendee of Berkshire’s shareholder meetings, sees the odds of Buffett dedicating lines to Japanese stocks in his letter this year as quite slim.

He said that given there was no change in Buffett’s holdings this year, any further endorsement is unlikely. “The impact of Buffett’s investment has died down somewhat,” Bito said.

Berkshire holds an average of 8.1% of Itochu, Sumitomo Corp., Mitsubishi, Marubeni and Mitsui, according to financial disclosures.

The US investment firm also sold its biggest yen bond since 2019 in October, which has kept investors on tenterhooks for any signs that Buffett is poised to increase his exposure.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge

Trump to Create White House Council to Drive Energy Dominance

Oil Steadies as Trump’s Reciprocal Tariffs Add to Trade Tensions