China Refiners Set to Resell US Oil Cargoes After Tariff Blitz

(Bloomberg) -- China’s state-run refiners are expected to resell US oil cargoes and seek alternative supplies in the aftermath of Beijing’s response to Washington tariffs, a move that is already pushing up the cost of some replacement grades.

Refiners are seen seeking more crude from traditional suppliers in Africa and the Middle East, according to traders who sell oil to Chinese buyers. US cargoes purchased for February to March will likely be resold, they added, asking not to be identified because they’re not authorized to speak to the media.

Beijing imposed levies of 10% on US crude purchases on Tuesday as part of a sweeping response to President Donald Trump’s opening trade war salvo. The Chinese duties are set to take effect on Feb. 10.

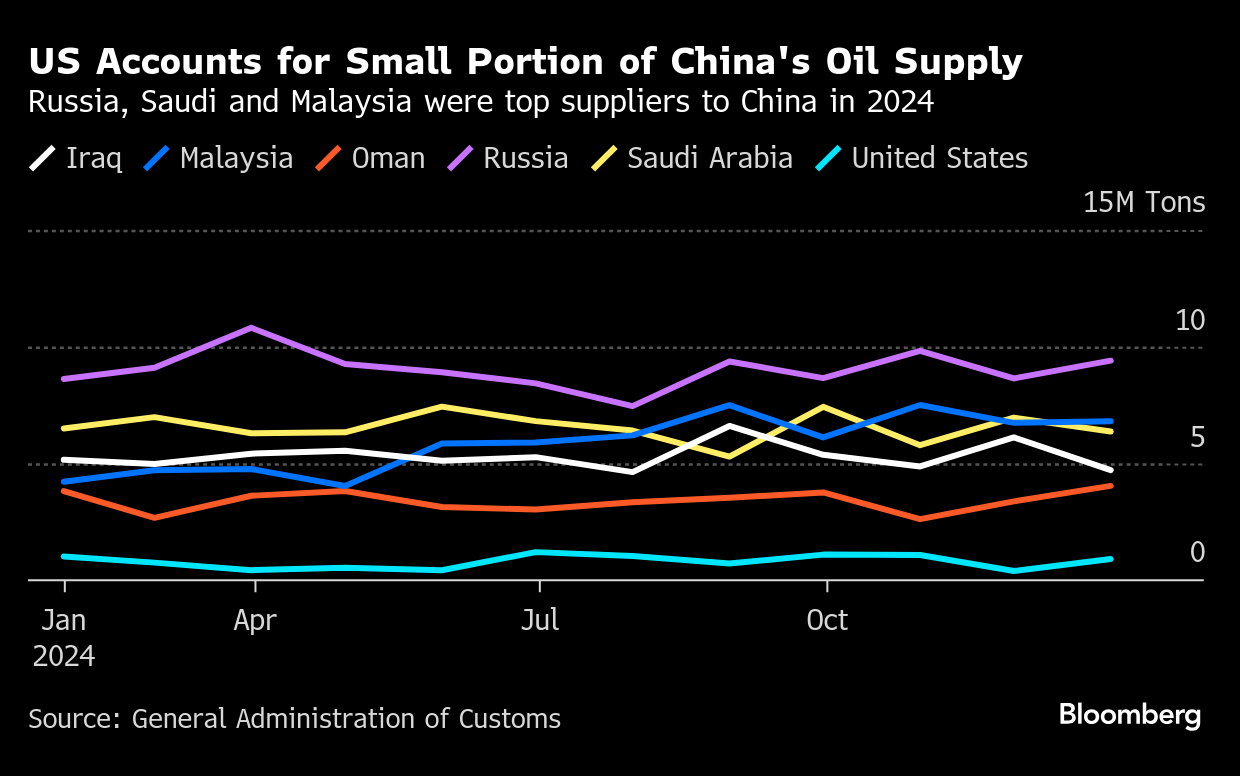

The world’s top oil importer has been seeking to diversify its raw material supplies, and crude imports from the US have dwindled from their peak in 2020. The nation received an average of six million barrels a month last year, accounting for about 2% of its overall imports in 2024, according to customs data.

Still, should US imports be resold, China’s major refiners will need to source almost 200,000 barrels a day to fill the gap, according to a research note from industry consultant Energy Aspects Ltd.

Some regional light crude prices will be supported as a result, said Jianan Sun, a London-based analyst with Energy Aspects. Sun added Murban and Libyan grades were among top options for May arrivals, with North Sea light grades and CPC as alternatives.

The Chinese may also turn to Middle Eastern grades for replacements. In the region, Oman crude — a proxy for medium grades — has been trading at a premium of $3.50 to $4 a barrel over the regional benchmark, compared with $1.50 to $1.80 during the first week of the year.

Oil from Mexico is also likely to make its way to Asia if Trump follows through on threatened tariffs. The president delayed those levies by a month.

Teapots Squeezed

China’s vast private refining sector is not a regular buyer of US crude, but so-called teapots are facing their own supply difficulties, with pressure on capacity utilization and the prospect of significant run cuts. Broad US sanctions on Moscow’s oil sector last month pushed prices higher and disrupted flows to Asia. There is then the looming disruption to Iranian flows as Trump seeks to ramp up punishment measures against Tehran.

“We see early signs of sanctions-driven frictions in both Russia and Iranian oil flow,” Goldman Sachs Group Inc. analysts including Yulia Grigsby wrote in a note dated Feb. 5. “Tighter sanctions enforcement can lead to a larger production drop by 1 million barrels a day.”

A cargo of Seria Light crude from Brunei was recently purchased by a teapot based in Shandong province at a hefty premium of $8.50 to $9 a barrel to the Brent futures benchmark, according to the traders. That price includes freight and other costs.

On the Wire

Chinese travelers opted for adventures closer to home during this year’s Lunar holiday, taking journeys by road and train rather than flying abroad, with increased spending defying concerns of a slowdown in consumption.

The tables have turned. As US President Donald Trump reignites his trade war with China, he’s got all the bargaining chips.

China has come back from a week of Lunar New Year celebrations to the grim reality of a trade war.

Enphase Energy Inc., a US solar and battery systems supplier, is in the process of moving its battery cell manufacturing out of China to avoid tariffs imposed by President Donald Trump.

This Week’s Diary

Thursday, Feb. 6:

- No major events scheduled

Friday, Feb. 7:

- China’s foreign reserves for January, including gold

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, Feb. 8:

- No major events scheduled

Sunday, Feb. 9:

- China’s consumer and producer price indexes for January, 09:30

- China to release Jan. aggregate finance & money supply by Feb. 15

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field