Oil Edges Lower as Trade War Concerns Vie With Pressure on Iran

(Bloomberg) -- Oil nudged lower as concerns that a trade war between the US and China will hurt global growth vied with President Donald Trump’s ramping up of economic pressure on OPEC member Iran.

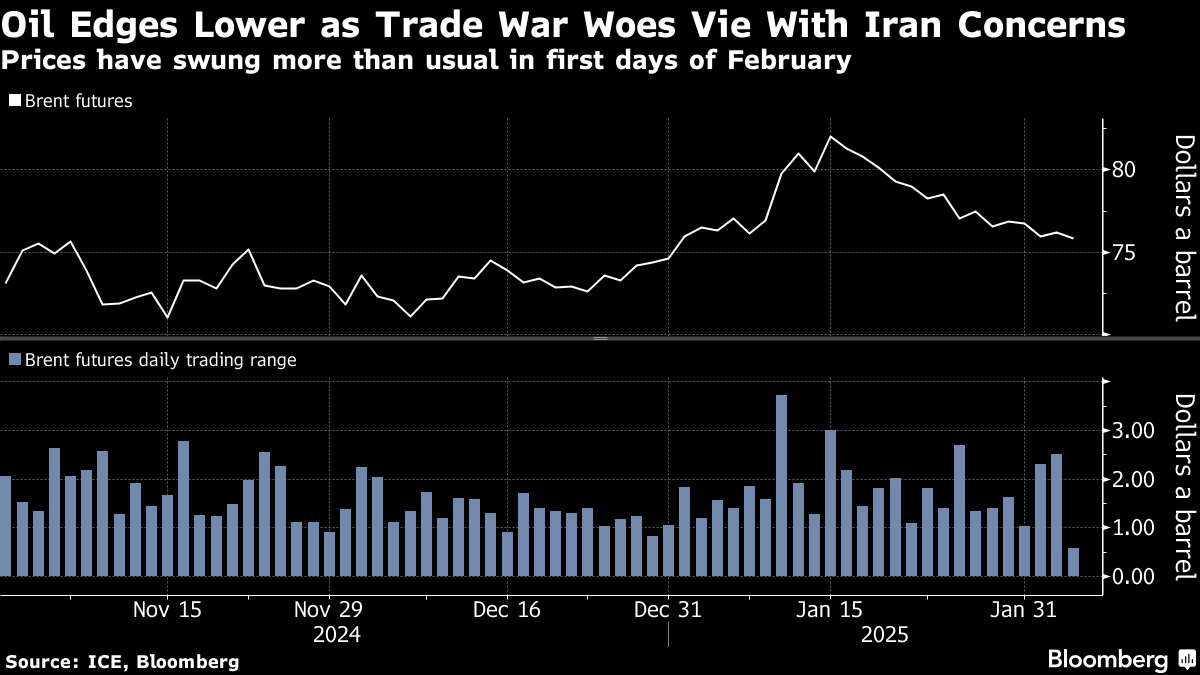

Brent crude traded below $76 a barrel after a rocky start to the week that saw markets whipsawed by the announcements of tariffs, and then delays to duties on Canada and Mexico. West Texas Intermediate was near $72. Meanwhile, Trump signed a directive on Tuesday asking Treasury Secretary Scott Bessent to use sanctions and tougher enforcement of existing measures to increase the pressure on Tehran.

Beijing on Tuesday issued a swift but restrained retaliation to Trump’s levies. A trade war between the world’s two biggest economies is unlikely to rattle US exports of crude, as flows to China had already dipped to less than 5% of total American shipments. China markets reopened after Lunar New Year holidays, although futures in Shanghai were little changed by the midday break.

“Near term implications to commodity markets will be limited,” analysts from Goldman Sachs Group Inc. including Samantha Dart said in a note. “Impacted US volumes are likely to easily find alternative buying markets, while China replaces impacted import volumes with alternative suppliers.”

Trump also proposed the US take over the Gaza Strip and assume responsibility for reconstructing the war-torn territory in a press conference with Israeli Prime Minister Benjamin Netanyahu. Trump suggested he would be open to deploying US troops to secure the area.

Crude is at risk of losing all of its year-to-date gains, as concerns over global growth from Trump’s tariff threats erase earlier gains from cold winter weather and US sanctions on Russia. While Trump has held off from levies on Canada, at least one US refiner said it stood ready to switch to domestic oil should the increased duties come into force.

Elsewhere, the industry-funded American Petroleum Institute reported US nationwide commercial crude inventories rose by 5 million barrels last week, according to a document seen by Bloomberg. That would be the second straight advance from the lowest level since March 2022, if confirmed by official data later on Wednesday.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Falls After Trump Delays Canada, Mexico Tariffs by a Month

Wright Confirmed to Lead Energy Agency Key to Trump’s Plans

Oil Rises as Trump Slaps Tariffs on Biggest Crude Supplier to US

UAE’s Adnoc Aims to Buy Nova Chemicals, Roll Into Deal With OMV

Ukrainian Drone Surge Highlights Russian Oil Refining Risk

South Korea Exports Resilient as Trump’s Tariff Threat Looms

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles

Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk