Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

(Bloomberg) -- Oil steadied after a string of declines as the prospect of increased flows from Iraq and Russia weighed on the outlook, with market gauges flashing signs of weakness on the likelihood of oversupply.

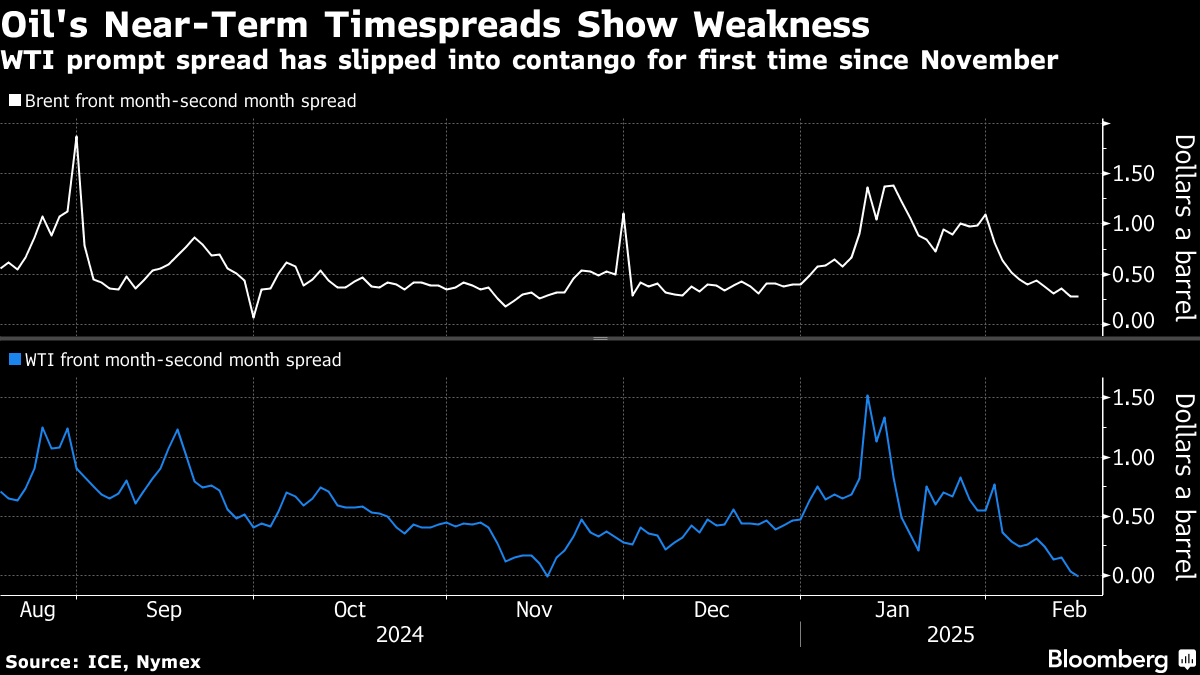

Brent traded below $75 a barrel, while West Texas Intermediate was above $70. WTI’s front-month contract briefly traded at 1 cent less a barrel than the contract for the next month, the first time since November the so-called prompt spread has turned negative in a bearish structure known as contango.

The flip from the bullish backwardation pattern comes after two of the world’s main oil forecasting agencies last week said that there will be a mild glut this year. Supply concerns worsened over the weekend, with the president of Iraq’s semi-autonomous Kurdistan region flagging the likely resumption of oil exports next month and President Donald Trump’s push for an end to the war in Ukraine raising the prospect of an increase in flows from Russia.

“Sentiment in the oil market continues to sour with weakness in the flat price, while timespreads are also pointing towards a weaker physical market,” said Warren Patterson, head of commodities strategy for ING Groep NV.

Crude has been whipsawed by Trump’s rapid-fire tariffs — some of which were promptly walked back — and threats of sanctions on producers including Iran. Prices spiked on Friday after US Treasury Secretary Scott Bessent said the administration aims to squeeze Tehran’s oil exports to less than 10% of current levels, before dropping amid doubts over the plan’s feasibility.

(A previous version of this story corrected the first name of Ukrainian President Zelenskiy.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Asian Stock Rally Pauses, China Tech Shares Gain: Markets Wrap

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge

Trump to Create White House Council to Drive Energy Dominance

Oil Steadies as Trump’s Reciprocal Tariffs Add to Trade Tensions

Isuzu to Build Car Plant in South Carolina as Trump Tariffs Loom