South Korea Exports Resilient as Trump’s Tariff Threat Looms

(Bloomberg) --

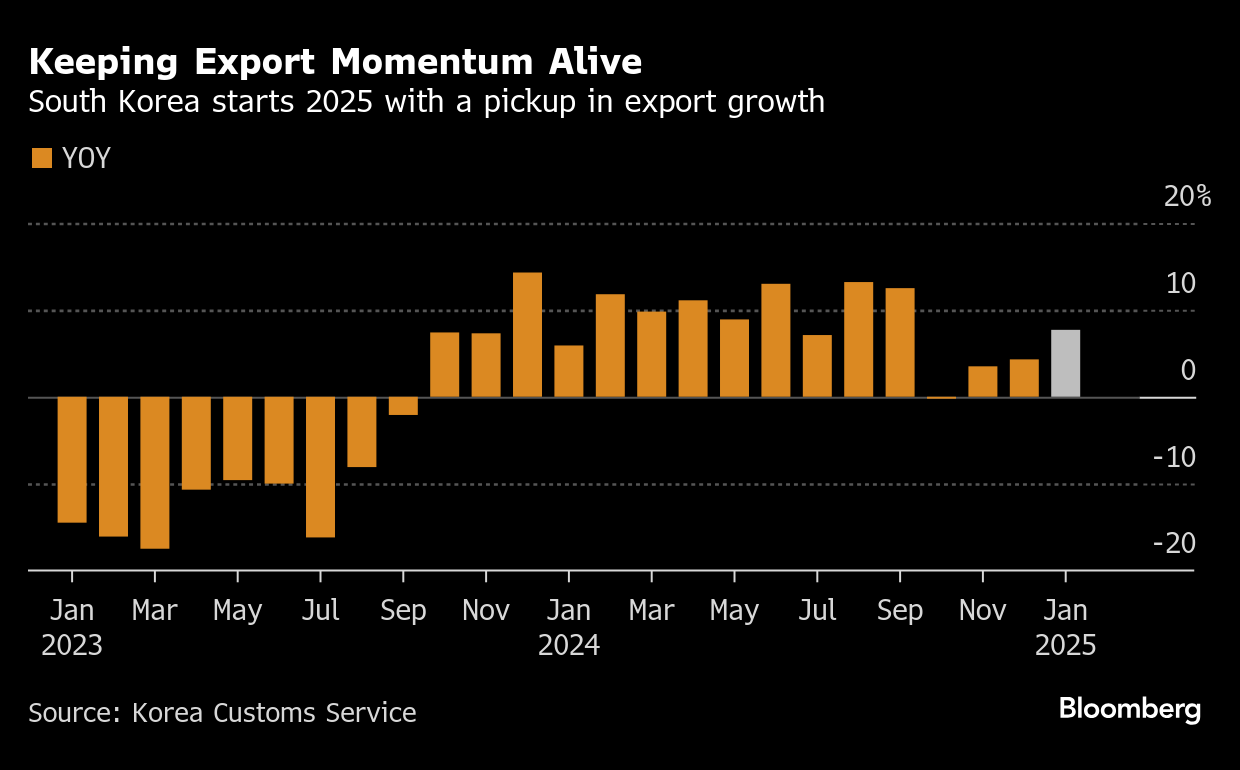

South Korea’s exports maintained growth momentum in January, keeping optimism alive at the start of a year overshadowed by domestic political turmoil and Donald Trump’s tariff threat.

The value of shipments adjusted for working-day differences increased 7.7% from a year earlier, according to data released Saturday by the customs office. That compared with a 4.3% gain initially reported for December.

In headline figures distorted by the Lunar New Year holiday, exports fell 10.3%, less than the 14% contraction surveyed by Bloomberg. Overall imports decreased by 6.4%, resulting in a trade deficit of $1.9 billion.

South Korea is one of the world’s biggest exporters, with technology products at the core of its earnings. Trump’s tariff threats have posed a severe risk for the trade-reliant economy.

Semiconductors are the driving force behind South Korea’s exports and its producers including Samsung Electronics Co. face restrictions on shipments to China as Washington seeks to prevent Beijing from acquiring advanced devices needed to fuel artificial intelligence development.

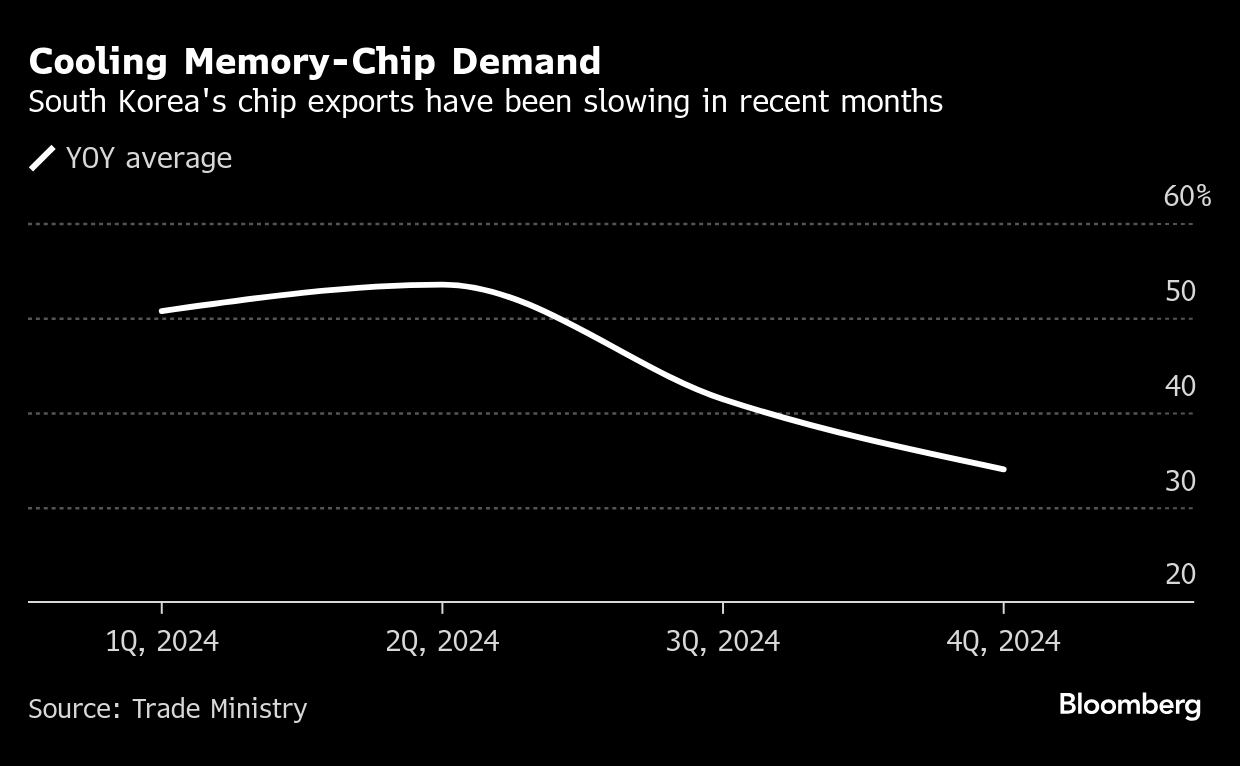

South Korean chip exports in January rose 8.1% from a year earlier, according to the Trade Ministry. Despite it being the 15th month of increased shipments, the slowing growth added to evidence that momentum is flagging in a sign of weakening demand for memory chips.

On Friday, Samsung’s chip division reported a smaller-than-expected quarterly profit while domestic rival SK Hynix Inc.’s shares plunged, in part on concerns that DeepSeek’s low-cost AI would lead to sharp cuts in spending on data centers and state-of-the-art chips.

South Korean chipmakers also face fresh headwinds stemming from Trump’s return to power. Howard Lutnick, the US president’s commerce secretary nominee, told US senators earlier this week that his administration would review subsidies promised for foreign chipmakers under the Biden administration.

Trump, sworn in as president for a second term last month, has also threatened varying levels of tariffs for trading partners. Among key issues are widening deficits the US is recording with export giants including China and Mexico. South Korea ranks eighth among countries with the largest surpluses against the US.

South Korea plans to increase its imports of US energy, should trade imbalances between the two countries emerge as an issue with Washington, Bloomberg News has previously reported. It may also consider raising US food imports.

Seoul has sent a working-level team to Washington to get more specific details of Trump’s trade policy, and is working on action plans to minimize the impact on its businesses. The government also seeks talks with the US president to discuss cooperation.

Concerns over trade come amid a slowing economy after President Yoon Suk Yeol’s short-lived declaration of martial law battered consumer confidence. Yoon has been arrested on charges of insurrection and a court is reviewing the impeachment motion passed against him.

The South Korean central bank has cut its growth forecast for this year because of the political turbulence, global trade under Trump and weakening chip exports. The Bank of Korea said last week that gross domestic product only rose 0.1% last quarter from the previous three months.

Seeking to shore up the economy via consumption, the government led by Acting President Choi Sang-mok designated a one-off holiday before the three-day Lunar New Year break in late January. Many workers took additional days off, which contributed to the larger-than-usual distortions in export figures year-on-year.

The BOK is expected to reduce its benchmark interest rate when it convenes later this month, to counter the slowing economic momentum. It unexpectedly kept the rate unchanged at 3% last month, following two consecutive cuts in late 2024.

South Korean exporters are widely embedded across global supply chains, including automobiles, rechargeable batteries, shipbuilding and refined oil. A slowdown in their performance is a top concern for the country’s policymakers. Exports accounted for 90% of the nation’s GDP growth last year, according to the Trade Ministry.

(Updates with charts, chip exports and comments from trade ministry)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold

US Ends Waiver Allowing Iraq to Buy Electricity From Iran

Stocks Bounce Back as Powell Says Economy Is Fine: Markets Wrap

Amador to Become Mexico Finance Chief as Ramirez de la O Resigns

Oil Posts Seventh Weekly Loss on Easing War Risk, Tariff Chaos

Oil Trims Losses as Traders Weigh Demand Impact from Tariffs

China’s Congress Pledges to Fix Overproduction of Steel and Fuel