Stocks Climb as Traders Brush Aside Tariff Threats: Markets Wrap

(Bloomberg) -- Stocks kicked off the week with gains, rebounding after a slide driven by concerns over inflation and US tariff threats. The dollar strengthened and gold hit a record high.

The advance in equities was led by the market’s most-influential group - technology - with the Nasdaq 100 up over 1% Monday. Nvidia Corp. extended a five-day surge to 14% while Meta Platforms Inc. rose for a 16th consecutive session. Materials producers were also on the spotlight amid President Donald Trump’s plans to impose 25% tariffs on all US imports of steel and aluminum. United States Steel Corp. and Alcoa Corp. climbed at least 2.8%.

Trump said Sunday the steel and aluminum tariffs would apply to shipments from all countries, including major suppliers Mexico and Canada. He didn’t specify when the duties would take effect. The president also said he would announce reciprocal tariffs this week on countries that tax US imports.

Aside from the global trade picture, investors will also be focused on this week’s key inflation data and Federal Reserve Chair Jerome Powell’s testimony before Congress. Expected inflation rates over the next year and three years ahead were both unchanged in January at 3%, according to results of the New York Fed’s Survey of Consumer Expectations published Monday.

“Inflation data, Powell’s congressional testimony, and tariffs are poised to drive the market story,” said Chris Larkin at E*Trade from Morgan Stanley. “If the S&P 500 is going to break out of its two-month consolidation, it may need a respite from the types of negative surprises — like DeepSeek, tariffs, and consumer sentiment — that have tripped it up over the past few weeks.”

Hedge funds emerged as big buyers of US stocks last week, shifting away from a previously bearish stance in the wake of stronger-than-expected earnings reports. They snapped up US equities at the fastest pace since November, resulting in the heaviest net buying of single stocks in more than three years, according to Goldman Sachs Group Inc.’s prime brokerage report for the week ended on Feb. 7. The activity was heaviest in the information technology sector.

The S&P 500 rose 0.7%. The Nasdaq 100 climbed 1.3%. The Dow Jones Industrial Average added 0.3%. The Bloomberg Magnificent Seven Total Return Index advanced 0.9%. The Russell 2000 Index gained 0.5%.

The yield on 10-year Treasuries was little changed at 4.49%. The Bloomberg Dollar Spot Index rose 0.2%. Gold topped $2,900 an ounce.

To Jose Torres at Interactive Brokers, many investors are starting to realize that much of the tariff talk is hardly going to come to fruition, with the rhetoric increasingly appearing to be a negotiation tactic.

“The posturing is intended to benefit domestic economic conditions rather than disrupt global commerce momentum, and the outcomes are likely to be much better than feared,” he said. “For this reason, traders are stepping up to the plate today and scooping up stocks.”

“In the Old Testament, even God rested on the seventh day!” said Bespoke Investment Group strategists. “Since the Inauguration, though, whether you love or hate him, we can all agree that President Trump’s second term has started with a nonstop fire hose of news and headlines. Amid the backdrop of a nonstop news flow, the market has been surprisingly calm.”

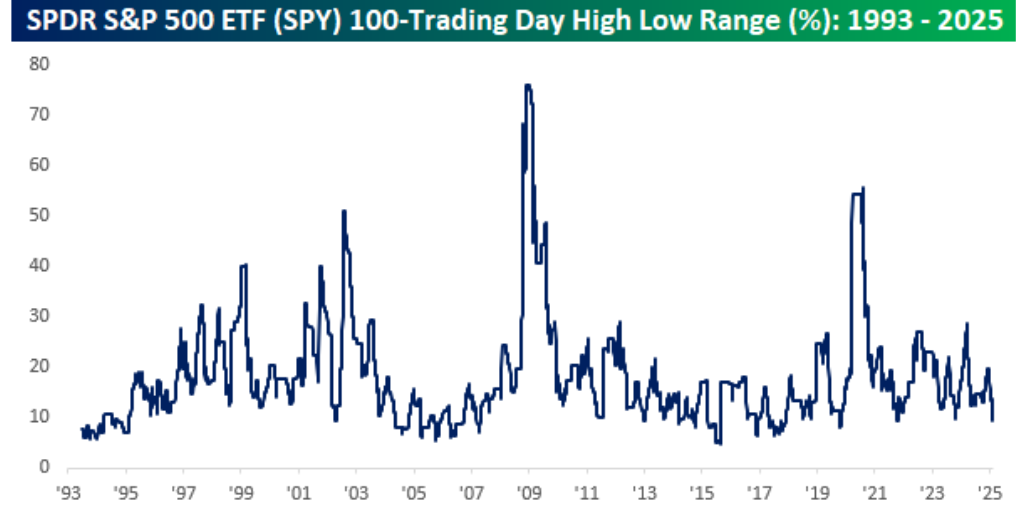

Over the last 100 trading days, the $630 billion exchange-traded fund tracking the S&P 500 (SPY) has traded in a relatively narrow range of less than 10%, according to Bespoke. While that may sound like a wide range, it ranks in just the 13th percentile of all comparable periods dating back to SPY’s inception in 1993. Back in Covid, this reading spiked above 50% and during the Financial Crisis, it widened even more, peaking above 75%.

“Investors may be better served by not reacting to the news cycle,” said Anthony Saglimbene at Ameriprise. “Stand still and let tariff, Big Tech, and interest-rate developments play out over the near term. Making investment decisions on still unknown outcomes increases the risk of being wrong or offside if developments shift in the opposite direction.”

“Although multiples are elevated, we remain fully invested due to the potential for continued economic growth, moderating inflation and an accommodative Fed,” said Richard Saperstein at Treasury Partners. “Our characterization for stocks this year is a choppy market that trends higher over the year.”

“Despite day-to-day confusion, tariff uncertainty, the geopolitical environment, and elevated valuations in the tech space remain the biggest unknowns for investors,” said Mark Hackett at Nationwide. “Together, these factors point to measured gains this year rather than blockbuster returns of recent years.”

The resilience of stocks in the face of tariffs may invite further trade escalations, making equity pullbacks likely, according to Deutsche Bank AG strategists including Binky Chadha.

They note these pullbacks require same playbook as for geopolitical shocks, which have historically seen sharp but short-lived selloffs, with equities typically bottoming even as the event continues and recouping losses before any de-escalation.

In such scenarios, equities would typically weaken 6%-8%, moving lower for three weeks before gaining strength for three weeks.

“For investors, the greatest market risk likely lies in policy unpredictability,” according to Christian Floro at Principal Asset Management. “Given this environment, diversification is essential to manage portfolio risk and capture opportunities as companies, countries and markets adjust.”

While headlines continue to be dominated by concerns over tariffs and megacap tech spending, the market narrative shift around broadening and leadership is being confirmed by fundamentals and market dynamics, according to Lisa Shalett at Morgan Stanley Wealth Management.

“Watch for rotation of stock index leadership from the Magnificent Seven toward value, cyclicals and non-GenAI infrastructure secular growth,” she said. “Consider adding cyclicals like financials, energy, domestic manufacturers and consumer services to US stock positions.”

Corporate Highlights:

- Toronto-Dominion Bank expects to raise about $14 billion through the sale of its entire stake in Charles Schwab Corp. as part of a corporate overhaul in the wake of its historic US money-laundering settlement.

- Microsoft Corp. is under investigation from the French antitrust authority amid concerns the US tech giant is degrading the quality of results when smaller rivals pay to use Bing technology in their own search-engine products.

- McDonald’s Corp. sales rose in the fourth quarter after growth in the chain’s international business made up for a decline in the US.

- Lyft Inc. will launch driverless rides with technology vendor and Intel Corp. spinoff Mobileye Global Inc. in Dallas as soon as 2026, building on a partnership that was first announced last November.

- Hyatt Hotels Corp. struck a deal to purchase Playa Hotels & Resorts NV for about $2.6 billion, expanding its reach into the all-inclusive resort market in countries including Mexico and Jamaica.

- Hertz Corp. has kicked off negotiations to settle litigation surrounding a make-whole payout of over $270 million that has been demanded by some bondholders, the company said on Monday.

- BP Plc shares surged after Elliott Investment Management built a stake in the company, seeking to end years of under-performance by pushing for significant change.

- The notion that China’s DeepSeek spent under $6 million to develop its artificial intelligence system is “exaggerated and a little bit misleading,” according Google DeepMind boss Demis Hassabis.

Key events this week:

- Fed Chair Jerome Powell gives semiannual testimony to Senate Banking Committee, Tuesday

- Fed’s Beth Hammack, John Williams, Michelle Bowman speak, Tuesday

- US CPI, Wednesday

- Fed Chair Jerome Powell testifies to House Financial Services panel, Wednesday

- Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

- Eurozone industrial production, Thursday

- US initial jobless claims, PPI, Thursday

- Eurozone GDP, Friday

- US retail sales, industrial production, business inventories, Friday

- Fed’s Lorie Logan speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7% as of 1:27 p.m. New York time

- The Nasdaq 100 rose 1.3%

- The Dow Jones Industrial Average rose 0.3%

- The MSCI World Index rose 0.5%

- Bloomberg Magnificent 7 Total Return Index rose 0.9%

- The Russell 2000 Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $1.0311

- The British pound fell 0.2% to $1.2373

- The Japanese yen fell 0.4% to 151.96 per dollar

Cryptocurrencies

- Bitcoin rose 2.3% to $97,398.57

- Ether rose 5.1% to $2,683.08

Bonds

- The yield on 10-year Treasuries was little changed at 4.49%

- Germany’s 10-year yield declined one basis point to 2.36%

- Britain’s 10-year yield declined two basis points to 4.46%

Commodities

- West Texas Intermediate crude rose 1.9% to $72.34 a barrel

- Spot gold rose 1.6% to $2,906.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz