Asian Stocks Retreat as Samsung, SK Hynix Weigh: Markets Wrap

(Bloomberg) -- Asian equities fell Friday, as concerns over the impact DeepSeek will have on the artificial intelligence market pressured South Korean chipmakers. US futures climbed after robust results from Apple Inc.

A gauge of the region’s shares halted a two-day gain, with SK Hynix Inc. and Samsung Electronics Co. falling in delayed reaction to the selling of AI stocks, as the nation’s markets reopened after Lunar New Year holidays. The former is a key supplier to Nvidia Corp. while Samsung’s pivotal chip division reported a smaller-than-expected profit. Markets in mainland China, Hong Kong and Taiwan remain closed.

Earnings for mega-cap tech companies face heightened scrutiny after investors dumped AI-related stocks earlier this month. Nvidia shares rose Thursday but remained on track for their worst week since September. The Nasdaq 100 is also set to drop for the first week in three.

“There is lot more” recalibration to come in the AI trades, Gareth Nicholson, chief investment officer at Nomura Singapore Ltd. told Bloomberg Television. “We will see more rotation and it makes us even more bullish, albeit we needed some steam to come out of the system to build a stronger momentum forward.”

Despite this week’s selloff in technology stocks, Asian equities are on pace for their first monthly advance in four as concerns over President Donald Trump’s use of tariffs eased after he held back from imposing levies on China.

Australian stocks and US futures edged higher, partly reflecting robust results from Apple that lifted the iPhone-maker’s shares in after-market trading. Intel Corp. also rose post-market after reporting better-than-projected fourth-quarter revenue.

Samsung “missed consensus, mainly from the semiconductor division,” said SK Kim, Daiwa Securities executive director and analyst, speaking on Bloomberg Television. “In semiconductors, Samsung has higher exposure to China and they are also supplying the AI chips to Chinese customers.”

Treasuries fell after ending Thursday’s session little changed. The Fed’s favored inflation gauge, the personal consumption expenditures index, is due later Friday and is expected to show a small acceleration in price hikes.

“Friday’s PCE is likely to show that inflation is still elevated and above the Fed’s target, and it comes at a time when markets are hyper jittery about a trifecta of other issues, including big tech, AI and Federal Reserve uncertainty,” said Carol Schleif at BMO Private Wealth.

Elsewhere in Asia, Japanese government bond futures extended a drop ahead of Bank of Japan’s Governor Kazuo Ueda’s appearance in parliament later Friday. The yen fluctuated around 154 per dollar level after advancing on Thursday in the wake of comments from BOJ Deputy Governor Ryozo Himino reaffirmed views that the authority will keep raising rates this year.

Gold was steady after touching a record high to trade around $2,795 per ounce Friday. It’s on track for the best month since March. Oil prices also gained, with West Texas Intermediate at around $73 per barrel.

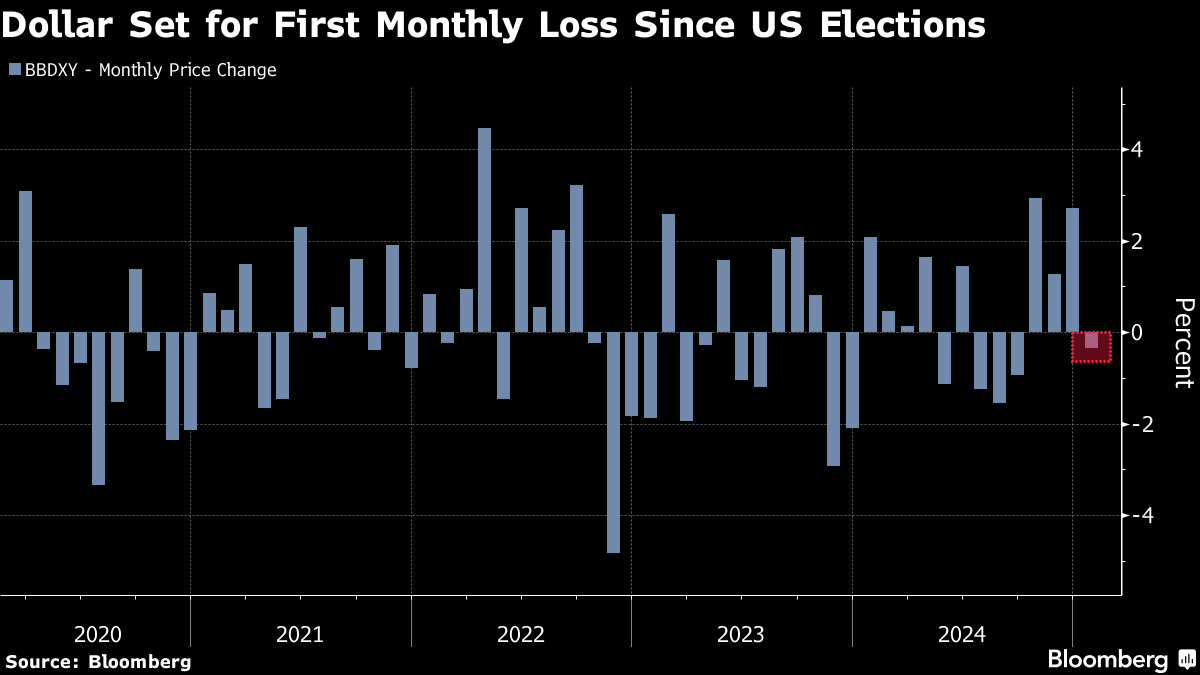

In the foreign exchange market, the currencies of Mexico and Canada slumped on Thursday after Trump said he would follow through on his threat to impose 25% tariffs on imports from both countries as early as Saturday. A gauge of the dollar was on track for its best week in the past seven, though still down for the month as investors parse tariff news.

Key events this week:

- US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 1:19 p.m. Tokyo time

- Nasdaq 100 futures rose 0.6%

- Japan’s Topix rose 0.3%

- Australia’s S&P/ASX 200 rose 0.5%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0385

- The Japanese yen was little changed at 154.35 per dollar

- The offshore yuan was little changed at 7.2982 per dollar

Cryptocurrencies

- Bitcoin fell 0.8% to $104,268.48

- Ether fell 0.6% to $3,224.23

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.53%

- Australia’s 10-year yield advanced three basis points to 4.41%

Commodities

- West Texas Intermediate crude rose 0.9% to $73.42 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles

Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk

Glencore-Indonesia JV Eyes $1 Billion Sustainability-Linked Loan

Oil Fluctuates as Trump’s Rapid-Fire Trade Moves Rattle Market

China’s Surging Power Demand Creates a Climate Conundrum

Oil Set for First Weekly Drop This Year as Trump Rattles Market

Oil Extends Drop With Focus on Rising Stockpiles, Trump Actions

ADNOC achieves industry-leading carbon intensity at Shah Oil Field enabled by AI