China’s Gas Growth to Slow as Cheaper Options Squeeze Demand

(Bloomberg) -- A slowing economy and cheaper alternatives are likely to take the edge off China’s appetite for natural gas.

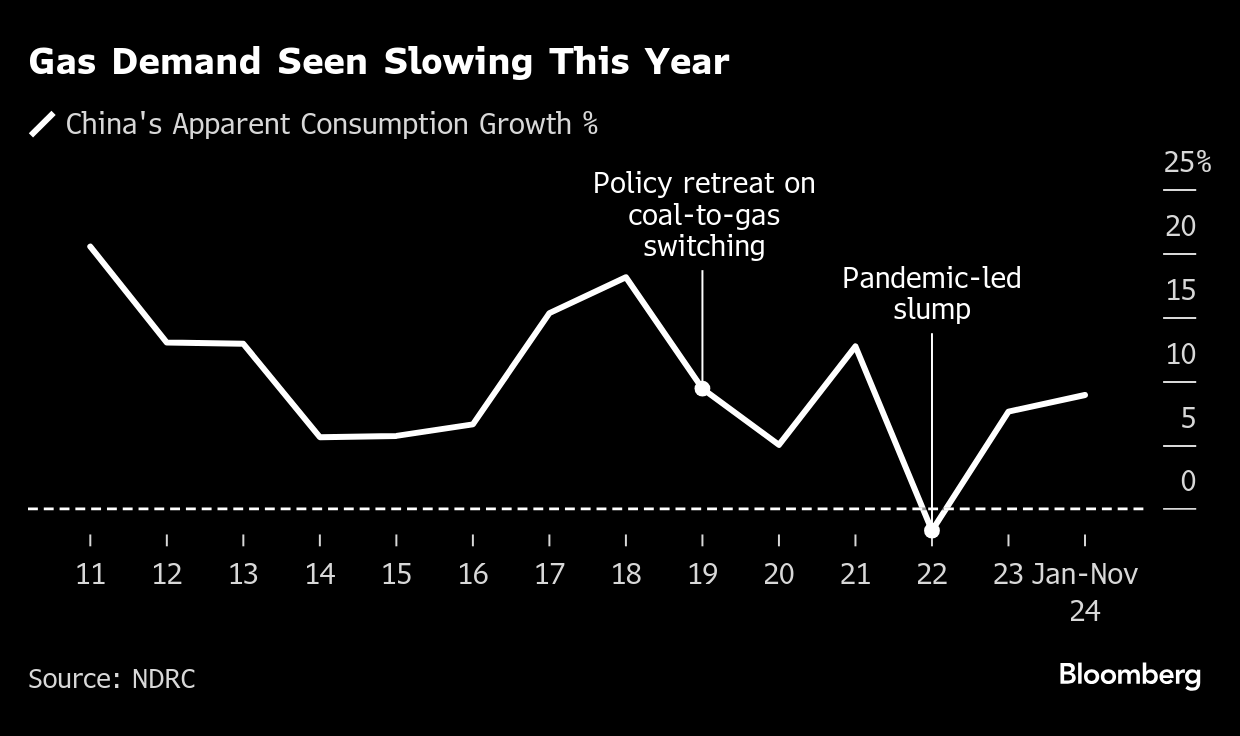

Consumption of the cleaner-burning fuel, billed as a crucial bridge to net zero, has regularly seen double-digit percentage growth in recent years. But that’s expected to subside to more modest levels as weakness in industrial usage and a surfeit of both dirty coal and renewable energy put the brakes on demand.

Government policy isn’t helping. Beijing’s program of switching the country from coal to gas has lost momentum, while some provinces are ordering cuts in electricity prices to support their factories. All the while, increases in domestic output, as well as more supply of gas piped overland from Russia, are being encouraged. That bodes particularly ill for the seaborne tankers that carry pricier liquefied natural gas to China’s coastal terminals.

Gas imports climbed nearly 10% to a record of over 130 million tons in 2024, although the headline figure masks a drop off in demand in recent months for LNG, which is shipped from as far afield as Australia and the US and accounts for nearly 60% of China’s overseas supply.

China International Capital Corp. expects growth in apparent gas demand — or domestic production plus imports — to fall to 6.2% this year, from an estimated 9.4% in 2024, according to a note from the bank last month. Chinese consultancy Gastank also expects a drop to 6%.

Guangdong province, a coastal economic powerhouse that has rapidly expanded its gas consumption, is a case in point. The government there is reducing power bills to bolster its export-led industries ahead of a looming trade war with the US. Gastank estimates that fuel costs in the province may need to fall to about $7 per million British thermal units, which is around half the current price of LNG, according to chief information officer Rita Huang.

Guangdong is also in the forefront of developing market-based electricity trading, which allows consumers to choose their power options. So not only will factories be reluctant to raise output — and use more fuel — while the economy is weak, they’ll also be seeking the cheapest rates, said Zhang Xiaotong, an analyst at Chinese consultancy JLC.

That puts gas imports, especially LNG, at a steep disadvantage. The menu of alternatives starts with domestically produced gas, including coal bed methane. Then there’s China’s massive glut of coal, solar and wind generation that have expanded at an unprecedented pace, as well as the nation’s burgeoning nuclear power industry.

On the Wire

China’s oil demand and growth outlook could both darken amid persistent deflation and its declining credit impulse, according to Bloomberg Intelligence.

China exported a record amount of goods last year, swelling its trade surplus to almost $1 trillion and underscoring how global commerce remains unbalanced despite government protectionism and efforts by companies to diversify their supplier bases.

Lunar New Year is usually a pretty sleepy time for car dealerships in China, as people stop work and head home for the lengthy holiday. This year could be different.

This Week’s Diary

(All times Beijing unless noted.)

Tuesday, Jan. 14:

- China to release Dec. aggregate finance & money supply by Jan. 15

Wednesday, Jan. 15:

- CCTD’s weekly online briefing on Chinese coal, 15:00

- China Silicon Industry Association’s weekly price assessment

Thursday, Jan. 16:

- Nothing major scheduled

Friday, Jan. 17:

- China industrial output for December, including steel & aluminum; coal, gas & power generation; and crude oil & refining, 10:00

- Retail sales, fixed assets investment, property investment, residential sales, jobless rate

- 4Q GDP

- 4Q pork output and inventory

- Retail sales, fixed assets investment, property investment, residential sales, jobless rate

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, Jan. 18

- China’s 2nd batch of December trade data

- Grains, sugar, cotton, rubber, palm oil, pork & beef imports

- Oil products imports & exports breakdown; LNG & pipeline gas imports

- Bauxite, steel and aluminum imports; rare-earth product, alumina and copper exports

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Advances in Risk-On Mood as China Weighs Tariff Exemptions

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus