China’s Surging Power Demand Creates a Climate Conundrum

(Bloomberg) -- China’s electricity demand is becoming a key focal point in the global fight against climate change.

As the world’s largest polluter, China holds outsized sway over whether emissions can be reduced fast enough to avoid the worst impacts of global warming. The country’s breakneck adoption of clean energy technology has created hope that it will peak and start reducing greenhouse gases far earlier than its stated goal of 2030.

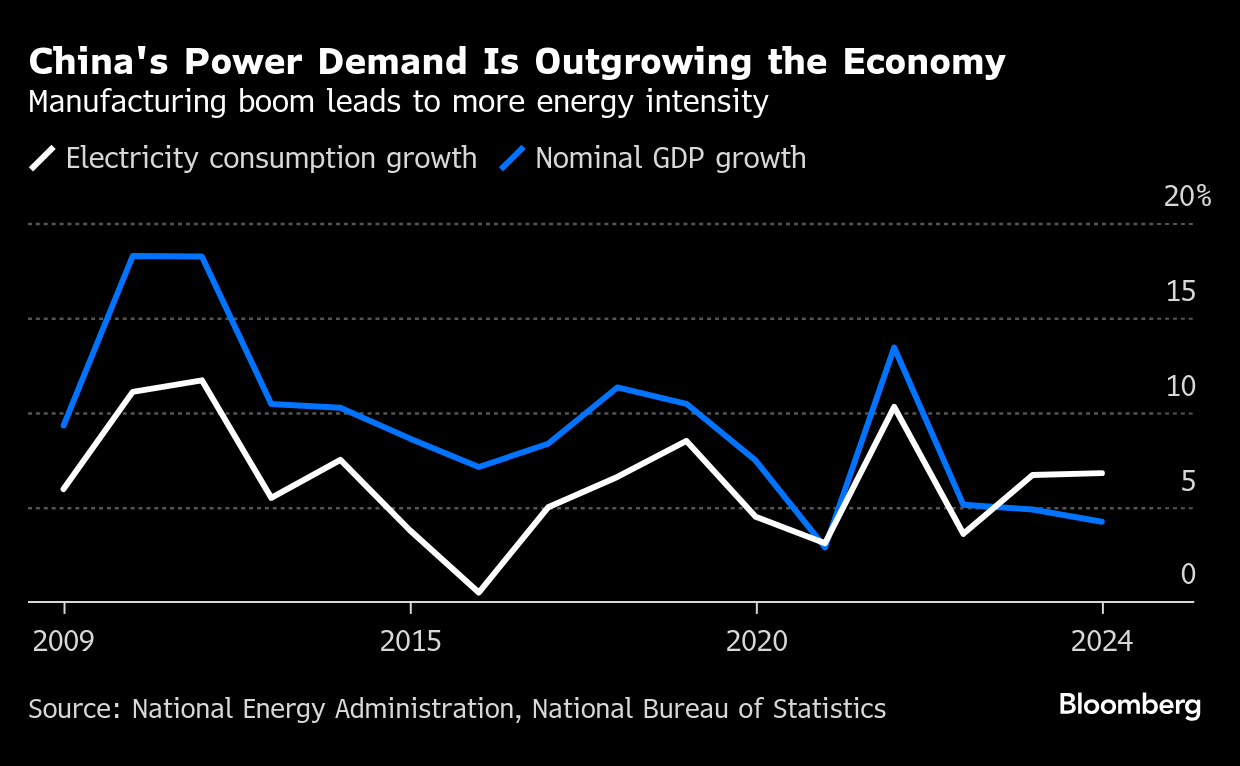

But that hasn’t happened so far, in large part because the nation’s energy demand is growing unprecedentedly fast, requiring ever more coal to be burned. Electricity use grew 6.8% last year, outpacing overall economic growth at the highest clip in at least 15 years. And as China faces a slowing economy and trade tensions that are likely to be exacerbated by new US President Donald Trump, the future of power demand growth remains a huge question mark in China’s efforts to decarbonize.

“Energy demand and power demand are the number one swing factors for emissions,” said Lauri Myllyvirta, lead analyst for the Centre for Research on Energy and Clean Air. “There’s certainly a lot more room for different pathways on the demand side, depending on Trump and everything else that happens in international trade.”

Power and growth have long been linked in China. Former Premier Li Keqiang once said electricity usage, rail freight and bank lending provided a more accurate reflection of the economy than reported GDP figures. Increasing efficiency by reducing the amount of energy needed to produce goods has long been a metric the government uses to grade itself.

But that relationship has reversed in recent years as Beijing leaned on manufacturing to lead an economic rebound following the end of the Covid-19 pandemic. Electricity use rose faster than nominal GDP growth in three of the past five years, after trailing it for the entire previous decade. The China Electricity Council, the power industry’s top lobbying body, expects consumption to grow 6% in 2025.

Growing power demand is stymieing efforts to decarbonize the power sector, which accounts for nearly half of the country’s greenhouse gas emissions. Even after record additions of wind turbines and solar panels, clean power generation wasn’t enough to meet all the increased demand last year, forcing thermal power plants to burn more coal and generate about 1.5% more power than in 2023.

The biggest driver of this elevated power demand has been the industrial sector, accounting for about two-thirds of China’s electricity use. Even as a real estate collapse dragged down steel and cement output, production of materials like copper, aluminum and petrochemicals hit record highs last year using increasing amounts of energy.

President Xi Jinping’s push for so-called ‘new quality productive forces’ also meant more energy was needed to produce goods like biopharmaceuticals, airplanes, solar panels and EVs, along with the machinery and factories needed to make them, according to the China Electricity Council.

All that is “making the economy more electricity intensive,” said Muyi Yang, senior China analyst for climate and energy research group Ember.

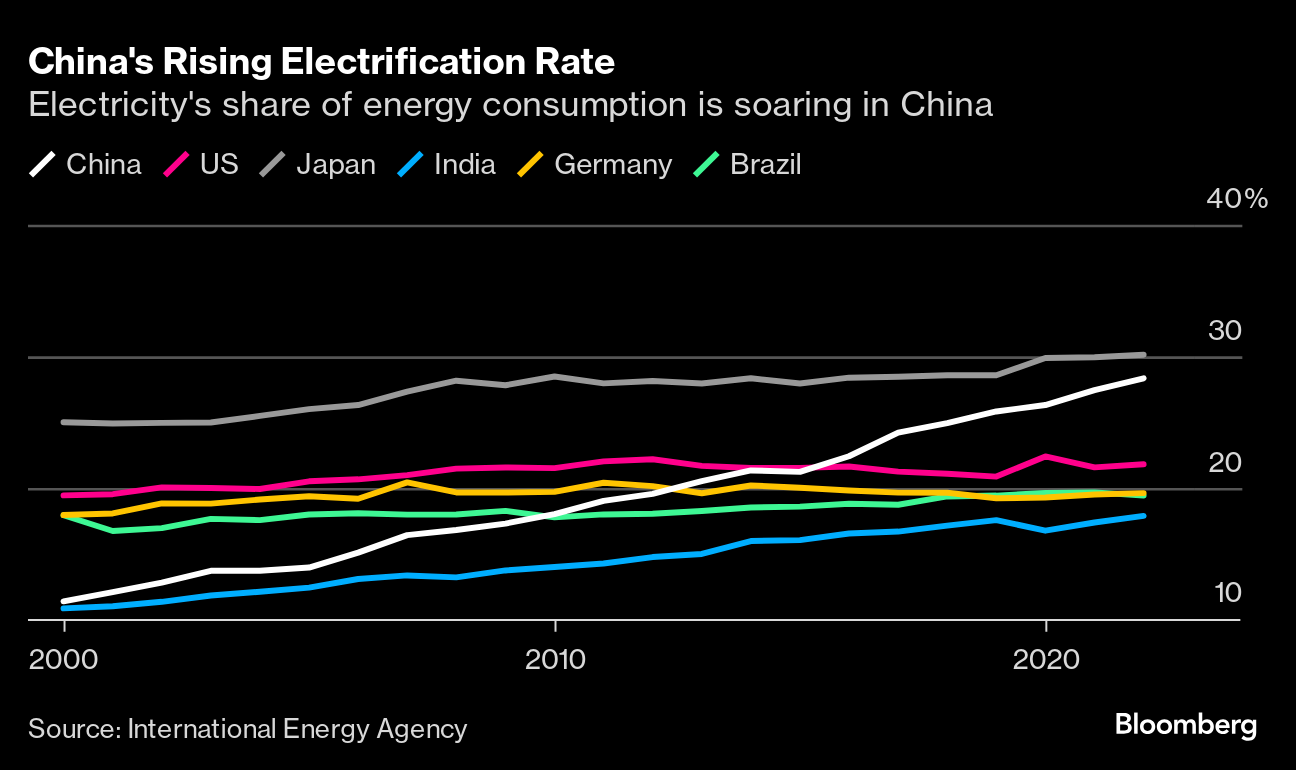

Other factors are also contributing to power demand growth. The economy has steadily electrified in recent decades, replacing smaller coal furnaces that powered factories and heated homes with electricity or cleaner-burning gas. That’s now happening in the transportation sector too, where sales of EVs are booming. Demand to charge EVs jumped 38% last year and now accounts for about 1.1% of all power consumption, according to National Energy Administration data.

While EV charging might put more stress on the power system, it’s still a “net climate win” because electric motors are more efficient than those powered by gasoline or diesel ones, said Cosimo Ries, an energy analyst with consultancy Trivium China. China National Petroleum Corp. recently said it now expects oil demand to peak this year, half a decade ahead of its previous forecast.

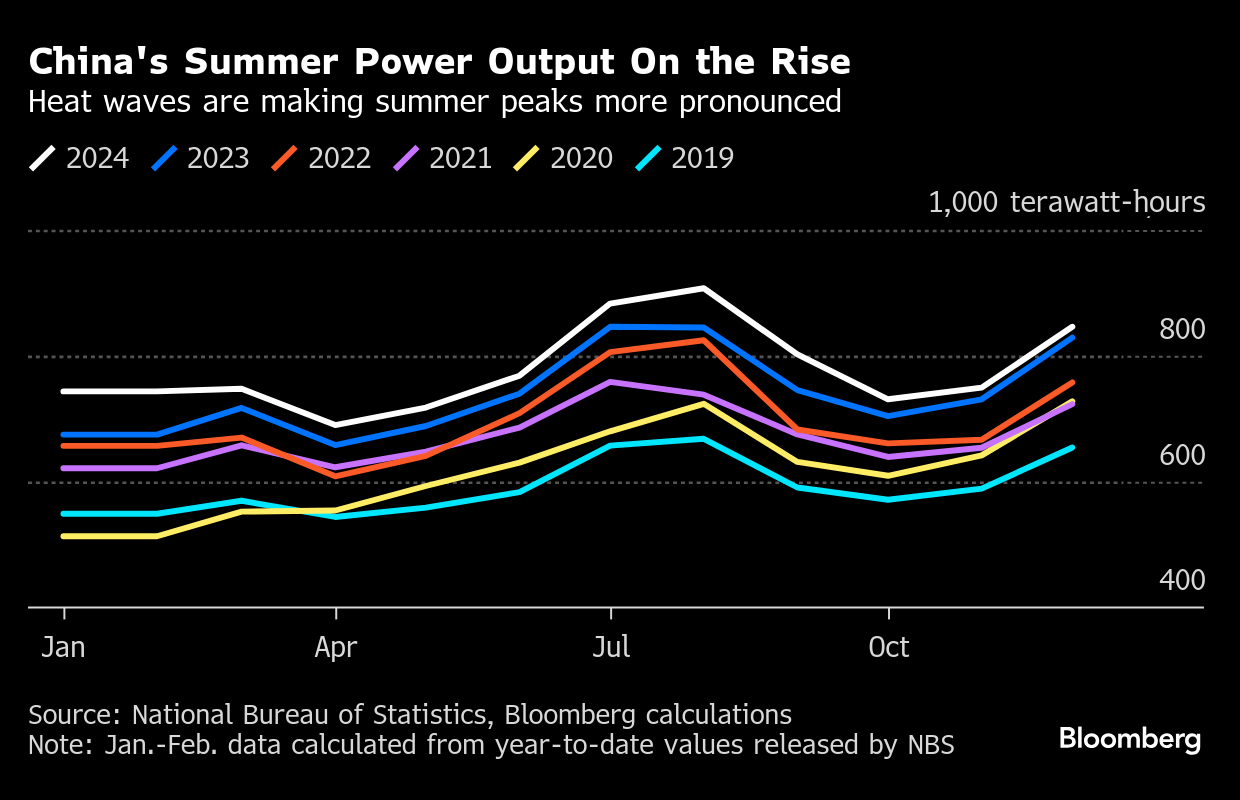

Artificial intelligence is also taking a toll. Data centers are expected to account for 5% of total power consumption by 2030 from about 1.6% in 2023, according to Goldman Sachs Group Inc. analysts including Jacqueline Du. Then there are heat waves that have battered China each of the past three years, driving sales of air conditioners and reshaping demand curves to make summer peaks more pronounced.

“A lot of it is definitely from external shocks that we’ve seen, especially with the summer heat waves,” Ries said.

There are signs that China’s manufacturing boom might be slowing, with industrial power demand growth dropping back down to historic levels in the last few months of 2024, CREA’s Myllyvirta said. Still, with the government set to unveil fiscal stimulus measures later this year and potentially having to respond to increased tariffs from the US, uncertainties over the path of the economy, and the country’s decarbonization journey, abound.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

UK Climate Adviser’s Plan Clears Path for Heathrow Growth

bp to invest $10b annually in hydrocarbons in strategy reset

Oil Rises as Iran Sanctions, Trump Tariff Comments Rattle Market

Woodside Looks to Louisiana LNG to Become Global Powerhouse

Oil Speculators Turn Sour as Bullish Wagers Get Trimmed Back

Shell to grow working interest in the Ursa platform in Gulf of America

Iraq Says It’s Ready to Restart Oil Via Turkish Pipeline

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses