Crude Oil Steadies With Traders in Limbo Over US Trade Policies

(Bloomberg) -- Oil steadied as investors waited for clarity on the US administration’s plans for trade policy, with Donald Trump’s pick for commerce secretary saying Canada and Mexico may be able to avoid levies.

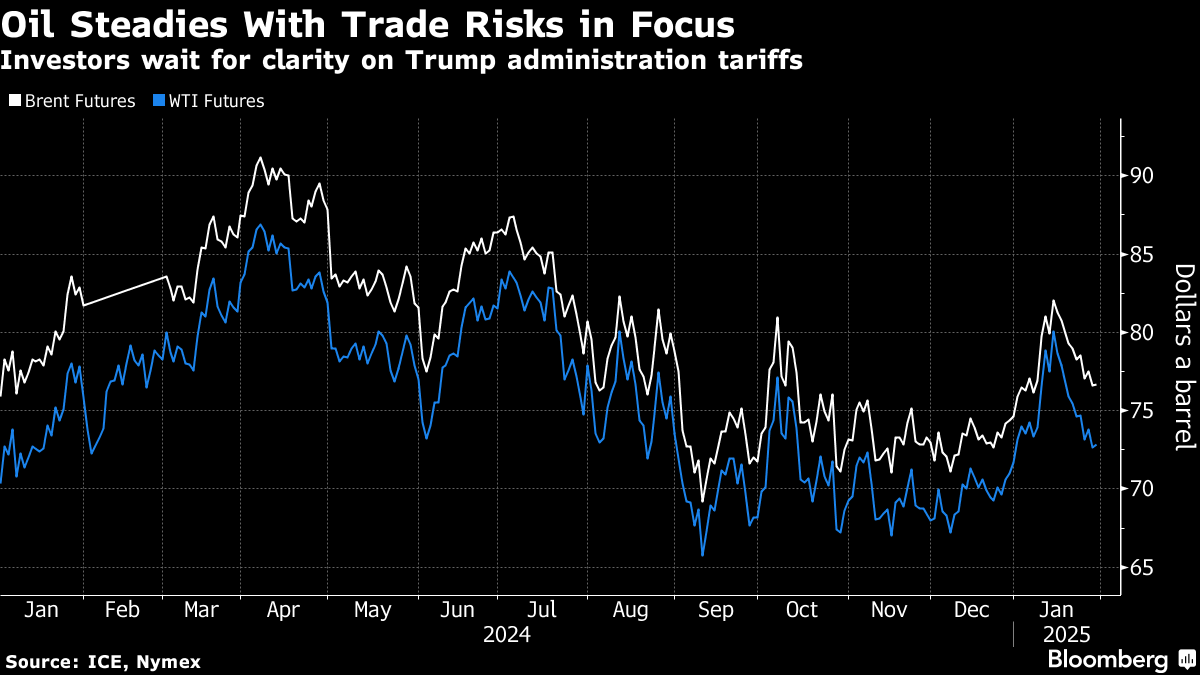

Brent was above $76 a barrel, while West Texas Intermediate held near $73, after a climb in stockpiles on Wednesday helped drive US futures to the lowest close this year. Howard Lutnick said the US’s two neighbors could avoid the curbs if they took action on illegal migration and fentanyl. Previously, officials had indicated that the penalties could kick in this weekend.

The high degree of uncertainty was reflected in comments from the Bank of Canada, which reduced interest rates on Wednesday. Governor Tiff Macklem said policymakers didn’t know what the US was going to do, or what the consequences would be. Canada is a major shipper of crude to the US.

Oil has had a bumpy start to the year, initially pushing higher as cold weather aided demand, and the outgoing Biden administration rolled out a fresh package of sanctions against Russian flows. The early gains have since been unwound, with Trump promising to boost domestic crude production, while pressuring OPEC to lower prices. The US president has also vowed to refill the nation’s strategic crude reserve, and reframe trading ties with major economies.

“Trump’s desire to increase America’s dominance in the energy sector is likely to fall short of his aspirations,” ANZ Group Holdings analysts including Daniel Hynes said in a note. Among plans, the proposed refilling of the US strategic reserve could “significantly tighten” the oil market, they said.

Canada is the biggest overseas supplier of crude to the US, sending nearly all of the 4 million barrels a day the country exports to its southern neighbor. The two nations share a highly integrated oil market, with Midwest refiners relying on Canadian imports for almost 70% of the crude they processed in 2023.

In Mexico, Economy Minister Marcelo Ebrard said the country has a strategy in place in case Trump fulfills his tariff pledges on Feb. 1, without giving details. The US administration has also said it may impose levies against China, and, earlier this week, threatened Colombia with curbs in a brief spat.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold

US Ends Waiver Allowing Iraq to Buy Electricity From Iran

Stocks Bounce Back as Powell Says Economy Is Fine: Markets Wrap

Amador to Become Mexico Finance Chief as Ramirez de la O Resigns

Oil Posts Seventh Weekly Loss on Easing War Risk, Tariff Chaos

Oil Trims Losses as Traders Weigh Demand Impact from Tariffs

China’s Congress Pledges to Fix Overproduction of Steel and Fuel