Oil Extends Drop With Focus on Rising Stockpiles, Trump Actions

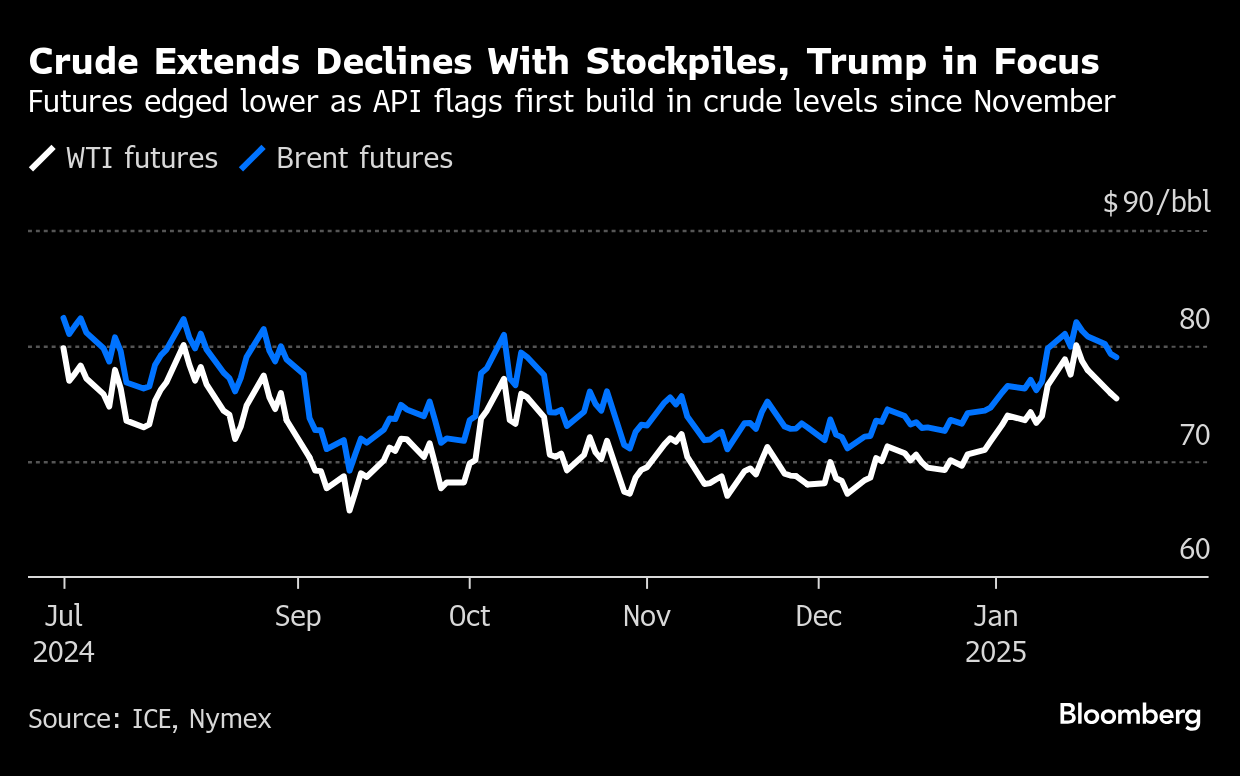

(Bloomberg) -- Oil edged lower after an industry report pointed to the first gain in US crude stockpiles since mid-November, as the market watched for further pledges on global trade from President Donald Trump.

Brent dropped below $79 a barrel, extending a run of losses that started last Thursday, while West Texas Intermediate was near $75. Inventories rose by 1 million barrels last week and fuel stockpiles surged, the American Petroleum Institute reported, according to a document seen by Bloomberg.

US crude stockpiles are typically drawn down toward the end of the calendar year for tax reasons. Government figures are due later on Thursday.

Oil is still higher this year after a strong start, following sinking temperatures in the Northern Hemisphere that increased heating demand and as US sanctions on Russia’s oil industry upended markets. India has widened its backing for Russian insurers as it strives to keep the discounted barrels flowing.

The market continues to brace for actions from the new Trump administration, after tariff threats on China, Canada and Mexico, and warnings of more penalties on Moscow if President Vladimir Putin doesn’t engage on ending the nearly three-year war in Ukraine.

“The tariff threats so far are only threats. They are bargaining chips,” said Vandana Hari, founder of Vanda Insights in Singapore. “There may be cautious optimism that Trump will nail down a rapprochement with Putin, but the market will need more tangible assurance” before pricing it in, she said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge