Oil Holds Gain as IEA Warns on Russia Curbs and Stockpiles Ebb

(Bloomberg) -- Oil held a powerful, early-year advance on mounting concerns about risks to global supplies, and as commercial crude inventories in the US posted their longest run of declines since 2021.

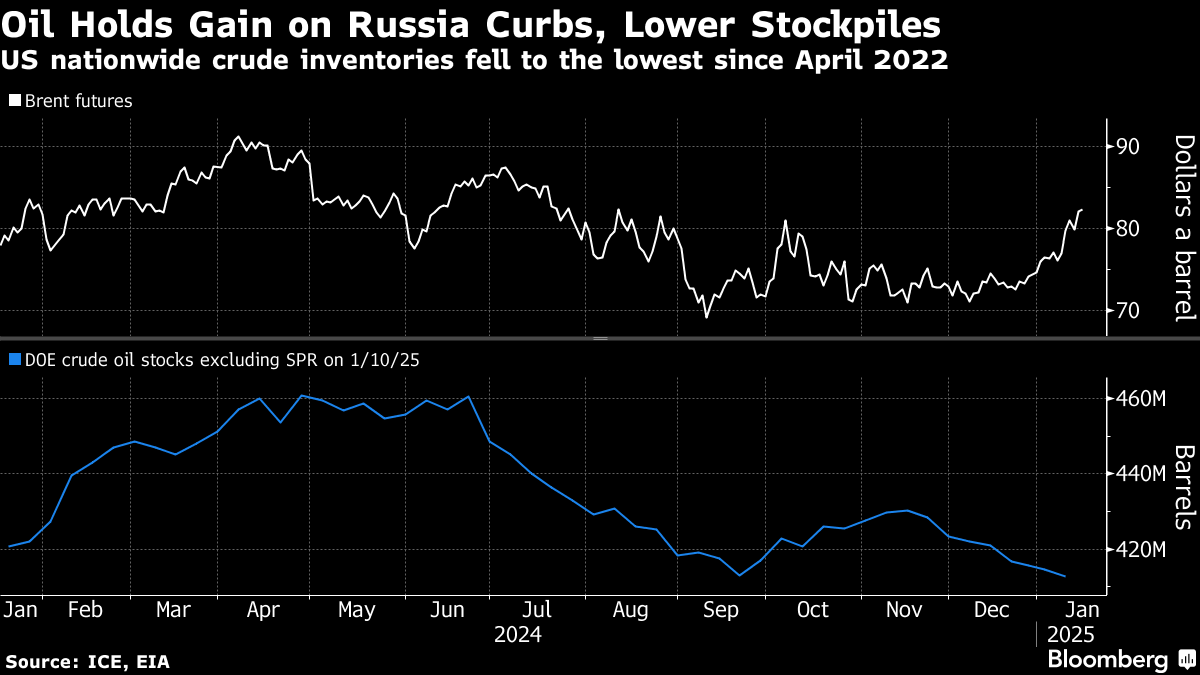

Brent crude was near $82 a barrel after climbing by 2.6% on Wednesday, when it hit the highest since July. West Texas Intermediate was above $80. US sanctions announced last week against Russia’s energy industry have rattled the market, with the International Energy Agency warning that they could “significantly disrupt” the nation’s supply and distribution chains.

Already, long-standing buyers of Russian crudes are looking elsewhere, while the amount of oil stranded off the Chinese coast has swelled as traders and shippers try and avoid being caught in the curbs. In India, state refiners are rushing to pay for existing Russian purchases.

Brent crude has rallied 10% since the start of the year, helped by a cold weather fanning demand, the fall in US inventories, and multiple risks to shipments. In addition to the curbs against Russia, traders are concerned the incoming Trump administration may both tighten sanctions against Iran, and impose trade levies that disrupt oil flows or risk drawing retaliatory measures.

“Sanctions on Russia, combined with relatively resilient demand from China and the rest of the world, have triggered a significant repricing of crude,” said Anindya Banerjee, head of commodity and currency research at Kotak Securities Ltd., who also cited support from US lower stockpiles. Some traders had been reversing bets on falling prices, or short-covering, he said.

In its monthly market snapshot on Wednesday, the IEA said the 160 tankers sanctioned by the US last week had shipped more than 1.6 million barrels a day of Russian oil in 2024, about 22% of the country’s seaborne exports. It also noted that previous rounds of curbs had been “highly effective, reducing the activity of designated tankers by 90%.”

In the US, inventories fell for an eighth week to hit the lowest since April 2022, according to official data on Wednesday. In a sign the near-term physical market is tightening, WTI’s prompt spread — the difference between its two nearest contracts — has widened to $1.34 a barrel in backwardation. That’s a bullish pattern, and compares with 42 cents a month ago.

As trade tensions build ahead of Trump’s Jan. 20 inauguration, Canada — a major crude shipper to the US — is in the spotlight. Authorities have drawn up a plan to tax over $100 billion worth of US-manufactured items if the US levies tariffs, according to an official familiar with the matter. Still, the leader of the country’s top oil-producing province has vowed to fight efforts to cut or tax crude exports.

Crude’s gain on Wednesday came even as Israel and Hamas agreed to a ceasefire deal, bringing a temporary halt to the war in the Gaza Strip that has gone on for 15 months and touched off broader turmoil in the Middle East. The ceasefire will start on Sunday and last six weeks, Qatari and US officials said.

©2025 Bloomberg L.P.