Oil Holds First Decline This Year on Signs Rally Was Overdone

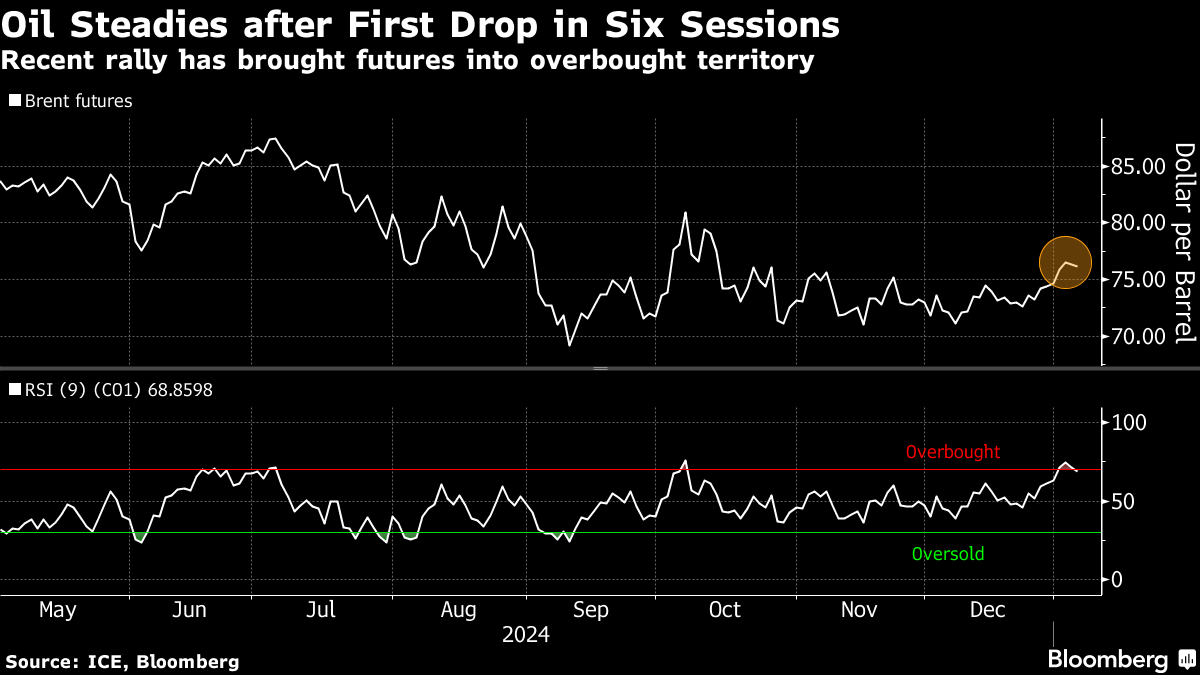

(Bloomberg) -- Oil steadied following its first decline in six sessions, as technical markers showed the recent rally may have gone too far.

Brent fell to near $76 per barrel, after losing 0.3% on Monday. West Texas Intermediate was around $73. Futures reversed gains on Monday after the nine-day relative strength index indicated prices were at overbought levels, and on a bearish move in WTI’s prompt spread.

Crude may struggle to hold onto gains after last week breaking out of a narrow range it had traded in since mid-October, as expectations for a glut, the possible revival of idled OPEC+ production and lackluster demand from top importer China weigh on market optimism. While money managers were bullish at the start of the year, analysts including Bank of America Corp. have reiterated warnings that new supply from non-OPEC countries will outstrip growth in global consumption.

Oil prices will probably hold around current levels, give or take two dollars, said Mukesh Sahdev, head of commodities markets oil at Rystad Energy A/S. “There will be no major price moves until Trump enters office” later this month, he said.

Output from the Organization of the Petroleum Exporting Countries fell by 120,000 barrels a day to 27.05 million a day in December, with the United Arab Emirates accounting for most of the drop, according to a Bloomberg survey. Modest gains in Libya and Nigeria were offset by similar-sized reductions in Iran and Kuwait.

In broader markets, the dollar pared a sharp decline against most major currencies after US President-elect Donald Trump denied a Washington Post report that he will limit his plan for tariffs. A weaker greenback makes commodities priced in the currency more attractive.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions