Oil Holds Near Five-Month High as Global Supply Risks Intensify

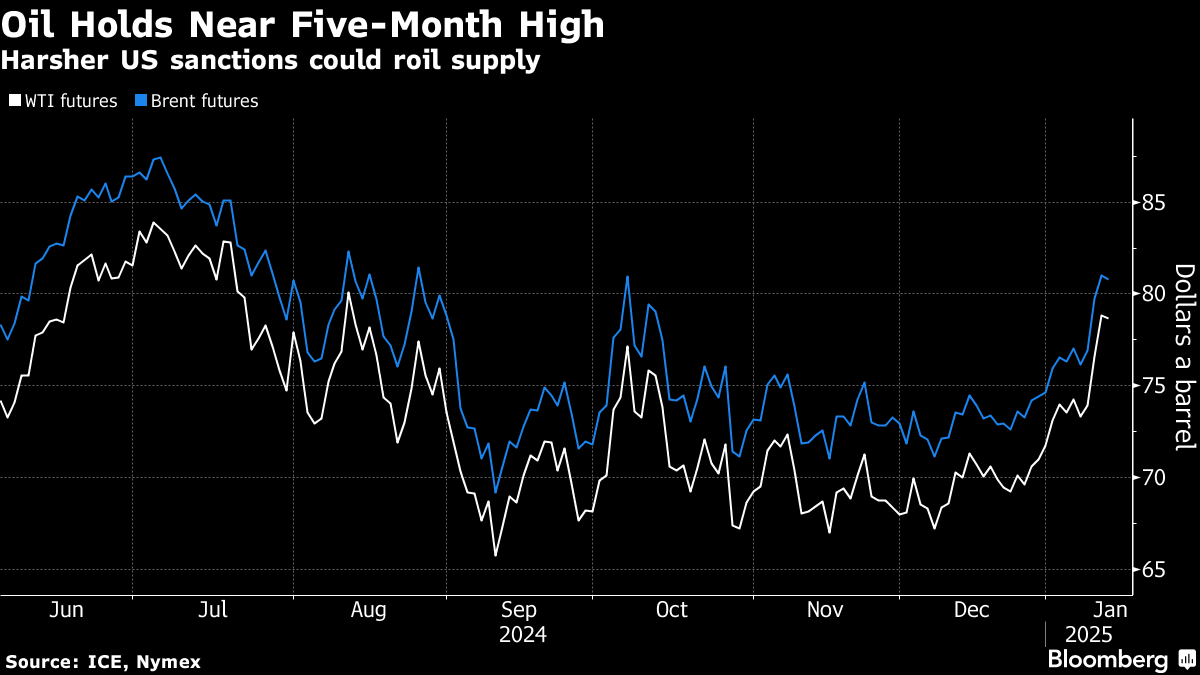

(Bloomberg) -- Oil held near a five-month high on threats to global supplies posed by harsher US sanctions against Russian flows and potential trade tariffs from the incoming Trump administration.

Brent steadied near $81 a barrel, after surging by more than 5% over the previous two sessions, while WTI was near $79. The US imposed its most aggressive sanctions yet on Russia’s oil industry on Friday, targeting key exporters, insurance companies and more than a 150 tankers. At the same time, 10 European nations are also pushing for tougher curbs.

In Canada, meanwhile, Alberta Premier Danielle Smith warned of possible US tariffs once Donald Trump assumes the presidency next week, with no exemptions for oil, after meeting the president-elect in Florida. More than half of US crude imports come from Canada, most of it from Alberta.

Crude has seen a strong start to the year as the multiplying supply risks deliver a further boost to a market that had already been lifted by falling US stockpiles and colder weather fanning demand. While the full impact of the latest US sanctions package remains far from clear, it may drive a rerouting of global flows as users across Asia, including refiners in India and China, are forced to reach far and wide for replacement barrels.

“There is still plenty of uncertainty over how much of an impact the latest US sanctions will have on Russian oil exports,” said Warren Patterson, head of commodities strategy at ING Groep NV. “While they have the potential to wipe out the surplus we expect for this year, the actual volumes lost will likely be more limited as players find ways to circumvent these sanctions.”

Some early signs of disruption are already apparent. Among them, a senior Indian bureaucrat told reporters that sanctioned vessels won’t be allowed to discharge, and tanker rates have jumped as the curbs threaten to cut the supply of ships. In the physical market, Chinese buyers snapped up prompt supplies of crude from the United Arab Emirates and Oman in a tender.

Widely tracked metrics point to a fast-tightening market. Brent’s prompt spread — the difference between its two nearest contracts — has spiked to $1.31 a barrel in backwardation, a bullish pattern. That compares with a gap of 40 cents at the end of last year.

Russian sanctions and winter demand are “fueling momentum in oil prices and there could be further runway here,” said Charu Chanana, chief investment strategist for Saxo Markets Pte in Singapore, citing expectations for Trump tightening sanctions against Iran. “We expect WTI to potentially reach $85 in the near term, even as rising non-OPEC+ production and slowing demand from China could limit upside from there.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Traders Lurch From Praying for Volatility to Drowning in It

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026