Oil Holds Near October High on Strength in Middle East Markets

(Bloomberg) -- Oil steadied near its highest level in almost three months, after some Middle Eastern oil grades strengthened on robust demand from Asian refiners.

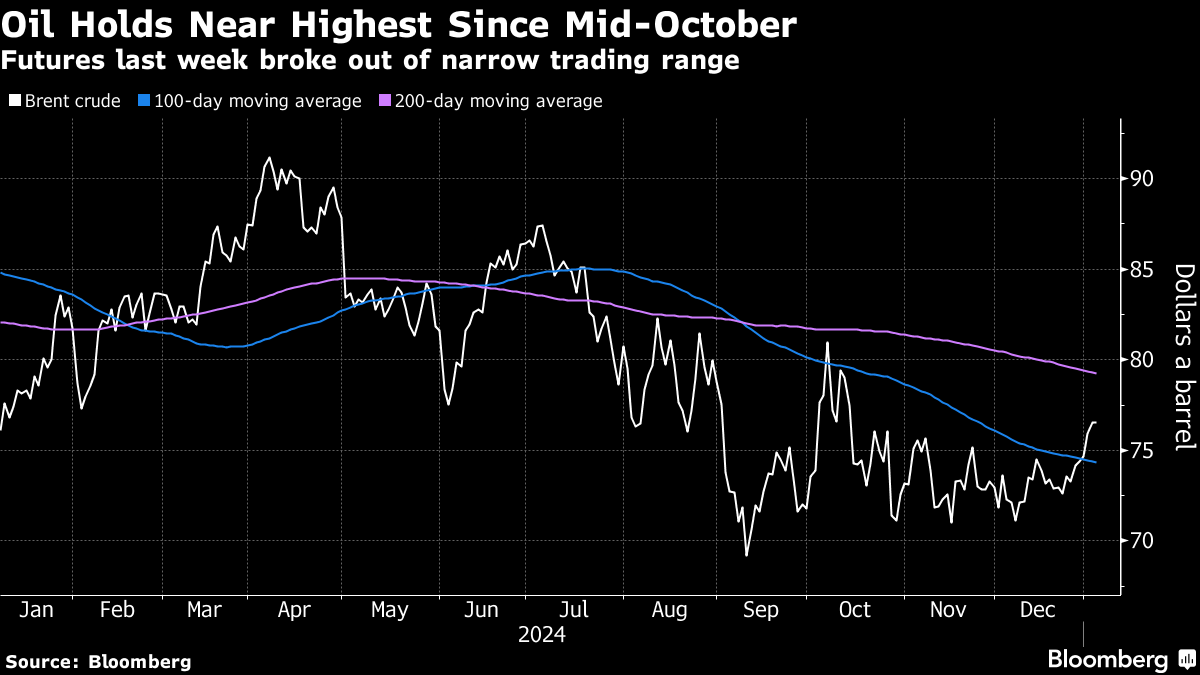

Brent traded near $76 a barrel after earlier Monday hitting its highest since Oct. 14. West Texas Intermediate was around $74. Traders will be looking out for official selling prices from Saudi Arabia, the biggest exporter, after Oman and Dubai crudes jumped at the end of last year on scant supply from Iran and Russia.

Oil “appears to be driven by the Middle East physical market,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Lower flows from Iran and Russia have pushed Asian buyers to look for alternatives.”

Oil last week followed bullish drivers — including falling US stockpiles and increased unpredictability as Donald Trump prepares to return to the White House — to break out of a narrow range it had traded in since mid-October. That optimism is being pared by expectations for a glut, the possible revival of idled OPEC+ production and lackluster demand from top importer China.

Brent is “likely anchored around $70,” Morgan Stanley analysts including Martijn Rats said in a note dated Jan. 5. The bank forecasts a surplus of about 700,000 barrels a day this year, as rising supply from OPEC and producers from outside of the group outpaces demand growth.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field