Oil Rally Breaks Crude Out of Tight Range With Technical Support

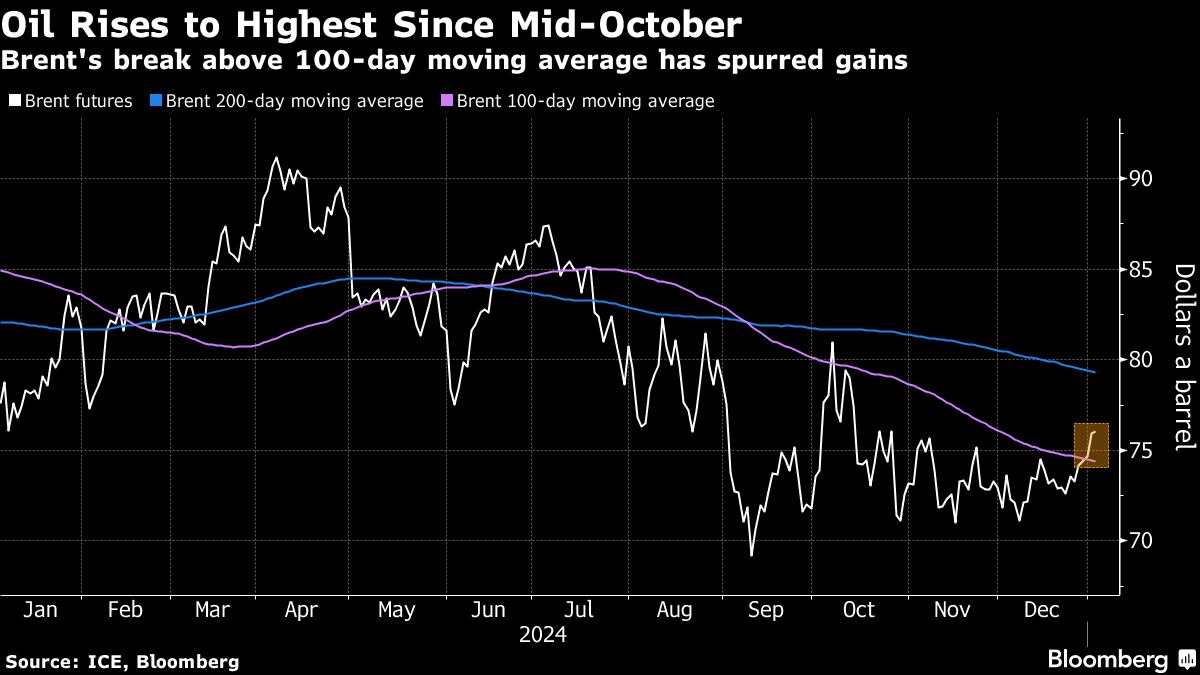

(Bloomberg) -- Oil has broken out of a tight trading range that it’s been stuck in for months, with a breach of a key technical threshold and shrinking US crude stockpiles helping to drive prices higher.

Brent was steady near $76 a barrel after a four-day rally that’s pushed futures to the highest level in more than two months. West Texas Intermediate was above $73. Nationwide crude inventories remain well below the seasonal average after stockpiles dropped for a sixth straight week.

A jump by both benchmarks above their 100-day moving average also spurred algorithmic buying, helping to break crude out of the roughly $6 range it’s been in since mid-October. Oil is also on track for a second weekly gain.

“The question now is whether this can kick toward the 200-day moving average,” said Chris Weston, head of research for Pepperstone Group Ltd. “That may need economics to improve.”

The outlook for 2025 remains uncertain, however, with expectations for a glut, the possible revival of idled OPEC+ production and lackluster demand from top importer China. The return of Donald Trump to the White House at the end of this month also adds a level of unpredictability for global markets.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge