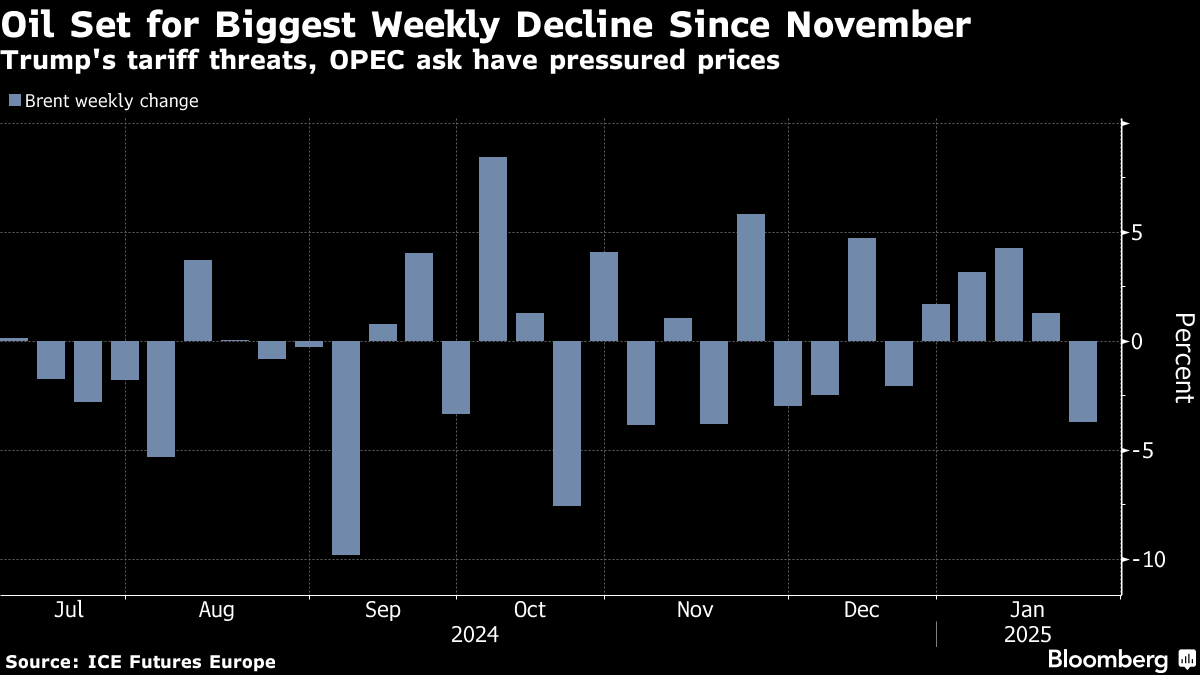

Oil Set for First Weekly Drop This Year as Trump Rattles Market

(Bloomberg) -- Oil headed for the first weekly decline this year after Donald Trump raised the prospect of trade wars and said he will ask Saudi Arabia and OPEC to lower prices in his first few days as the new US president.

Brent traded near $78 a barrel and is down more than 3% this week, while West Texas Intermediate was above $74. Trump’s first week in the White House began with tariff threats on Canada, Mexico and China, followed by a pledge that he would ask the producer group to “bring down the cost of oil.”

On Thursday night, Trump said he would rather not have to use tariffs on China. The president made the remarks during an interview on Fox News, adding that he will also reach out to North Korean leader Kim Jong Un.

That’s helped put futures on track for the biggest weekly loss since November, though prices are still higher this year after a cold Northern Hemisphere winter drove up heating demand and US sanctions on Russia upended crude markets. Trump has threatened more penalties on Moscow if President Vladimir Putin doesn’t “make a deal” to end the prolonged war in Ukraine.

The broad US sanctions that were implemented in the final days of the Biden administration tightened the flow of Russian oil and increased prices of other physical barrels from the Middle East. That’s led to some Asian refiners lowering crude processing rates or considering cuts.

“It will be no easy task to convince OPEC to increase output,” said Warren Patterson, the head of commodities strategy for ING Groep NV in Singapore. “Furthermore, lower oil prices would also be an obstacle to significantly increasing US oil production.”

One of Trump’s executive orders this week was to declare a national energy emergency to help boost domestic production. In his first term, the president repeatedly called on OPEC+ to lower prices when he felt they were too high.

US crude stockpiles, meanwhile, declined for a ninth week, according to a report on Thursday from the Energy Information Administration. Inventories are lower than the five-year seasonal average for this time of the year, and went against an earlier industry report which estimated a build.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

UK to Announce New Sanctions Against Russia on Monday: AFP

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump