Oil Steadies as Traders Look to Tariff Fallout and Stockpiles

(Bloomberg) -- Oil steadied as traders weighed the potential market fallout from President Donald Trump’s plan for tariffs on imports from major US crude supplier Canada and other countries, as well as the outlook for stockpiles.

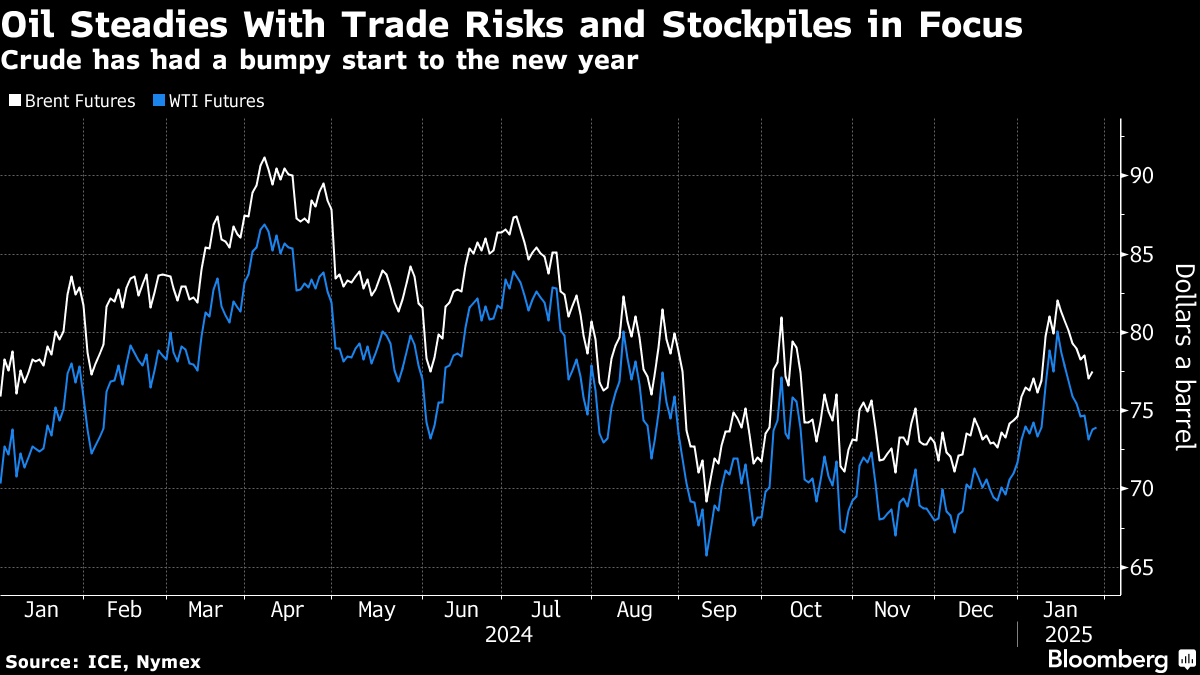

Brent held above $77 a barrel after a modest gain on Tuesday, while West Texas Intermediate was near $74. White House press secretary Karoline Leavitt reiterated that levies on Canada, Mexico and China will start as soon as Feb. 1. More than half of US crude imports come from its northern neighbor.

Stockpiles were also in focus. US commercial inventories increased by 2.86 million barrels last week, according to people familiar with the American Petroleum Institute’s assessment. That would be the first gain in 10 weeks if confirmed by official data later Wednesday.

Crude has had a bumpy start to the year as US sanctions against Russia and cold weather initially ratcheted prices higher, while the possible impact on energy demand from a Trump-initiated trade war, plus poor economic data from China, then pulled them back. Aside from touting his package of tariffs, the US president has also been calling on OPEC+ to help lower crude prices, in part as he looks to pressure Moscow to end the Ukraine war.

For now, widely watched market metrics continue to highlight underlying tightness in the market. WTI’s prompt spread — the difference between its two nearest contracts — was 85 cents a barrel in backwardation. That’s a bullish pattern, and compares with a gap in the 40-cent range about a month ago.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk

Glencore-Indonesia JV Eyes $1 Billion Sustainability-Linked Loan

Oil Fluctuates as Trump’s Rapid-Fire Trade Moves Rattle Market

China’s Surging Power Demand Creates a Climate Conundrum

Oil Set for First Weekly Drop This Year as Trump Rattles Market

Oil Extends Drop With Focus on Rising Stockpiles, Trump Actions

ADNOC achieves industry-leading carbon intensity at Shah Oil Field enabled by AI

Oil Holds Drop as Trump’s Tariff Threats Raise Trade War Fears