Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk

(Bloomberg) -- Oil steadied after sinking by almost 2% on Monday, as US President Donald Trump raised the stakes on planned tariffs, muddying the outlook for global crude shipments and demand.

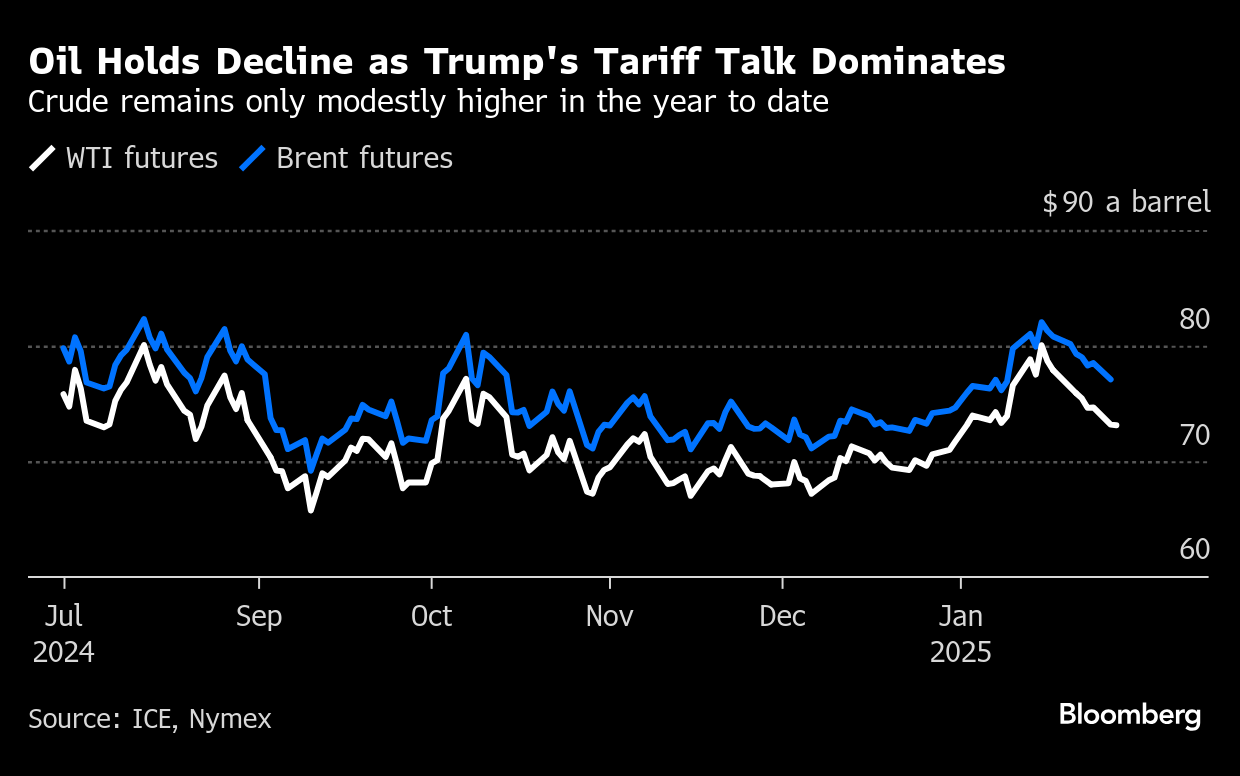

Brent crude traded above $77 a barrel, while West Texas Intermediate was near $73. In a series of remarks, Trump said he favored across-the-board tariffs “much bigger” than 2.5% and charges on some foreign-made goods in the “near future,” listing products including steel, aluminum and copper.

The comments helped to lift the US dollar, a headwind for most commodities.

Crude has had a bumpy ride this year, initially rising on a cold Northern-Hemisphere winter and US sanctions against Russian energy, then falling as Trump’s tariff threats rattled markets and fanned volatility. Monday’s retreat came amid a brief-but-intense tariff spat between Colombia and the US, and then gained traction amid a wider selloff in global markets.

“Tariff headlines will be weighing on sentiment, and while it seems to be more metals focused for now, the risk of escalation and broader tariffs is growing,” said Warren Patterson, head of commodities strategy at ING Groep NV.

In Canada, Alberta’s premier said that the country should prepare for tariffs on Feb. 1, a date highlighted by Trump in earlier remarks. More than half of US crude imports come from the northern neighbor, most from Alberta.

Elsewhere, Scott Bessent was confirmed as Treasury Secretary, with the Financial Times reporting that he was in favor of universal tariffs starting at 2.5%. In his hearing, Bessent backed tougher curbs on Russian oil, while also saying that the US could “make Iran poor again” through sanctions.

Looking ahead, oil traders expect OPEC and allies to stick with their current supply policy at a review meeting next week, resisting pressure from Trump to boost production and bring down crude prices. At present, the group intends to bring back output in monthly tranches starting from April.

Trading volumes in Asia on Tuesday are likely to be lower due to the upcoming Lunar New Year holidays.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field