Oil Advances as Dwindling Inventories Counter China Weakness

(Bloomberg) -- Oil advanced, with traders weighing short-term supply risks against further signs of Chinese economic weakness.

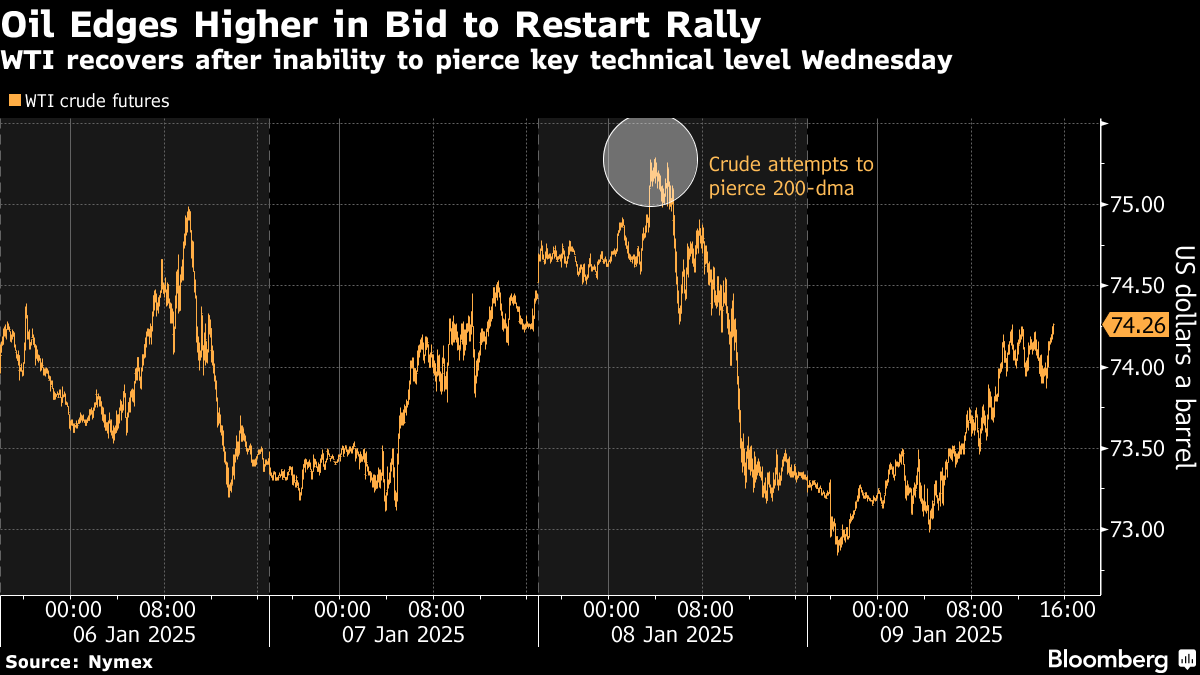

West Texas Intermediate rose 0.8% to settle near $74 a barrel, tacking on its seventh gain in the last nine sessions. Oil prices fell more than 1% on Wednesday after futures failed to breach a key technical level.

Crude’s strong start to 2025 has been supported by continued US inventory drawdowns and potential risks to Iranian supply in a second Donald Trump presidency. Cold weather is expected to boost demand for heating fuels this month, and Russia’s seaborne crude exports recently slumped to their lowest since August 2023.

Cold weather will boost first-quarter demand for heating oil, kerosene and liquefied petroleum gas by 500,000 to 700,000 barrels a day, JPMorgan Chase & Co. analysts said in a note Thursday. At the high end, that’s more than 40% of the 1.6 million barrel-a-day increase in total oil demand the bank expects for the period.

“Winter comprises a sizable chunk of energy demand, but the swings from normal to deep-freeze conditions will have effects on both supply and demand for oil,” analysts including Natasha Kaneva said in the note.

Limiting crude’s gains, consumer inflation in China fell further toward zero, a setback for government efforts to revive demand. Recent strength in the US dollar has also made commodities priced in the currency — including oil — less attractive to some buyers.

Concerns also persist that supplies may exceed demand. Many banks have retained their bearish outlooks, and Standard Chartered Plc cut its 2025 Brent crude forecast by $5, to $87 a barrel, and lowered its first-quarter estimate by $7, to $82.

“The outlook is slightly bearish,” Viktor Katona, head of oil analysis at consultancy Kpler, said at the online Gulf Intelligence Outlook Forum. “We’re not going to see demand growth above 1 million barrels a day at any point in the future. With the China that we currently have, it’s not going to happen. The slowdown is evident.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus

Oil Traders Lurch From Praying for Volatility to Drowning in It

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply