Aramco Cuts World’s Biggest Dividend in Blow to Saudi Budget

(Bloomberg) -- Aramco cut the world’s biggest dividend in a blow for Saudi Arabia’s widening budget deficit, as the company seeks to relieve the stress on its own finances.

Saudi Aramco expects the total payout to be about $85 billion in 2025, compared with $124 billion for last year, it said in a statement Tuesday. The distribution has been in focus for investors and economists alike with the level of the payment likely to determine how much more the Saudi government would need to borrow to fill its budget deficit.

The payout has taken on increasing significance for Riyadh as Crown Prince Mohammed Bin Salman presses on with his multitrillion-dollar economic transformation plan. Aramco has been a key cog in that push, with revenue from its oil sales and the generous dividend. But the massive payout had started to stretch the company’s balance sheet and flipped it into a net debt position recently, a sharp turnaround from the over $27 billion in net cash just over a year ago.

Last year’s total dividend, the world’s largest, is made up of two parts: a base payment and a performance-linked portion. Starting in 2025, the company had earlier said it plans to start paying the special component as a portion of free cash flow after covering the base dividend and any investments. Aramco on Tuesday confirmed it would stick to that policy.

Also read: Aramco’s $124 Billion Payout in Focus for Wobbling Saudi Budget

The company said the base payout will be $21.1 billion for the fourth quarter, a 4.2% increase from a year earlier. At this rate, almost the entire dividend for 2025 would be made up of the base component.

Weaker Earnings

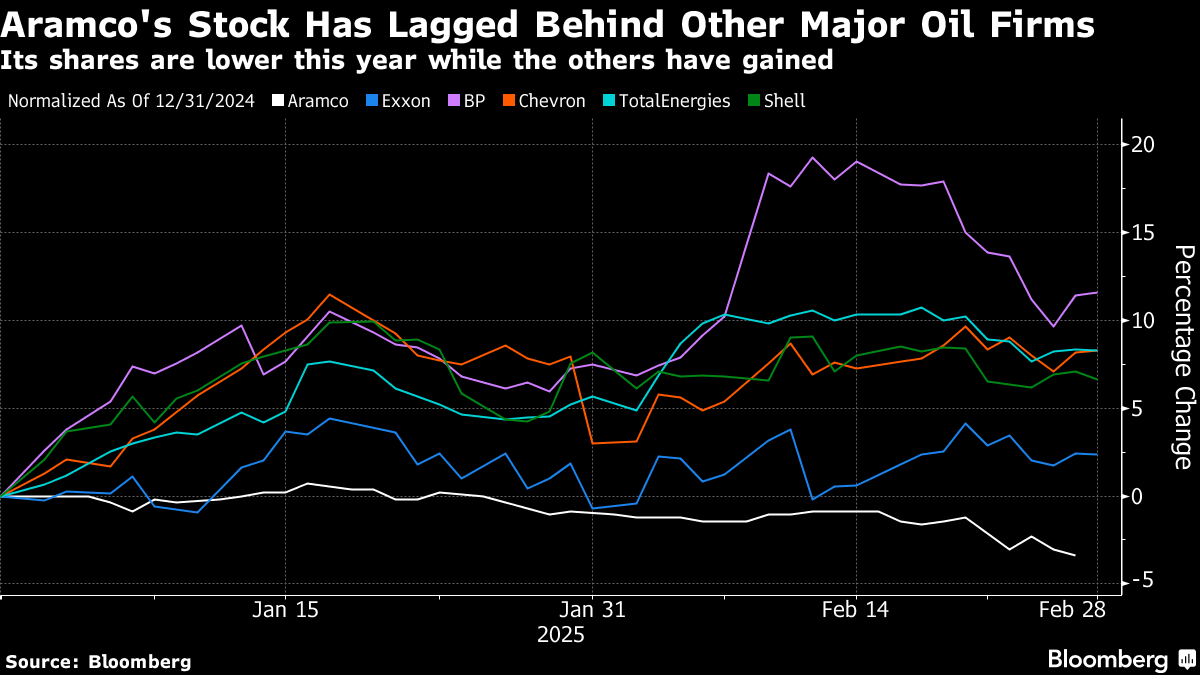

The focus on the dividend comes as Aramco reports weaker earnings due to subdued oil prices and production near the lowest level in more than three years. Weak prospects for global economic growth and softer demand have pushed crude prices in London to the lowest level in almost three months. Brent is averaging less that $77 a barrel this year, far below the more than $90 Saudi Arabia needs to balance its budget.

Aramco’s net income for 2024 was 393.89 billion riyals ($105 billion), narrowly missing analyst estimates compiled by Bloomberg. Free cash flow of about $85 billion was below the total dividend payout.

Riyadh is already forecasting a deficit of about $27 billion for 2025 with state income expected to fall short of expenses for the next several years. Debt sales of about $50 billion by state and government entities last year, along with Aramco’s payouts, helped close the deficit gap. The government has also sold more than $14 billion of bonds this year, making it the biggest borrower in emerging markets.

Aramco also plans to sell more debt after $9 billion in dollar and Islamic bonds last year, Chief Financial Officer Ziad Al-Murshed said in an interview in November.

(Updates with oil prices in the sixth paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions