China Refiners Face Yet Another Blow as Trump Presses Venezuela

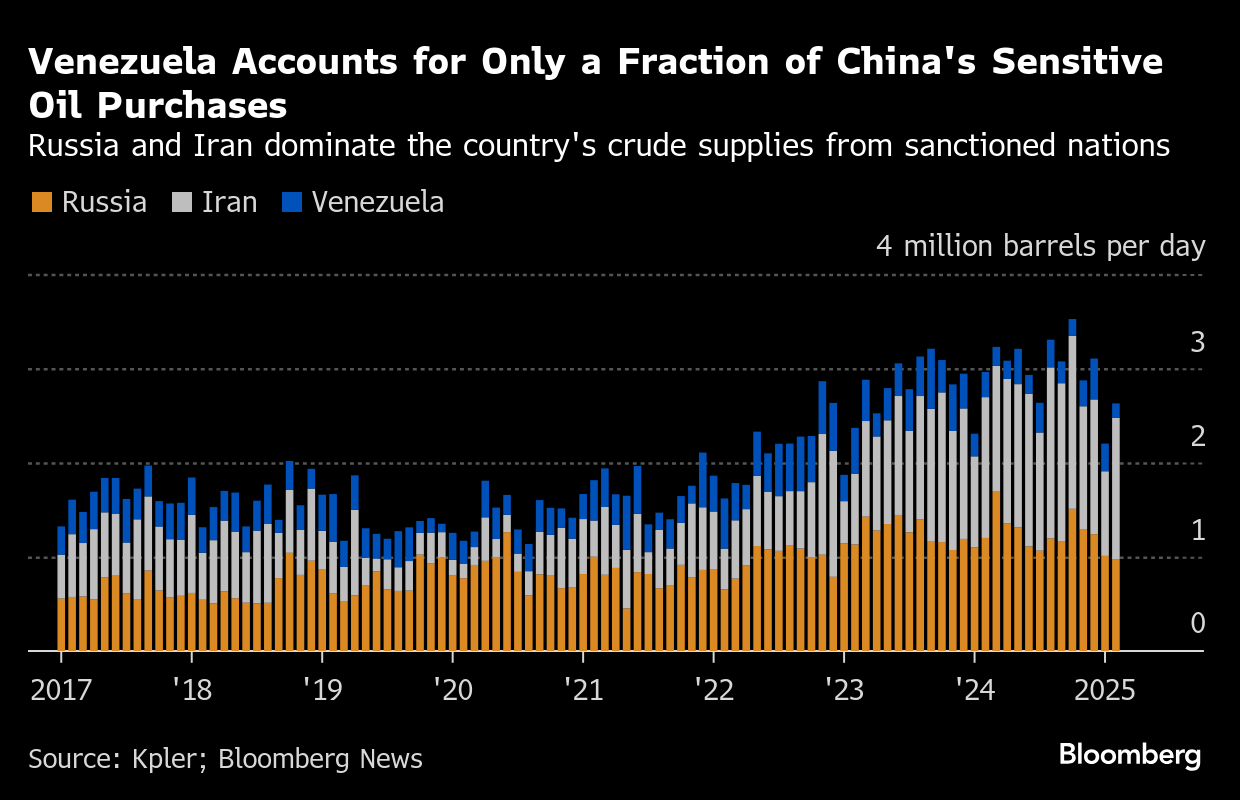

(Bloomberg) -- China’s private refiners, long plagued by excess capacity and paper-thin margins, are facing yet another setback as the Trump administration imposes a 25% tariff on any buyer of Venezuelan oil and gas.

Beijing has had close commercial and political ties to Venezuela for years, fostering close connections to both Hugo Chavez and his successor, Nicolas Maduro. China has been a key source of funding as well as the single largest buyer of the country’s crude, taking more than 40% of its oil exports in February.

Most Venezuelan oil cargoes go to China’s independent processors, a vast constellation of companies clustered in the eastern province of Shandong, which turn the dense Merey crude into fuel and bitumen to pave roads and for use in the construction sector. The imports can make up as much as a fifth of feedstock at some operations, according to estimates from Chinese analysts.

The latest measures will not be crippling to China’s oil industry — enforcement is difficult, circumventing maneuvers are common and priced-out buyers can turn elsewhere. But they will add cost and curb supply for smaller refiners suffering from weaker domestic demand, a structural shift away from oil for transportation, and US efforts to stem the flow of cheap sanctioned crude from Iran.

Already, over the past year, private refiners have seen low run rates and closures.

“Much like Washington’s latest sanctions on Chinese teapots linked to the Iranian oil trade, I believe Trump’s order is primarily aimed at Venezuela — cutting off its economic ties to the global market and pressuring it to come to the negotiating table with the U.S.,” said Muyu Xu, senior crude oil analyst at analytics firm Kpler in Singapore.

The teapots may temporarily pause purchases as scrutiny increases, traders said, but the flow of sanctioned oil is unlikely to stop. Workarounds, including ship-to-ship transfers in waters off peninsular Malaysia, are instead expected to increase in the coming months.

“Although the secondary 25% tariff will be tough to enforce, licensed companies may think twice about lifting Venezuelan crude,” Xu said, adding China was unlikely to back down. “Part of the reason is that some of the cargoes it lifts fall under sovereign debt agreements backed by Beijing.”

Officially, China did stop importing Venezuelan crude for a period after US sanctions in 2019, resuming only in February 2024. Unofficially, the world’s top crude importer never stopped its purchases, with Venezuelan oil often being masked as bitumen mix, according to traders and third-party data providers.

Venezuela’s Merey crude is typically among the cheapest in the world, making it an attractive option for those with the capability to refine the sludgy and sulfurous grade and much more affordable than alternatives from Iraq.

Still, the price is less attractive — and the risk higher — if secondary tariffs are not only imposed but enforced.

“For China, the calculus is straightforward: the costs inflicted by escalated tariffs dwarf the modest benefits derived from cheaper energy supplied by a minor producer,” Chang Shu and David Qu of Bloomberg Economics wrote.

China National Petroleum Corp., the country’s state-owned oil giant which started exploration projects in Venezuela in 1997, was a major buyer until 2019.

India’s Reliance Industries Ltd. has been a regular buyer of the grade, thanks to a waiver. State processors have taken a backseat in recent months.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field