China Vanke Due as Chinese Developers See Signs of Recovery

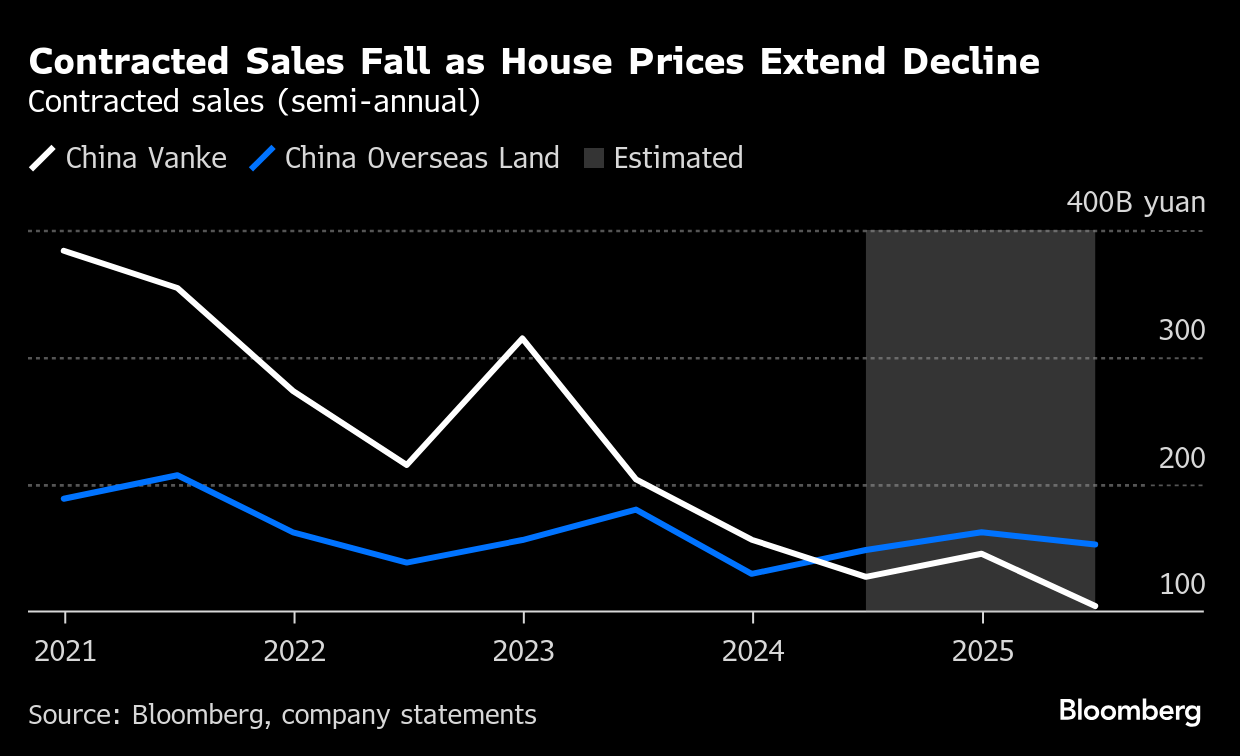

(Bloomberg) -- China Vanke Co. likely saw a record 45 billion yuan ($6.2 billion) net loss in 2024, as the Chinese property sector begins to see signs of recovery.

A string of recent profit warnings could be a positive future signal, Bloomberg Intelligence said. “Steep write-offs could set these companies up for a better profit outlook in 2025 which could improve earnings profiles, lift equity valuations and aid potential equity financing, which in turn could boost liquidity.”

Still, the recovery in housing market remains fragile, as new-home prices experienced a more rapid decline in February, marking the first deterioration in six months. Continued government support will be a key to sustain the recovery, CGS International analysts estimated. More cities including Shenzhen and Changsha are easing policies to boost the property market.

For last year though, aggregate core earnings for the top five developers — which also include China Resources Land Ltd., Longfor Group Holdings Ltd., and Greentown China Holdings Ltd. — are seen down 93% over the year, according to CGS International.

Country Garden Holdings Co. on Sunday reported a narrower loss in 2024 as the defaulted property giant seeks to build creditor support for its debt restructuring plan. It made steep write-offs on properties under development and completed homes held for sale in 2023, laying the foundation for a smaller loss. China Overseas Land & Investment Ltd. also saw 2024 profit miss analyst estimates as the property market continued its downward trend last year.

Over in the energy sector, PetroChina Co. hit record levels last year, as increased production offset lower energy prices.

In the consumer space, Kweichow Moutai Co.’s slower growth in the fourth quarter may signal a tough 2025, and revenue headwinds could linger throughout the year as consumer sentiment is still subdued, BI said.

Highlights to look out for

Monday: China Vanke’s (2202 HK) outlook will be closely watched as Chinese authorities are working on a proposal to help the developer plug a funding gap of about 50 billion yuan ($6.9 billion) this year, people familiar with the matter said in February. The embattled developer warned of a record 45 billion yuan loss for 2024, its first annual net loss since listing in 1991.

Tuesday: No major earnings of note.

Wednesday: Kweichow Moutai (600519 CH) likely saw full-year net income surge 15%, according to its preliminary earnings report. Management of the Chinese baijiu distiller earlier indicated that the company would maintain its five-year target and had implemented measures to stabilize wholesale average selling prices this year, according to a Citi note in February.

- Foshan Haitian Flavouring & Food (603288 CH) full-year net income is expected to rise 12%, reflecting a rebound in several of its key segments, including soy and oyster sauce sales, consensus estimates show.

Thursday: No major earnings of note.

Friday: Yaskawa’s (6506 JP) operating profit is set for a gradual recovery this year, according to BI, following a likely 4.7% drop in the fourth quarter. Its robot unit may continue to see stable demand due to its subsidiary expanding the firm’s hardware application, leading to margin gains.

(Updates with details throughout.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus

Oil Traders Lurch From Praying for Volatility to Drowning in It

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home