Oil Advances as China Plans Economic Boost, Red Sea Risks Grow

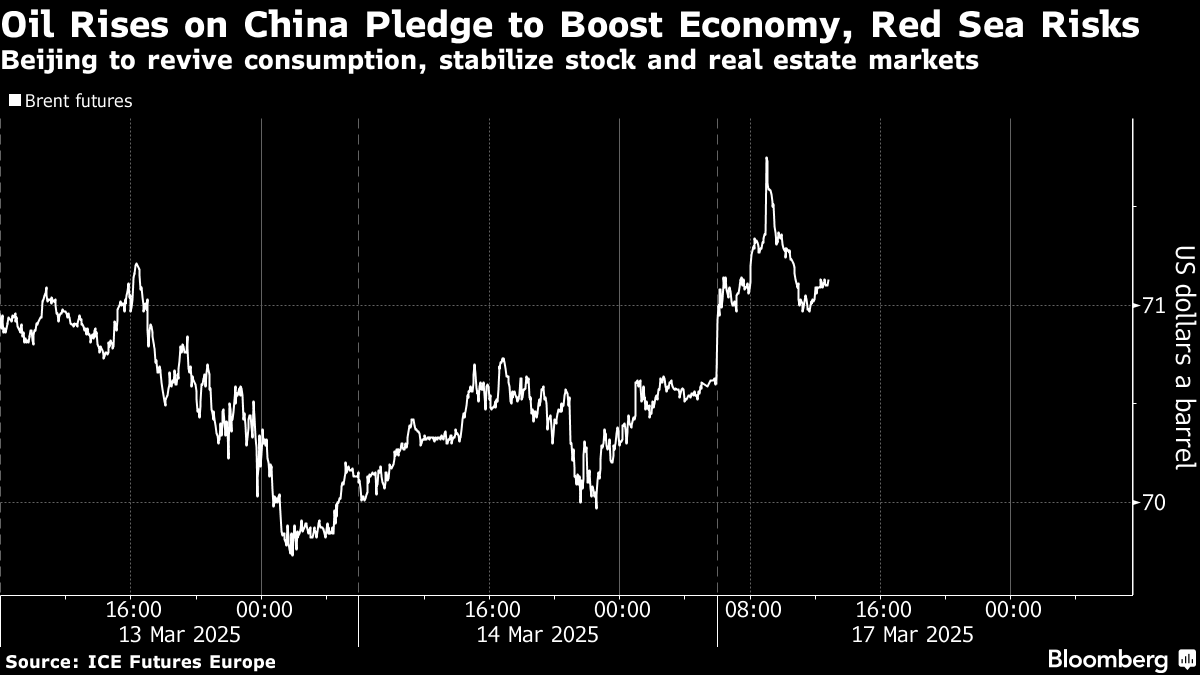

(Bloomberg) -- Oil rose for a second day after top importer China said it would take steps to revive consumption by boosting incomes, and the US ordered fresh attacks on the Houthis in Yemen.

Brent crude climbed above $71 a barrel after advancing 1% on Friday, with West Texas Intermediate near $68. Beijing will give details on policies to stabilize stock and real estate markets, lift wages and boost the nation’s birth rate, state-run news agency Xinhua reported.

Meanwhile, US military strikes on Yemen’s Houthi militants will be “unrelenting” until the group stops targeting civilian and military vessels in the Red Sea, Pentagon chief Pete Hegseth said on Sunday. That follows an order a day earlier from President Donald Trump to attack locations controlled by the Iran-backed militia in Yemen.

Still, crude has fallen by more than $10 a barrel from this year’s high in January, as Trump’s escalating trade war, an OPEC+ decision to increase supply and a possible end to the war in Ukraine all weigh on prices. The US president may speak to Russian leader Vladimir Putin this week, as Washington pushes for a deal to end the fighting in the three-year conflict.

The dour outlook led Goldman Sachs Group Inc. to lower its Brent crude forecasts, analysts including Daan Struyven said in a note on Sunday. The Wall Street giant also said oil demand growth would be lower than previous estimates as tariffs endanger global growth.

“While the $10 a barrel sellof since mid-January is larger than the change in our base case fundamentals, we reduce by $5 our December 2025 forecast for Brent to $71,” the analysts said. “The medium-term risks to our forecast remain to the downside given potential further tariff escalation and potentially longer OPEC+ production increases.”

However, prices may recover “modestly” in the short term as US economic growth remains resilient, and sanctions on Russia show no immediate signs of easing, Goldman said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field