Oil Advances as US Joins Chorus Slashing Global Glut Forecasts

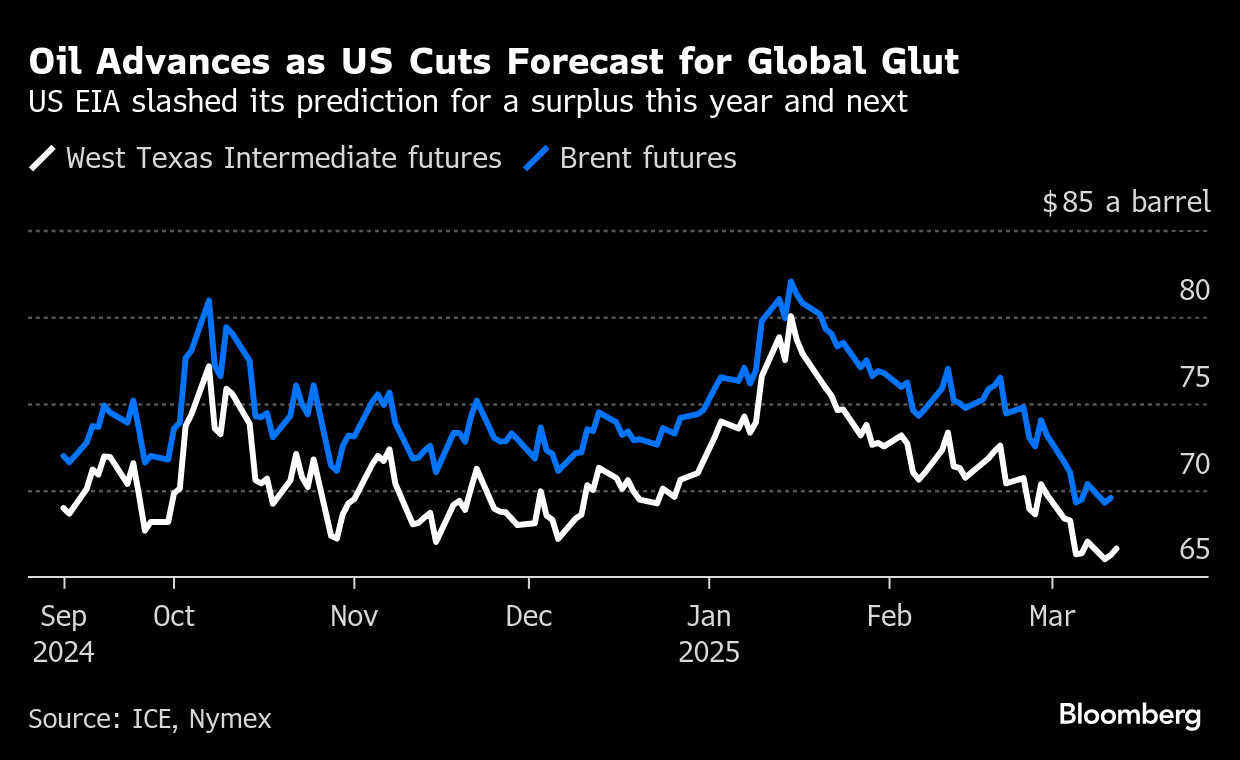

(Bloomberg) -- Oil extended a gain as the US cut its forecast for a global oversupply, following similar moves by other market watchers including the International Energy Agency.

Brent crude rose toward $70 a barrel after a modest gain on Tuesday, while West Texas Intermediate was below $67. The Energy Information Administration slashed its prediction for a surplus for this year and halved its outlook for a glut in 2026, citing the prospect of diminished flows from Iran and Venezuela.

Crude recouped early losses on Tuesday even as fresh trade salvos from US President Donald Trump threatened to prolong a plunge in risk assets. Futures have fallen from a high in mid-January on the chaotic rollout of tariffs, OPEC+ plans to add supply and weakening demand in China.

“Overall sentiment remains fragile despite a slight bounce in today’s session,” said Yeap Jun Rong, market strategist for IG Asia Pte. “Tariff developments are still lacking clarity and there’s persistent concerns over US growth.”

Elsewhere, the industry-funded American Petroleum Institute reported that US nationwide commercial inventories rose 4.2 million barrels last week, although a big draw was seen at the storage hub in Cushing, Oklahoma. That would be the first reduction at the delivery point for WTI in five weeks if confirmed by official data later on Wednesday.

Geopolitical concerns remain front and center. Ukraine has accepted a US proposal for a 30-day truce with Russia that raises the possibility of a pause of hostilities in the three-year-old war. Meanwhile, the Iran-backed Houthis in Yemen said they would immediately resume attacks on Israeli ships for the first time in about two months.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold

US Ends Waiver Allowing Iraq to Buy Electricity From Iran

Stocks Bounce Back as Powell Says Economy Is Fine: Markets Wrap

Amador to Become Mexico Finance Chief as Ramirez de la O Resigns

Oil Posts Seventh Weekly Loss on Easing War Risk, Tariff Chaos

Oil Trims Losses as Traders Weigh Demand Impact from Tariffs

China’s Congress Pledges to Fix Overproduction of Steel and Fuel